Global revenue recognition and forecasting

Streamline and automate compliance with multiple revenue reporting standards with Recurly’s enterprise-grade, fully configurable solution.

Automated revenue recognition overview

See how Recurly simplifies and automates revenue recognition and ASC-606/IFRS-15 compliance.

Recognizing recurring revenue continues to be more complex and regulated

The trend towards more diverse monetization and pricing models creates a greater need for accounting automation to comply with complex, global revenue recognition standards. Recurly can help.

Recurly Revenue Recognition is the only platform flexible and sophisticated enough to automate all aspects of ASC 606 requirements. Revenue data are available on Day 1 of the monthly close.

Free your subscription business from revenue compliance complexities to focus on growth

Comply with revenue recognition standards

Comply with ASC-606 and IFRS-15 with speed and confidence.

Reduce audit risk and costs

Eliminate manual processes and automate revenue recognition rules for a fast, accurate close.

Support multiple revenue models

Streamline revenue management for complex, diverse pricing and product bundles.

Report and forecast revenue accurately

Gain new insights with an integrated view of plan performance, billing, and revenue recognition data.

Key features

Recurly revenue recognition is a global, enterprise-grade solution that’s fast to implement, easy to customize, and was purpose-built for high-growth, high-velocity subscription businesses.

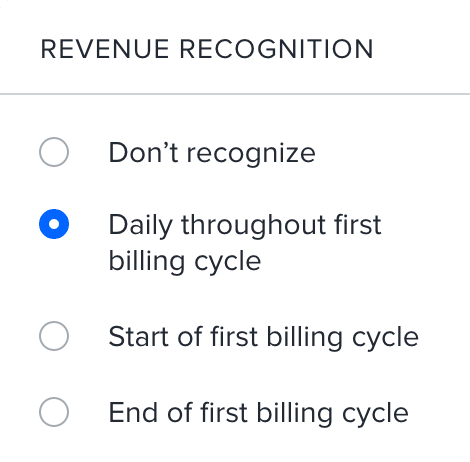

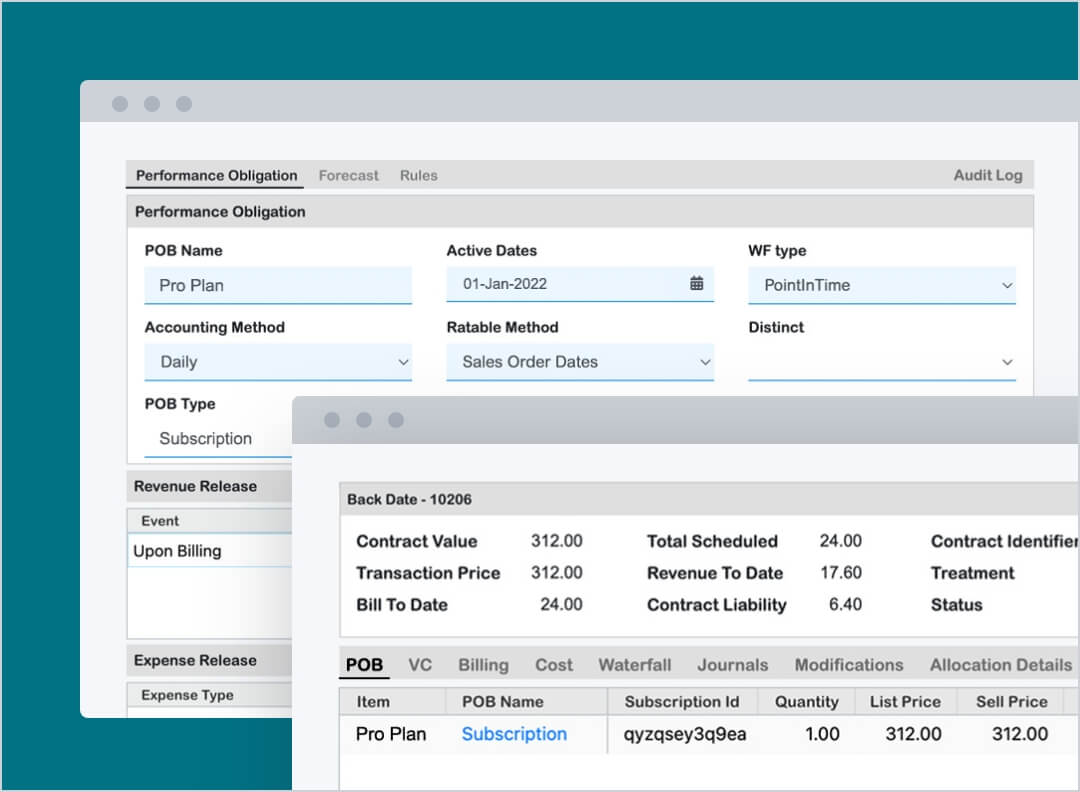

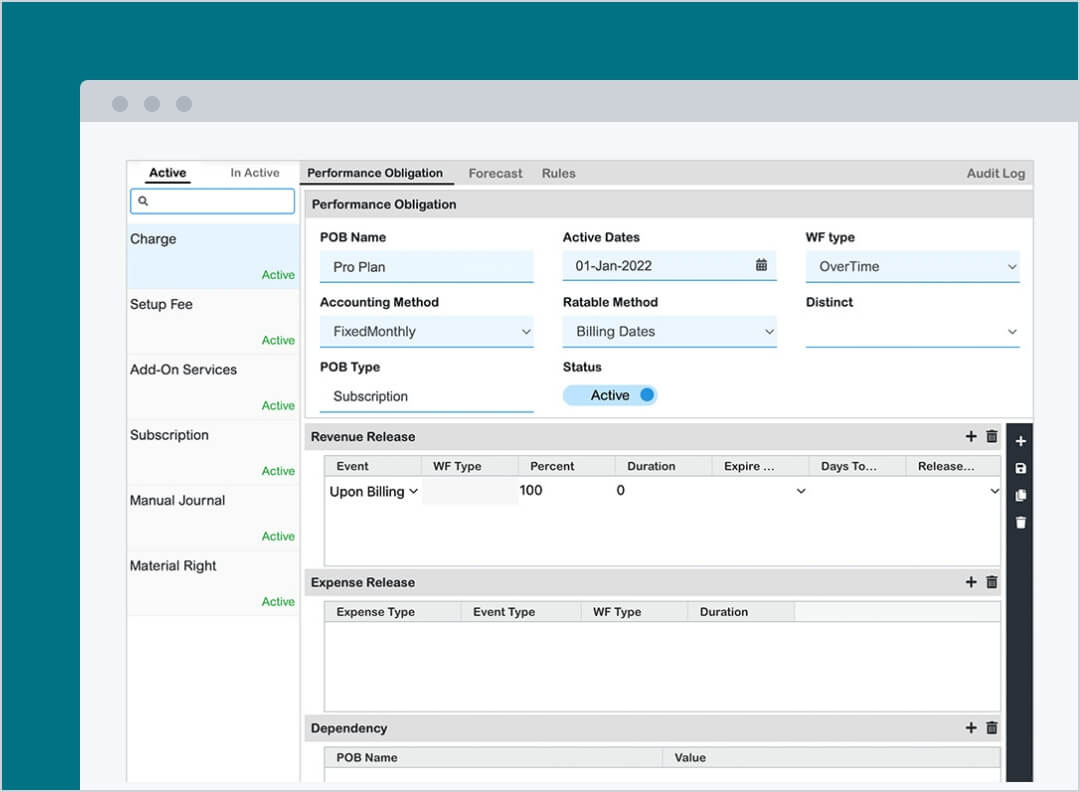

Automate revenue recognition

Streamline accounting and reporting processes with advanced revenue management automation, purpose-built for high-velocity subscription businesses offering complex plans and multiple products.

- Complex, high transaction volume use cases

- Real-time revenue reporting and forecasting

- Global capabilities and reporting standards

- Multiple revenue models

- Revenue close process automation

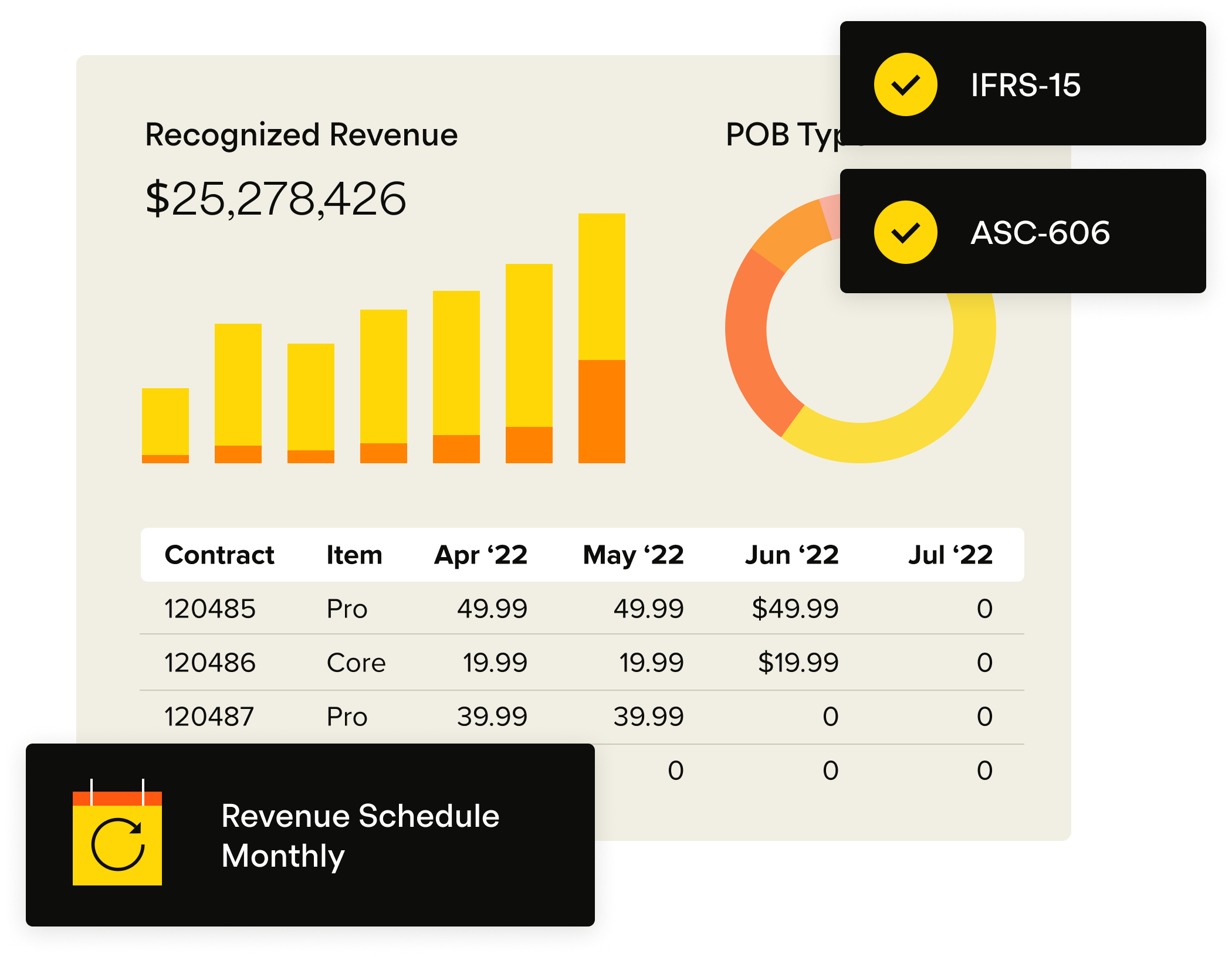

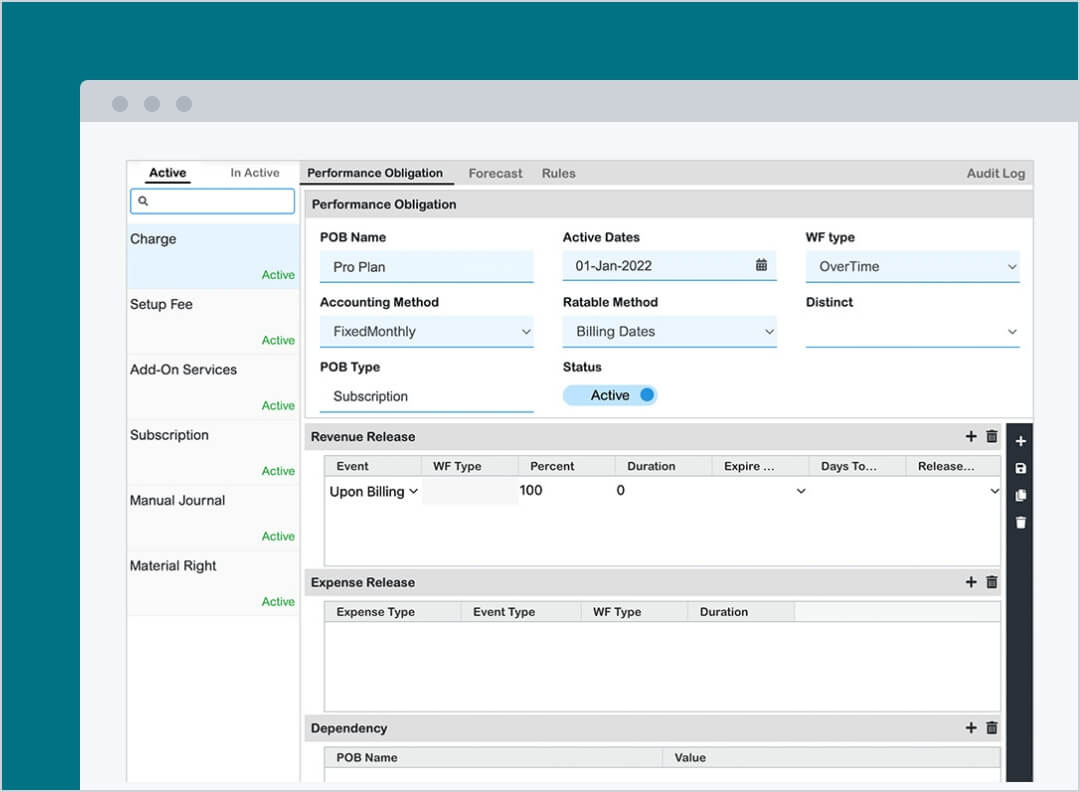

Streamline ASC-606 and IFRS-15 compliance

Reduce compliance risks and audit costs associated with ASC-606 and IFRS-15 accounting guidelines. Automate revenue recognition processes complicated by diverse sets of subscription contracts and pricing models.

- ASC-606/IFRS-15, ASC 842 & ASC 340-40 compliant

- Contract modifications and one-off scenarios

- Expense accounting (e.g sales commissions)

- Lease accounting

- Variable considerations (e.g. discounts, rebates, refunds)

- SSP analyzer

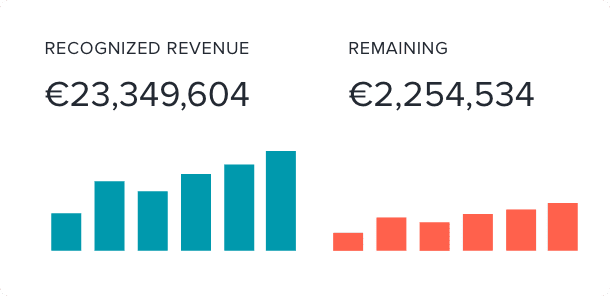

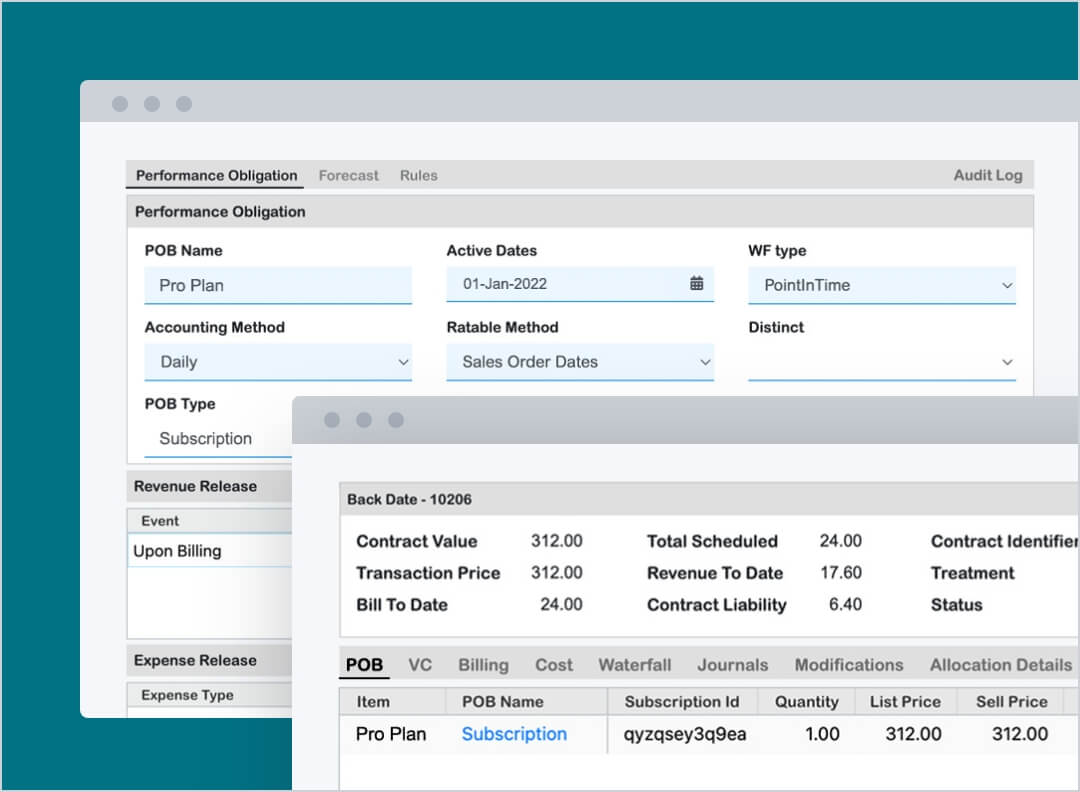

Accelerate financial close and improve forecast accuracy

Close the books faster and forecast monthly recurring revenue with greater accuracy and predictability with a single, aggregated view across subscriptions, recurring billing, and revenue recognition.

- End-to-end revenue automation

- Real-time, multi-dimensional revenue insights

- Multi-book, multi-entity revenue reporting

- Single view of subscription plans, billing, and revenue

Support multiple revenue models with agility

Enable revenue operations and accounting to quickly support evolving business requirements for complex and diverse subscriber contracts and plans. Use a single, global solution that easily scales and integrates with existing ERP and accounting systems.

- Support multiple revenue models (consumption, usage, milestone, percentage of completion or delivery)

- Accelerate global expansion with multi-currency and multi-book capabilities

- Reduce back-office bottlenecks that can hinder the launch of more complex offerings and promotions, such as discounts, coupons, loyalty programs, and plan upgrades/downgrades

- Lower the costs and burden on IT with a fast implementation, simplified tech stack, and fully integrated billing and revenue management solution

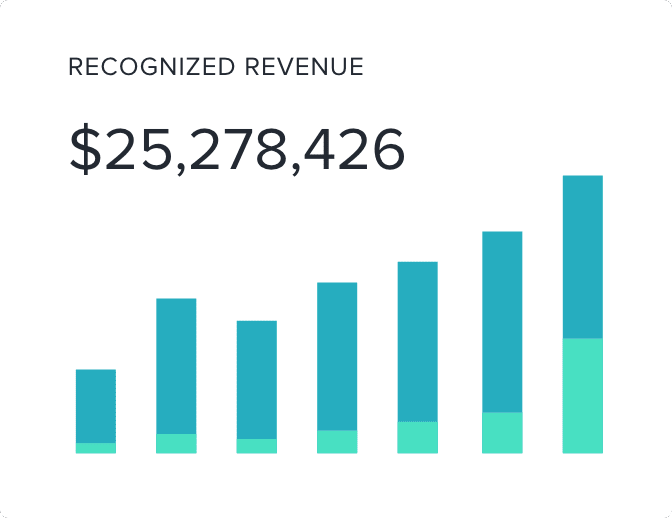

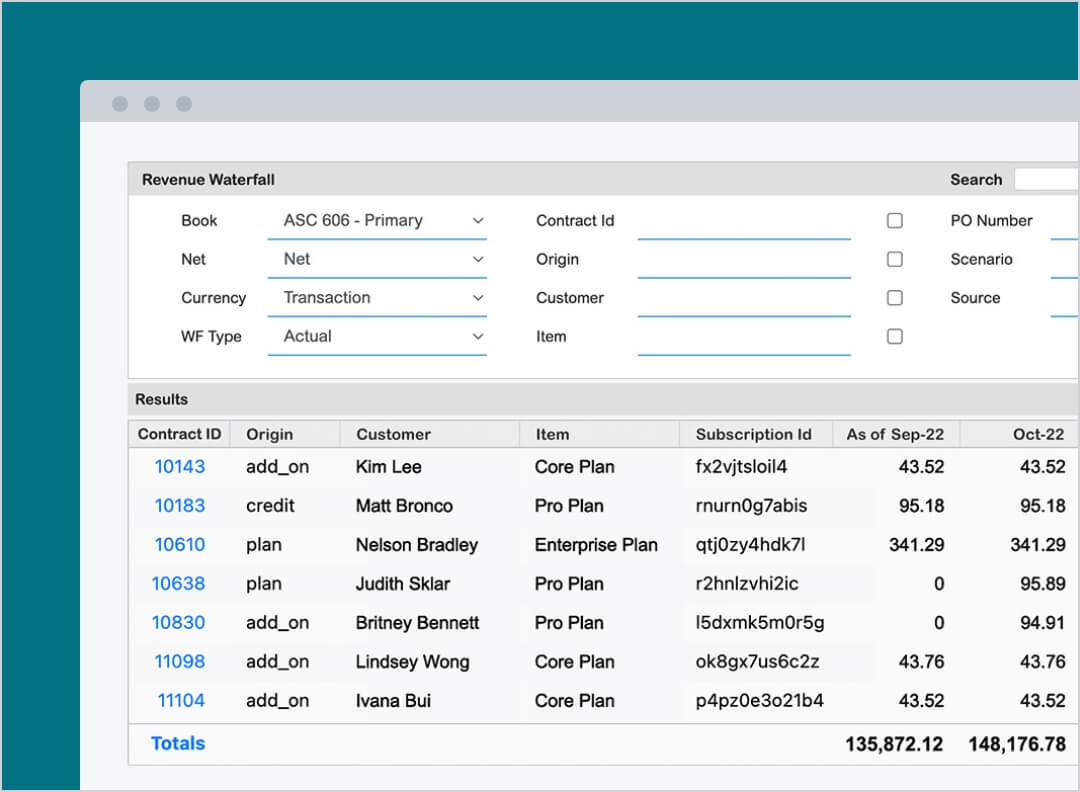

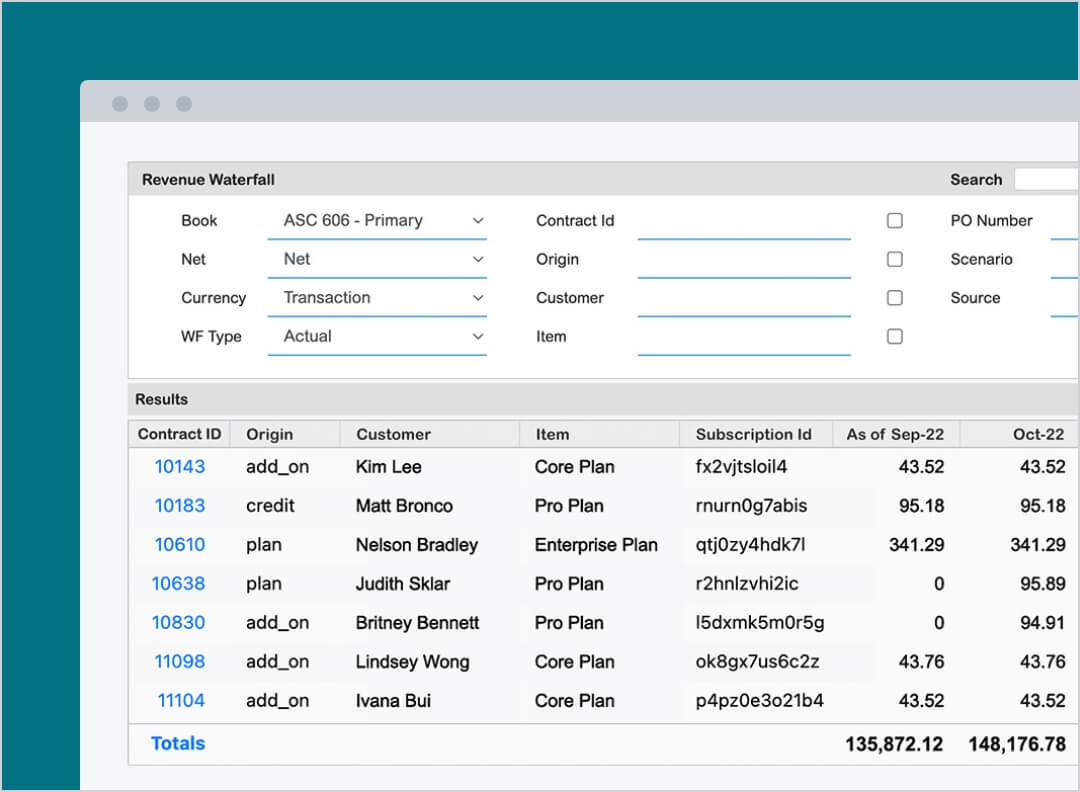

Revenue reporting and forecasting

Recurly revenue recognition improves revenue visibility and forecasting across a diverse set of monetization models, multiple currencies, and international payment methods. Finance teams can easily account for contract modifications, including volume discounts, up-sell, cross-sell, refunds, returns, cancellations, terminations, and price adjustments.

ASC-606 and IFRS-15 compliance

Automate revenue recognition workflows and streamline compliance according to the 5 step processes defined by FASB and IASB accounting standards.

Revenue forecasting and reporting

Action real-time, multi-dimensional revenue insights, reporting, and forecasting across a diverse set of monetization models, multiple currencies, and international payment methods.

Automated revenue recognition

Accelerate your monthly close and meet global financial reporting requirements.

Multiple revenue models

Support multiple, complex pricing models including consumption, usage, milestone, and percent of completion and/or delivery.

Global revenue recognition

Scale growth across countries with multi-currency, multi-book, and multi-entity accounting.

Experience matters. Enjoy unmatched, proven scalability with Recurly.

2,200+

leading brands

50M+

active subscribers

$10B

annual transaction volume

$880M

revenue recovered in 2021

Frequently asked questions

What is revenue recognition?

Revenue recognition is GAAP accounting principle that defines when and how revenue may be recognized. Revenue recognition for recurring billing and subscription contracts can be challenging to understand, calculate, and report.

Can I purchase Recurly Revenue Recognition without using Recurly for subscription management and billing?

Yes! You can purchase Recurly Revenue Recognition as a standalone product. To learn more, visit the product documentation.

What is ASC-606 revenue recognition?

ASC-606 is a revenue recognition standard that affects all businesses that enter into contracts with customers to transfer goods or services—including public, private, and non-profit subscription businesses. Learn more about ASC 606 compliance for subscription services.

What are the five criteria for revenue recognition?

The five criteria for revenue recognition are: 1) identify the contract with your subscriber, 2) identify the performance obligations in the contract, 3) determine the transaction price, 4) allocate the transaction price across the performance obligation(s) defined in the contract, and 5) recognize revenue when your business satisfies a performance obligation.

What are the methods of revenue recognition?

There are several revenue recognition methods. The most common are sales basis, complete contract, installment, cost recoverability, and percent complete.

Why is revenue recognition needed?

Revenue recognition is an essential accounting principle governing both when and how much revenue to recognize in financial statements. Companies are required to accurately account for their revenue earned.