Revenue recognition in subscription-based business models: The role of contract modifications & incremental expenses

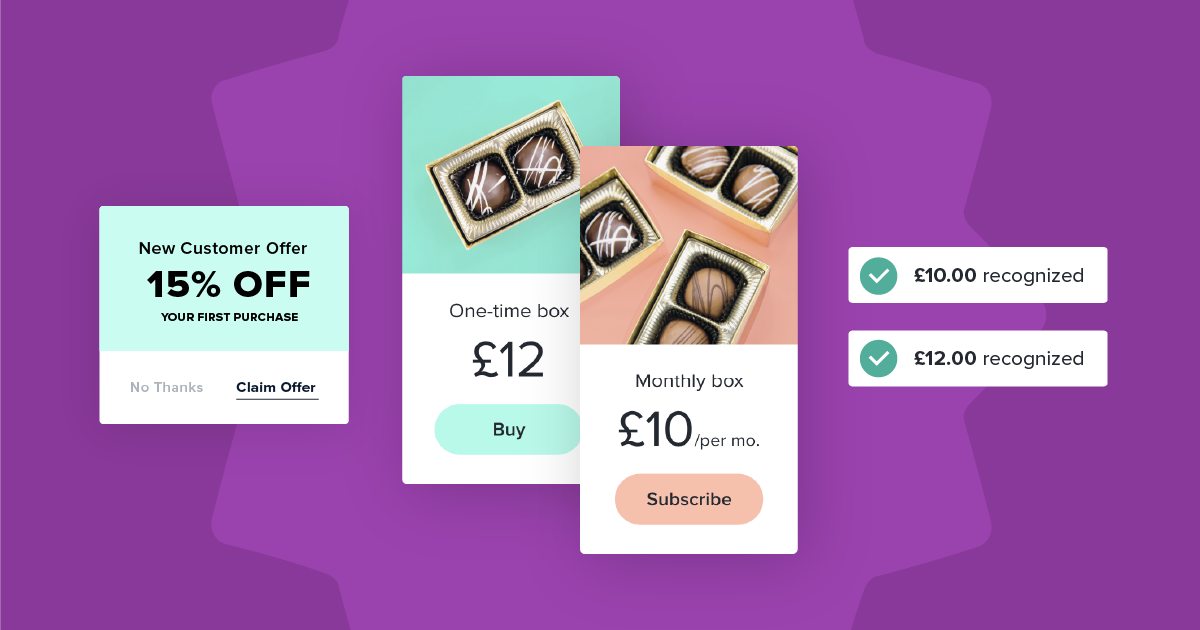

While subscribers are happy to have options to customize their subscription plans, subscription businesses must learn how to handle the impact of contract modifications and incremental expenses. When subscription contracts...