The guide to ASC 606 revenue recognition for SaaS

For the first time in 100 years, the standards governing revenue recognition policies have changed. In 2018, the Financial Accounting Standards Board (FASB), which establishes the standards for all accounting professionals and companies who follow these principles, and the International Accounting Standards Board (IASB) issued a new standard that changes revenue recognition rules.

ASC 606, is a hot topic for accountants. Partly because their rules and procedures don't change often, so complying means changing revenue recognition methods. Public businesses and private companies must both comply.

It's also a hot topic because ASC 606 is a powerful upgrade to the financial reports for SaaS businesses (as well as any other business that uses contracts with customers). After all, separating actual income from deferred revenue is more difficult in the subscription industry.

Let's break down what ASC 606 means for subscription-based business.

What is ASC 606 and why does it matter?

ASC 606 is an accounting principle that provides businesses with a universal framework for recognizing revenue from customer sales. It sets a single, industry-agnostic revenue standard for identifying revenue streams using a five-step process. It covers the money earned from contracts with customers and considers the costs SaaS businesses incur during the different stages of a customer lifecycle.

Comparing revenue sources across industries wasn't easy because cash flows differently in a business depending on your industry. ASC 606 plays a significant role in guiding how businesses recognize revenue.

Accurately determining the transaction price, considering variable elements, and identifying and allocating revenue to distinct performance obligations within subscription contracts is vital.

Contrary to traditional business models where service delivery happens at the moment of the transaction, subscription services recognize revenue when the cash, per the contract, has been earned and not just collected.

For subscription businesses, the transaction price is typically the total consideration expected over the contract term–including all fees, charges, and variable considerations, such as usage-based fees or discounts.

Additionally, subscriptions have multiple performance obligations within a contract, and revenue recognition typically occurs over time because services are delivered continuously.

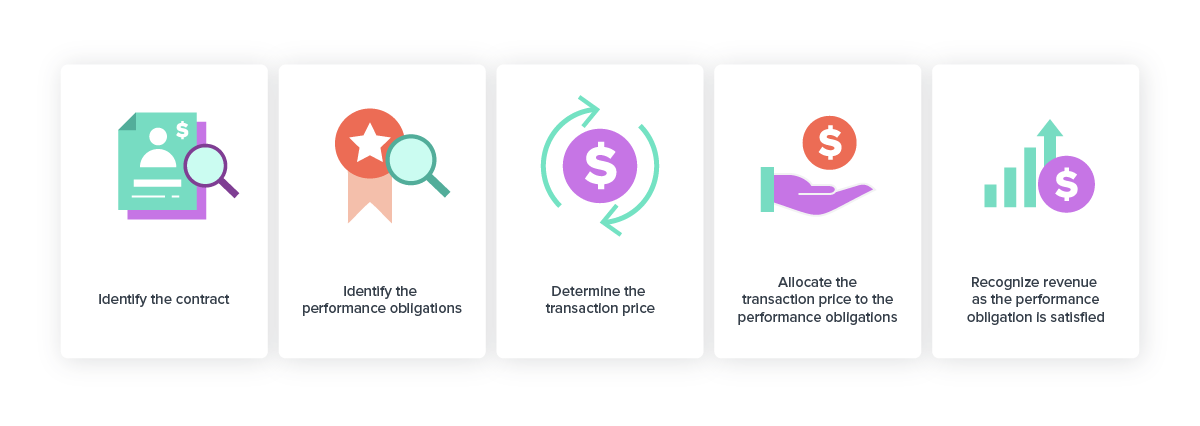

How does the five-step process of ASC 606 change the revenue recognition standard?

The five-step revenue recognition model sets the principles for revenue recognition in an annual reporting period for any business, regardless of industry or business model. As a subscription-based business owner, you'll notice how this framework makes room for companies just like yours.

Identify the contract with the customer. Outline specific criteria to be met including obtaining approval with the customer, clearly defining rights and payment terms, ensuring the commercial substance of the product or service, and assessing the likelihood of payment fulfillment.

Identify the performance obligations outlined by the contract. Carefully analyze the terms and conditions of the contract to determine what service is provided to the customer to fulfill the contract.

Determine the transaction price. Calculate the contract cost and predict the total amount the company is entitled to receive from the customer. Transaction prices can include non-cash transactions, variable considerations such as discounts, add-ons, mid-cycle upgrades or downgrades, and any price concessions your business offers.

Allocate the transaction price to the performance obligations. Assign the total consideration price to performance obligations. These obligations include software licenses, implementation services, and ongoing customer support.

Recognize revenue when the entity satisfies a performance obligation. Revenue should be recognized when an entity satisfies a performance obligation by transferring promised goods or services to the customer. This ensures financial statements provide a more accurate picture of the entity's economic performance.

The need for each step in the ASC 606 revenue recognition standard depends on the business, but this is a great baseline to follow for compliance to properly gain revenue from contracts.

How to implement ASC 606 in your business?

While the five steps of the ASC 606 revenue recognition standard seem simple, implementing it can become a challenge. Additionally, the timing of revenue recognition can impact financial statements and have legal and tax consequences.

Recognizing contract revenue too early can lead to

Overstated revenue: It inflates a company's reported annual revenue figures, making it appear more profitable than it is.

Legal and regulatory issues: It can be considered fraudulent accounting, and violations of accounting standards can result in fines or penalties.

Tax implications: If a business pays taxes on income it hasn't earned yet, it may face tax issues and penalties.

Recognizing revenue too late can lead to

Understated revenue: It makes the business appear less profitable, affecting investor perceptions and the ability to secure financing.

Cash flow problems: The company may not have access to the revenue it has already earned for current expenses.

Compliance issues: Non-compliance can result in financial restatements and associated costs.

When you're worried about turning in the right financial statements to the IRS with the right ASC 606-10-20 revenue recognized, that's when you want to pick the ideal revenue recognition software for your business.

Using automation tools like Recurly can streamline the revenue recognition process by automating calculations, ensuring accurate recognition of revenue, and reducing the risk of errors. By implementing the 5-step revenue recognition process as outlined in ASC 606 and utilizing automation tools, your business can improve accuracy, efficiency, and compliance in revenue recognition practices.

Check this out: Five recognition must-haves for DTC subscriptions

Why does ASC 606 compliance matter for businesses?

Compliance is key for all entities to build trust and accountability with stakeholders. The ASC 606 standard creates clear methods of revenue recognition that make it easy for all companies to be consistent with accounting practices.

While core principles of financial compliance are universal, the regulatory environment and revenue recognition models can create challenges for nonprofit organizations and public and private companies.

Nonprofits, for example, face unique tax-exempt regulations, public companies must meet stringent securities regulations, and though private companies have more flexibility, they must adhere to accounting standards.

ASC 606 requires more comprehensive disclosures than the standards accountants followed before. Still, its flexible framework allows your team to account for the uncertainty of revenue and deal with complex revenue scenarios.

Now, when your accountants talk about the comparability of revenue recognition, you can rest assured they can reach a point where they can compare apples to apples because non-profit, private, and public companies all follow the same principles for revenue recognition.

What is the impact of ASC 606 on different industries?

ASC 606 has a significant impact on various industries, including retail and Software-as-a-Service. This standard has brought about adjustments and challenges during the transition phase, but it has also brought potential changes and opportunities for these industries.

In the retail industry, ASC 606 has resulted in more consistent and comparable financial reporting across companies. However, this transition has posed challenges, especially for companies with complex sales arrangements or loyalty programs, as they need to identify separate performance obligations and allocate revenue accordingly.

For SaaS companies, ASC 606 has altered how they recognize revenue, primarily focusing on the transfer of control over a period of time. This change to recognizing revenue as services are provided requires SaaS companies to reevaluate their recognition practices and systems. Despite these challenges, ASC 606 has brought opportunities for SaaS companies, such as increased clarity and comparability in financial health reporting, as well as improved investor confidence.

Overall, ASC 606 has had a significant impact on various industries, necessitating adjustments and presenting challenges in the transition phase. However, it also brings important changes and opportunities, including more accurate reporting, increased comparability, and enhanced investor trust.

How does Recurly handle revenue recognition compliance under ASC 606?

More flexibility and personalization create the need for an automated revenue recognition platform. Subscription companies with complex revenue streams, such as different pricing tiers, billing frequencies, or contractual obligations, with high transaction volumes, or planning to scale, really benefit from automated revenue recognition systems.

Automated revenue recognition helps streamline operations, reduce errors, and ensure accurate financial reporting. And Recurly makes this a reality for our customers.

Our revenue recognition solution stays updated with the latest changes in accounting standards, including ASC 606. Those automatic updates roll over to our customers, automatically incorporating the criteria for revenue recognition, showing unrecognized revenue, and making it easier for accounting teams to track revenue over time.

Inside the automated revenue recognition process in Recurly

To grow limitlessly, recurring revenue businesses must be ready to adapt to evolving revenue recognition principles quickly.

Partnering with a subscription management and recurring billing platform ensures that business standards are understood and met with the expertise that is vital to compliance needs. Recurly's all-in-one solution offers:

Lower costs and a streamlined tech stack

Improved revenue visibility, reporting accuracy, and predictability

Accelerated financial closes

Reduced compliance risks

Support for changing business and accounting requirements

Direct-to-consumer subscription businesses must approach revenue recognition differently. Accurate Revenue recognition software is the answer for any growth-minded business looking to automate subscription revenue accounting.

With high-velocity, high-volume customer contracts and seemingly endless contract modifications, revenue recognition standards such as ASC-606–and IFRS-15 for businesses operating abroad–can easily become more complicated.

Check out this checklist with five revenue recognition must-haves for DTC subscription businesses.