Teaming Up with Avalara to Make Streaming Taxes More Streamlined

It’s no secret that streaming services have completely changed the way many Americans consume media. For years, consumers have been shifting away from purchasing one-off movies, shows, and songs — or getting most of their entertainment from a cable TV package — and instead subscribing to services like Netflix and Disney+. With COVID-19 forcing millions of consumers to stay home, these trends have only accelerated in 2020.

These streaming services haven’t just attracted consumers’ attention, though. State and local governments have also noticed the shift toward streaming and have started to impose various taxes on these platforms. Today, 33 states, along with the District of Columbia, impose various kinds of taxes on these kinds of communications services.

Recurly + Avalara for Communications: Making Streaming Taxes Simpler

Streaming taxes can be extremely confusing. Unlike traditional sales and use taxes, they can vary widely based on jurisdiction such as townships and counties. Since there’s no single tax rate companies can count on — and since new rules are constantly being introduced — you must pay close attention to local regulations, lest you unwittingly forget to pay taxes (or pay taxes unnecessarily).

To help streaming companies accurately calculate the local and state taxes they owe, Recurly now integrates with AvaTax for Communications. Avalara is a leader in tax compliance, and for years, we’ve integrated with Avalara AvaTax to help merchants calculate taxes in general.

AvaTax for Communications is specifically designed for merchants that provide communications services, like streaming platforms, who need to efficiently bill for surcharges, taxes, and fees and remit them to the appropriate tax authorities.

How does AvaTax for Communications work?

AvaTax for Communications continually monitors local regulations and ensures its system is compliant with the latest tax regulations for communications platforms. While powerful, it’s also flexible: you can override any rules as necessary or create special tax bundles.

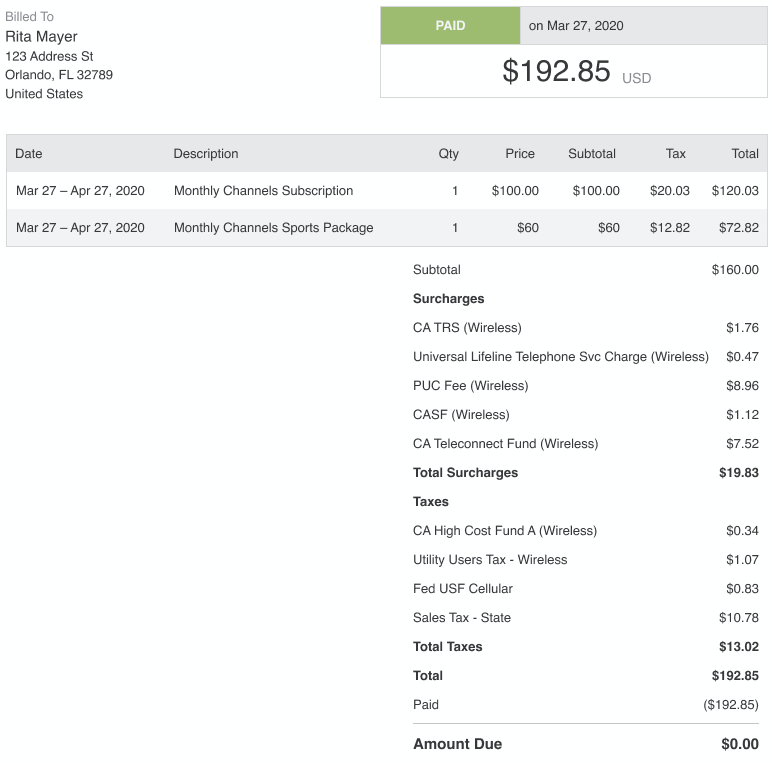

We integrate with AvaTax for Communications through Recurly's and Avalara's publicly available APIs. AvaTax for Communications automatically generates the appropriate sales tax, communications taxes, and communications surcharges and adds them to invoices to ensure subscribers have a complete and accurate picture of their bills.

Here’s a sample invoice that includes taxes automatically calculated by AvaTax for Communications:

Once you sign up with Avalara, integrating AvaTax for Communications with Recurly is a simple process — see our documentation for a step-by-step guide.

Finally, AvaTax for Communications works both in the US and abroad, so for merchants that provide streaming services globally, it will automatically handle applicable tax liabilities (such as European digital services taxes) anywhere in the world.

Important disclaimers

While AvaTax for Communications supports a variety of telecommunications use cases, Recurly currently only supports taxes applied to streaming and OTT (over-the-top) services. Please reach out to Recurly Support or our friendly sales team if you have any questions about Avalara support. We plan to continue to invest in this integration over time.

Additionally, while Recurly is not a tax expert, we aim to provide you with tools that you can use to comply with tax laws around the world. To understand which laws and regulations your business is subject to, please consult a taxation expert. If you do not have one, Recurly would be happy to refer you to a taxation expert who has worked with customers like you in the past.