Revenue recognition software for Saas businesses

For a SaaS business model, revenue recognition is one of the most important accounting requirements; you often bill for services to be rendered far into the future, so the time that revenue is recognized can have a major impact on your quarterly and annual revenue models.

In this article, we will explore what exactly revenue recognition is and how ASC 606 established a new framework for SaaS revenue recognition.

How do ASC 606 and IFRS 15 affect SaaS companies?

Essentially, ASC 606 standardized how companies can capitalize on or reduce costs to get a contract. Working in tandem, IFRS 15 establishes reporting principles when accounting for business costs, including cash flow information about timing, amount, and revenue uncertainty.

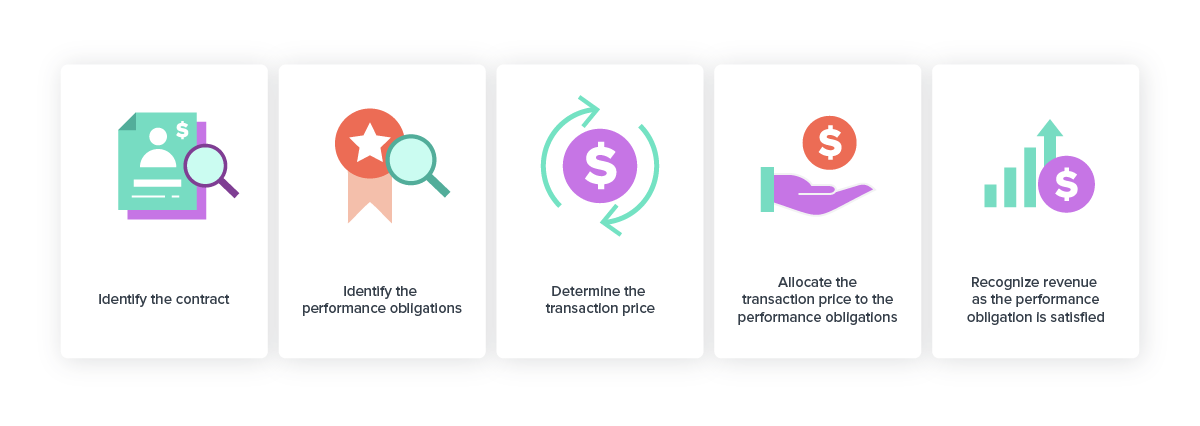

With ASC 606, a company has to apply five steps to meet the standard:

Identify a contract with a customer.

Identify the performance obligations in the contract.

Determine the transaction price.

Allocate the transaction price.

Recognize revenue when (or as) the reporting obligation meets the performance obligation.

Before these standards were put in place, there were variations in how businesses in different industries recognized their revenue for similar transactions. This gives you clarity on how to look at SaaS bookings compared to revenue streams.

Software revenue recognition example

Let’s say you ran accounting at a subscription company, and a customer bought an annual subscription for $29.99 on October 1. Is it possible to recognize all of the $29.99 as Q4 revenue?

Not really, you will have to count some of that as deferred revenue.

You have to recognize the revenue as the service is being delivered to the customer, $2.50 in revenue each month throughout the year.

Software revenue recognition is fairly straightforward in most cases. But it can get a little hairy sometimes—particularly if your pricing model is complicated. This is where a revenue recognition platform comes handy.

Why do you need revenue recognition software in SaaS?

Revenue recognition software automates the process that tracks your company’s closed sales and turns them into revenue recorded on your financial statements.

Under ASC 606, you can only record the noncallable portion of your contract as revenue. Let’s go back to the example–let’s say that you allowed customers to cancel their subscription at any point and receive a pro-rata refund or a refund based on what remained in their subscription policy. In that case, the arrangement would be recorded as a daily contract, with around 8 cents of revenue per day.

There are sometimes set-up fees in SaaS arrangements. With the previous accounting standard, these fees were recognized over the initial contract period or the estimated customer relationship period if longer. But the ASC 606 accounting standard only requires vendors to recognize up-front fees over a period that extends beyond the initial contract period if the customer has a “material right” to renew the contract.

Want to learn more? Here’s a Deloitte resource that walks you through several scenarios you may encounter.

As you can tell, there are judgment calls that go into revenue recognition SaaS decisions. We recommend you speak to a trusted accountant if you have questions about a specific scenario.

What are the benefits of using revenue recognition software?

By creating a revenue recognition framework and using software to automate the process, you can ensure that your business stays on the right side of the law—but the benefits don’t stop there. SaaS revenue management software can also help you run your business more effectively. Here are a couple of ways it can do that:

Through automation, a revenue recognition framework can enhance your product strategy by saving time for your teams. By automatic processes such as logging customer sales information, revenue management software can allow your sales representatives and accountants to focus on more important tasks.

Through revenue recognition, you can match your revenue to the time you perform services. You can use that data to hire seasonal staff when you actually need them.

Your MRR won’t have huge fluctuations based on the timing of your billings, so you can use it to get an accurate view of your company’s long-term growth trajectory.

A revenue management framework can streamline complicated revenue calculations, ensuring your accounting team can easily manage billing, cash flow, and reduce revenue leakage. The enhanced accuracy also reduces human error in the process of calculations.

How Recurly’s revenue recognition can help your SaaS business

Using a revenue recognition software, like Recurly, can help your business establish standards and rules to recognize your revenue, specifically how your company and industry operate, thus optimizing and streamlining your financial planning process to foster business growth.

Recurly’s revenue recognition solution for SaaS companies allows for multiple recognition methods. The flexibility provided by our platform allows you to comply with ASC 606 easily and at the same time, future-proof your company from any additional updates to accounting standards.

Learn more: See how Recurly helps businesses like yours stay compliant with the latest revenue recognition standards.