Global payments orchestration

Optimize, simplify, and secure complex payment processing with a symphony of resources that reach and win subscribers anywhere in the world you choose to play.

Payments orchestration overview

See how Recurly helps you accept recurring payments online with global payments orchestration and optimization.

Payment method flexibility is a deal breaker

Recurly knows 42% of US customers abandon their cart if their preferred payment method isn’t available. And 53% of customers view the security of their data and money as most important when choosing an online payment for their subscription services.

With half of your audience focused on payment methods, it’s crucial to offer the payment processor expertise and security protocols that win their business—and trust. Choose a payment platform you can grow from.

Expand and uncover new revenue opportunities with a seamless, scalable, multi-gateway and multi-payment strategy

Make gateways your growth strategy

Open the gate to frictionless signups by supporting multiple payment gateways. Give your broad customer base their choice of regional and global providers so every checkout results in conversion. And with testing and automatic gateway failover, failed transactions are a thing of the past. Keep your customer payments rolling in on a monthly basis without your team managing every manual step.

Reach and win global customers

Power a flexible payments strategy that can travel across borders—and demographics. Attract new subscribers with support for the method of payment they already use and prefer, from debit card payments to bank payments and more. Wherever the customer, whatever the currency, Recurly has you covered.

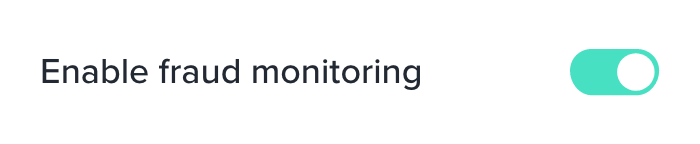

Lock in enterprise-level security

Recurly takes a no-compromise approach to security and compliance with tools that keep you within the guardrails. We protect subscribers’ data and ensure secure, compliant payment processing. Plus, always-on fraud management fights chargebacks every step of the way.

Key features

Scale your cash flow confidently with support for regional and global payment gateways, dozens of payment methods, more than one hundred currencies, and active fraud management. Skip awkward conversations over late payments. With Recurly, you can win customers with regular payments and start building your subscription business today.

Multiple payment gateways remove barriers to scale

Most customers expect some form of automated credit card payment form. Reach new audiences and boost revenue opportunities by choosing a mix of payment processors and gateways that support additional currencies and payment methods.

- Reach subscribers worldwide through 20+ gateways

- Gain support for 140+ currencies

- Provide gateway failover redundancy

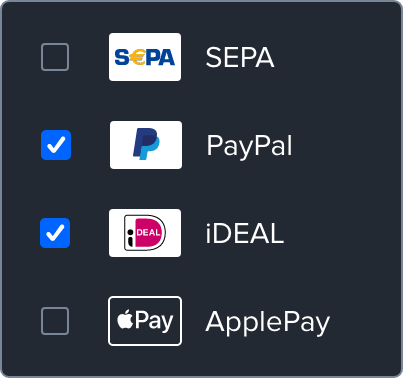

Alternative payment solutions entice global buyers

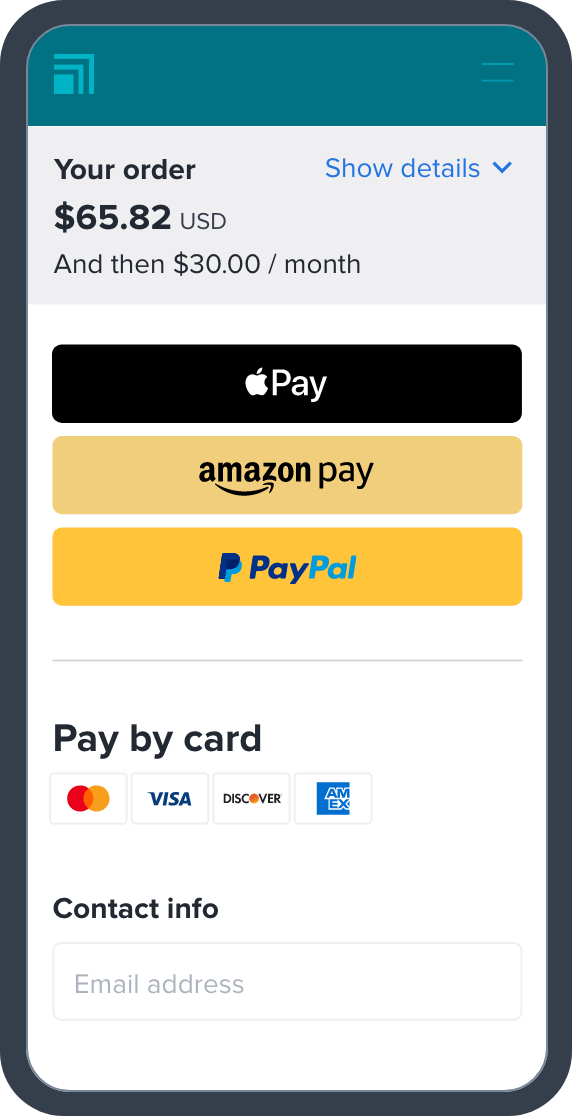

Offer one of the key features every customer is looking for: a secure payment form. Start accepting automatic payments in minutes—from anywhere. Explore a world of payment methods, including credit cards, Amazon Pay, PayPal, Venmo, Apple Pay, Google Pay, SEPA, Bacs, BECS, ACH, debit card payments, external gateway tokens, and more. Pick a payment model with a vision as broad as your business model.

- Support both local and global payment options

- Add new methods quickly and easily

- Allow customers to store a backup payment method

Subscriber wallets hold the cash

Save their card on file–securely and safely. Provide customer and payment assurance flexibility for your business by storing multiple payment methods for an account. Process payments with ease and security. No more missed payments because of missing credit card details.

- Vary the payment method by subscription

- Assign a different method to one-time payments

- Specify a backup method in the event of failure

Fraud management is always on duty

Decrease churn and minimize chargebacks with comprehensive, integrated fraud management that effectively fights fraud from card-not-present transactions, account takeover, and account creation fraud using AI-powered tools. That way, you can identify when a payment failure is a sign of something more.

- Partner with Recurly and Kount, the leading fraud management platform

- Engage with next-generation artificial intelligence scoring

- Perform in-depth analysis with business intelligence tools

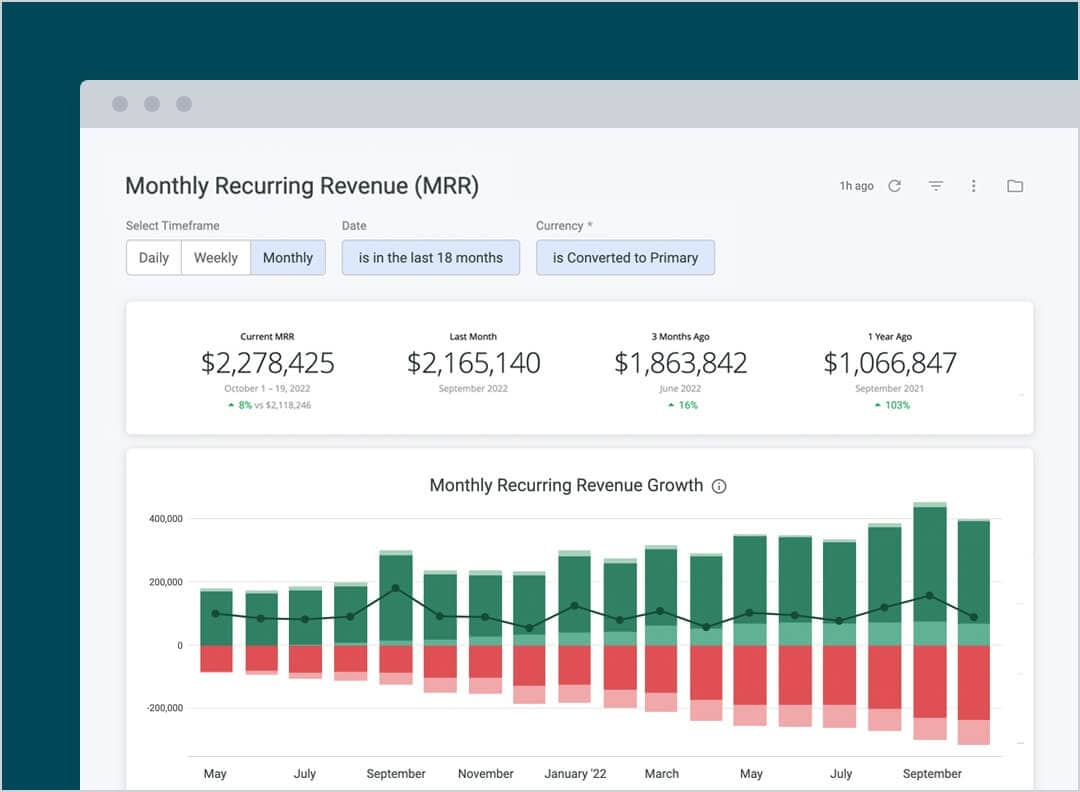

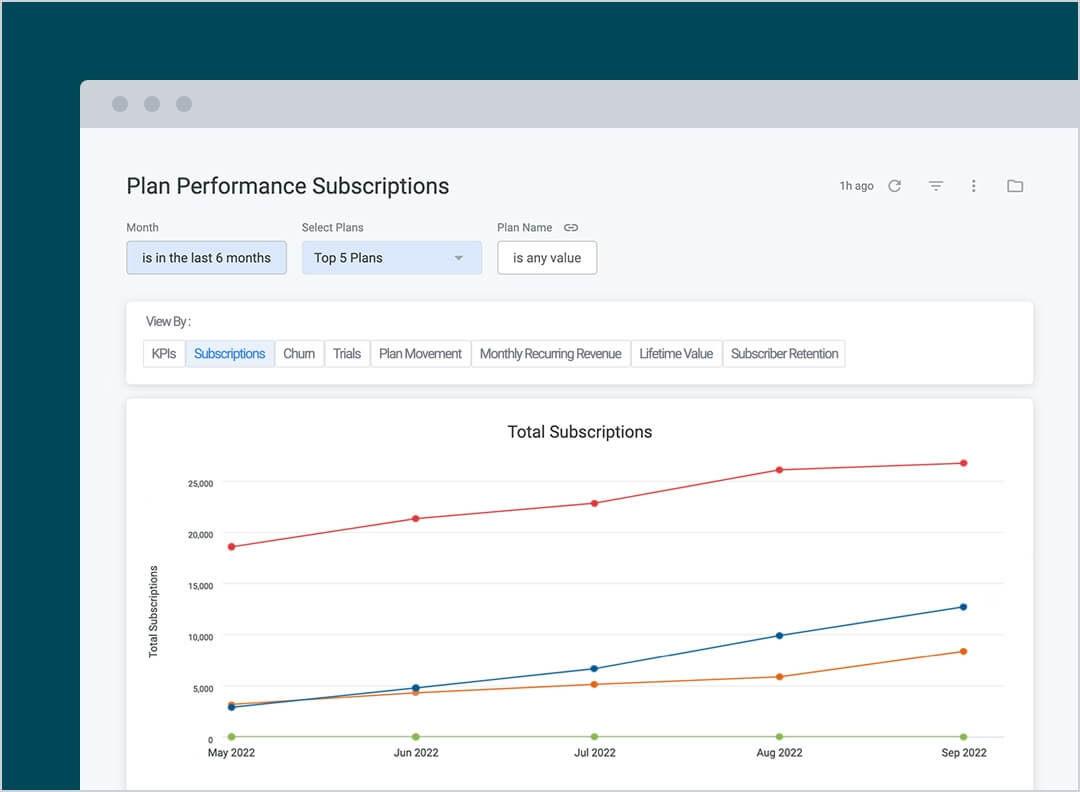

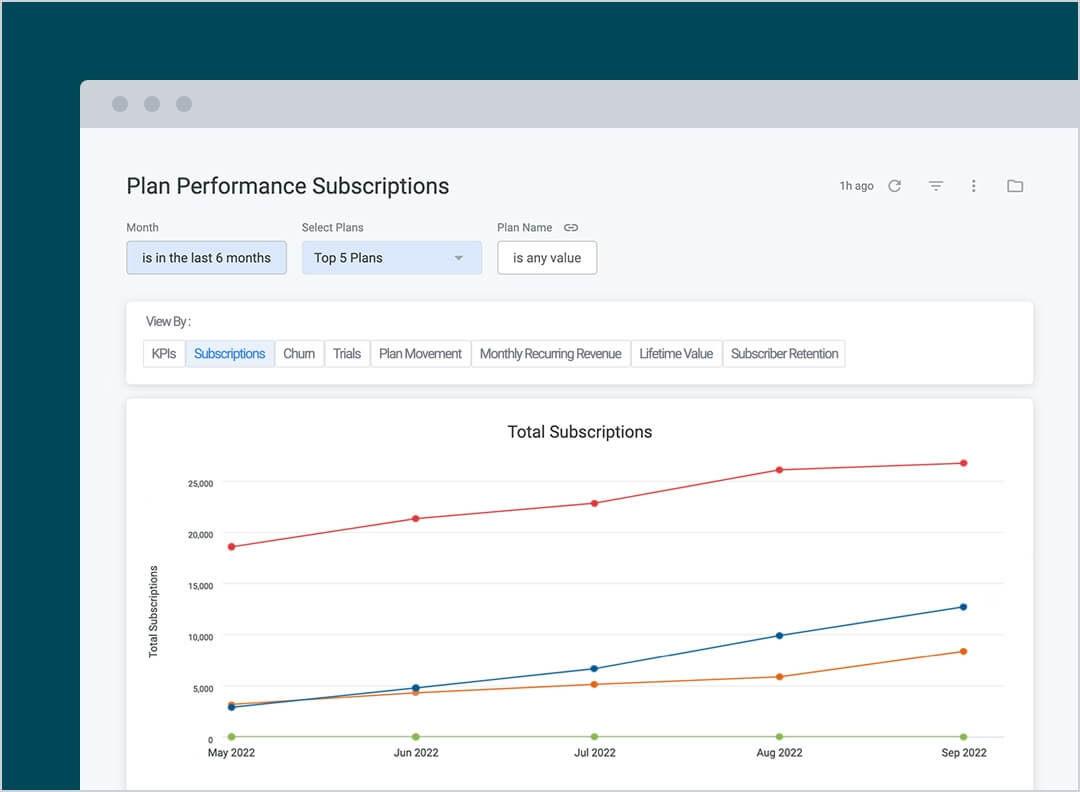

Identify growth opportunities with advanced subscription analytics

Gain deep insights into business performance with advanced subscription analytics via charts, tables, and graphs that allow you to optimize what’s working and tweak what’s not. Watch transaction volume rise and fall over a payment cycle to identify predictable cash flow opportunities and build a stable revenue stream.

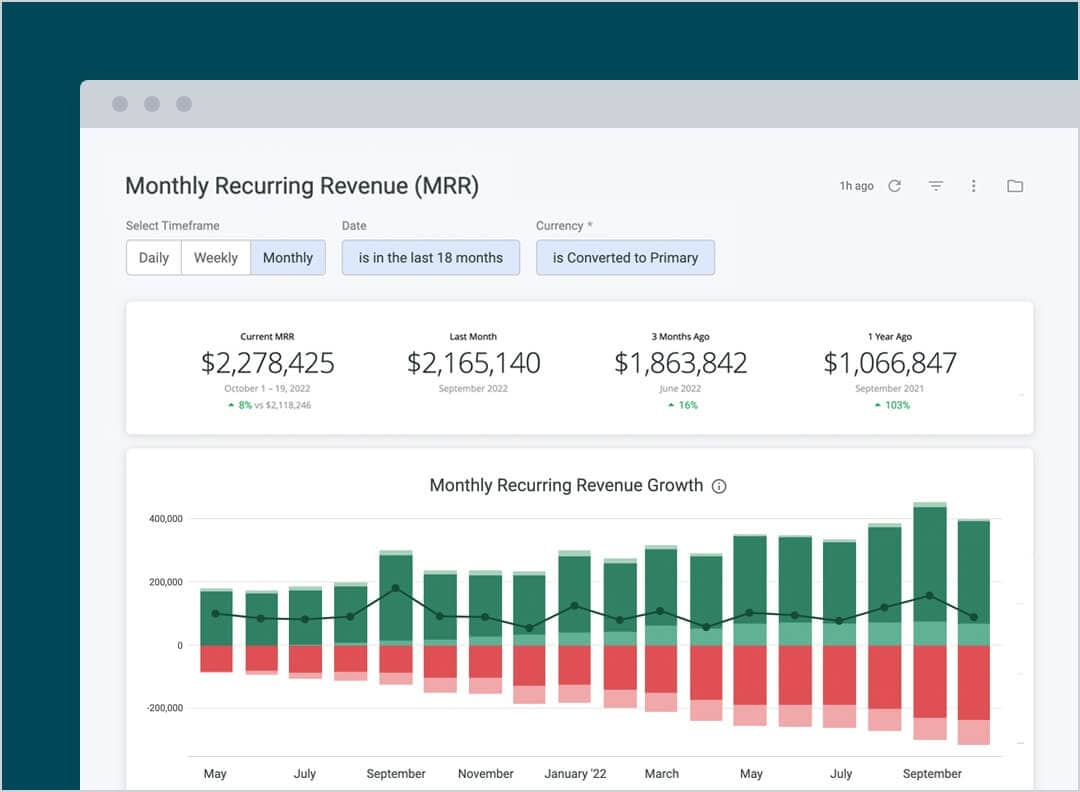

Learn more about reporting & analyticsMonthly recurring revenue (MRR)

Measures the predictable revenue a business expects on a regular basis by tracking total MRR and MRR changes. Develop a payment model flexible enough for your customers and designed to suit your billing process.

Helps monitor and evaluate business growth and revenue momentum.

Billings

Calculates the total amount of successful payments, refunds, and the net of the two over a selected time period, detailing new and renewing customers.

Views billing performance across country (if global) and state.

Plan performance

Evaluates the performance of a plan after pricing, plan length, or promotional changes.

Compares attributes of different plans, such as trial or plan length, to gauge which subscription plan is most successful.

Get connected through the Recurly partner ecosystem

Seamlessly extend your existing workflows and tech stack with pre-built integrations for dozens of CRM, ERP, and data systems, as well as gateways, accounting, tax, and fraud solutions.

View all partner integrationsPayment methods

Give your subscribers the flexibility to pay with major credit and debit cards, ACH, digital wallets like Amazon Pay, Apple Pay, Google Pay, Venmo, and PayPal, as well as local payment types including SEPA, UnionPay, Bacs, and BECS.

Learn morePayment gateways

Reach subscribers worldwide by connecting to your choice of 20+ gateways and accepting customer payments in 140+ currencies. Optimize for transaction fees and maximize payment success.

Learn moreKount

Protect your business from suspicious activity with superior and customizable fraud-fighting capabilities directly within Recurly, leveraging Kount’s next-generation artificial intelligence scoring and business intelligence tool to perform in-depth analysis.

Learn moreExperience matters. Enjoy unmatched, proven scalability with Recurly.

$12B

annual total payment volume

$1.3B

annual recovered revenue

140+

local currencies supported

96%

annual renewal invoice paid rate

Anything related to our revenue is obviously very significant. So, our ability to ensure that our payment processing works smoothly and is effective was critical. This is the most important benefit Recurly gives us.

Read case studyFrequently asked questions

How do I accept recurring payments?

Recurring automatic payments refer to a subscription billing model where consumers pay for a product or service in regular intervals (e.g., monthly or yearly). Subscription-based businesses can leverage payment processing services that can reduce administrative costs. Recurly offers the most popular global payment options to make global recurring payments easy and efficient.

What are the intervals of recurring payments?

Recurring payments may be scheduled for any interval, such as daily, weekly, monthly, or yearly. It depends on the billing cycle the customer prefers and the payment plan offered for those services. For instance, most gym memberships offer a monthly payment plan, while magazine subscriptions tend to offer an annual payment schedule.

How do I set up a recurring payment?

A customer provides a business with a payment method (e.g., credit card, Apple Pay, ACH) for the business to use to process each recurring payment. Credit card payments are one of the most common ways to pay for subscription services, and the right payment service provider can ensure you get payments on time every billing cycle.

What is the difference between a one-time payment and a recurring payment?

While a recurring payment is one that automatically recurs on a defined time interval, a one-time payment does not recur unless initiated by the customer or business. Subscription payments come out of the customer’s account on an ongoing basis, but they may make a manual payment for a single product or service.

What is the difference between autopay and recurring payments?

A recurring payment is a scheduled payment transaction made for a specific amount at a specific interval (i.e., $9.99 per month). Autopay, on the other hand, doesn’t refer to a fixed amount. It simply allows a business owner to collect payments from customer accounts when an invoice is issued, like customers who have their utility bills on autopay.