Credit card for subscription free trials?

Many components create the ideal customer acquisition promotional toolkit. Free trials are one of them. According to our survey report, The State of Subscriptions: What consumers want, 75% of consumers are more likely to subscribe if a free trial is offered. But this is no surprise–cautious customers love to try before they buy, and free trials are the perfect opportunity to showcase the value of your product and convince them to stay.

However, only 34.5% of subscription businesses offer free trials for customers to test their products. While deciding if businesses should allow for a product test, one of the questions many product marketers face is whether or not to require credit cards for free trials in subscriptions.

To decide if requesting credit card information for a subscription trial aligns with your strategy, ask yourself the following:

How does requiring a credit card align with your business model?

What is the user experience like during the free trial?

What is the pricing strategy after the free trial ends?

How will you monitor and analyze user behavior during free trials?

What are the potential advantages and disadvantages of requiring a credit card?

Let’s focus on this last question for the rest of the article. In this blog post, we’ll review the pros and cons of asking for credit card details during a free trial so you can seize what makes more sense for your business.

We'll also delve into the realms of virtual credit cards and prepaid cards–how they can be a viable solution to balance subscriber trust and business needs during free trials.

Should free trials be cardless for subscriptions?

The short answer is that it depends on your business goals. Allowing potential customers to test your product before buying is crucial to a winning acquisition strategy, but are you looking for a high sign-up volume or a more targeted audience?

While requiring a credit card helps you find a more targeted user base and makes the transition from trial to recurring customers easier, trials without cards pave the way for higher numbers in subscriber acquisition.

Each scenario has pros and cons for businesses and consumers–let’s review both.

Pros of requesting credit cards for free trials

Here are the top three advantages of asking for a credit card during free trials.

Reduced abuse of free trial periods

Subscription trials that request a credit card work like a filter, as you can prevent users from exploiting free trials repeatedly using multiple email addresses. This helps reduce abuse and ensures that genuine users make use of the trial.

Higher conversion and subscriber commitment

Asking for billing and payment information upfront increases engagement and the likelihood of converting trial users into paying subscribers. Only prospects who are willing to provide credit card details may be more committed to exploring the service during the trial period.

Streamlined billing and payment processing

When the free trial ends, users don't need to provide payment details again and can continue using the service without any interruption. This convenience can contribute to a positive user experience as it reduces friction for customers when transitioning from a trial to a paid subscription.

Cons of requesting credit cards for free trials

Here are the top three disadvantages of asking for a credit card during free trials.

Privacy concerns and customer trust

Requiring a credit card upfront may discourage potential users who are hesitant to share sensitive financial information or have privacy concerns. If they feel like their information is being misused or that they were charged unexpectedly, it can damage trust in your business and cause significant trial sign-ups.

Chargebacks and disputes

Providing credit card information increases the likelihood of chargebacks and disputes, which can be time-consuming and costly. Additionally, in cases where users forget to cancel before the trial period ends, they may unintentionally incur charges that can lead to customer dissatisfaction and support issues.

Legal and regulatory compliance

From PCI-DSS compliance to tokenization and encryption, subscription businesses must follow the legal and regulatory requirements for handling and storing users' credit card information, which can be complex and costly.

Other considerations for free trials in subscriptions

Besides the elements mentioned above, there are a couple of extra things to consider for free trials in monthly subscriptions.

Virtual cards and prepaid cards as payment alternatives: In the age of digital transactions, virtual credit cards and prepaid cards have emerged as alternatives to physical cards. These temporary cards offer a layer of security for customers while addressing privacy and fraud prevention concerns. Virtual credit card numbers may be the key to balancing subscriber trust and business needs during free trials.

Debit cards and subscription offers: The role of debit cards in free trials can’t be overlooked, as they provide a middle ground for users who seek the convenience of subscriptions without the potential risks associated with credit cards. They can be a viable solution for companies looking to broaden their subscriber base.

Real cards and fraudulent cards: The rise of credit card fraud poses risks for both users and businesses. Subscription companies must enhance security measures by correctly identifying valid credit cards during free trials to combat potential fraud.

Ultimately, the decision to request a credit card for a subscription free trial should be based on your specific business goals and target audience.

You should carefully consider the potential impact on user acquisition and conversion rates when making this decision. Consider your ultimate marketing and sales goals. Mandatory credit cards equal fewer sign-ups with a higher average revenue per user (ARPU). Cardless free trials equal a boost and sign-ups with a potential lower ARPU.

Best practices to manage free trials

Whether you decide to ask for payment details or not, here are some strategies to effectively manage free trials in your subscription business:

Transparent communication: Clearly communicate your free trial terms, including start and end dates and how users can cancel without charges. Send them reminders before the trial period ends, encouraging them to make an informed decision about whether to continue or cancel.

Clear cancellation process: Make it easy for users to cancel their subscriptions. Complex cancellation processes can lead to dissatisfaction and chargebacks.

Customer support: Make sure that your team provides excellent customer support to address user inquiries, cancellations, and concerns promptly.

It’s time to review how you will measure its effectiveness.

Measuring free trial effectiveness

Measuring the effectiveness of trials is crucial for subscription businesses. Understanding trials' performance provides valuable insights that can shape marketing strategies, optimize subscriber acquisition efforts, and better predict the revenue coming from the recently acquired paid subscribers.

One of the most effective ways to know if your free trials are effective is with A/B tests. Do prospects convert more with or without them? Which type of trial is driving more conversions? What is the ideal free trial length?

To answer these questions, divide your subscribers into smaller groups. Cohort analysis–usually segmented by user acquisition or start date–will help you gather insights on monthly recurring revenue (MRR), subscriber lifetime value (LTV), churn, and retention rates.

Test engagement and personalization strategies, trial lengths, and card-required vs. cardless trials for each plan. Then, use the trial conversion rate formula to seize the effectiveness of your trial strategy.

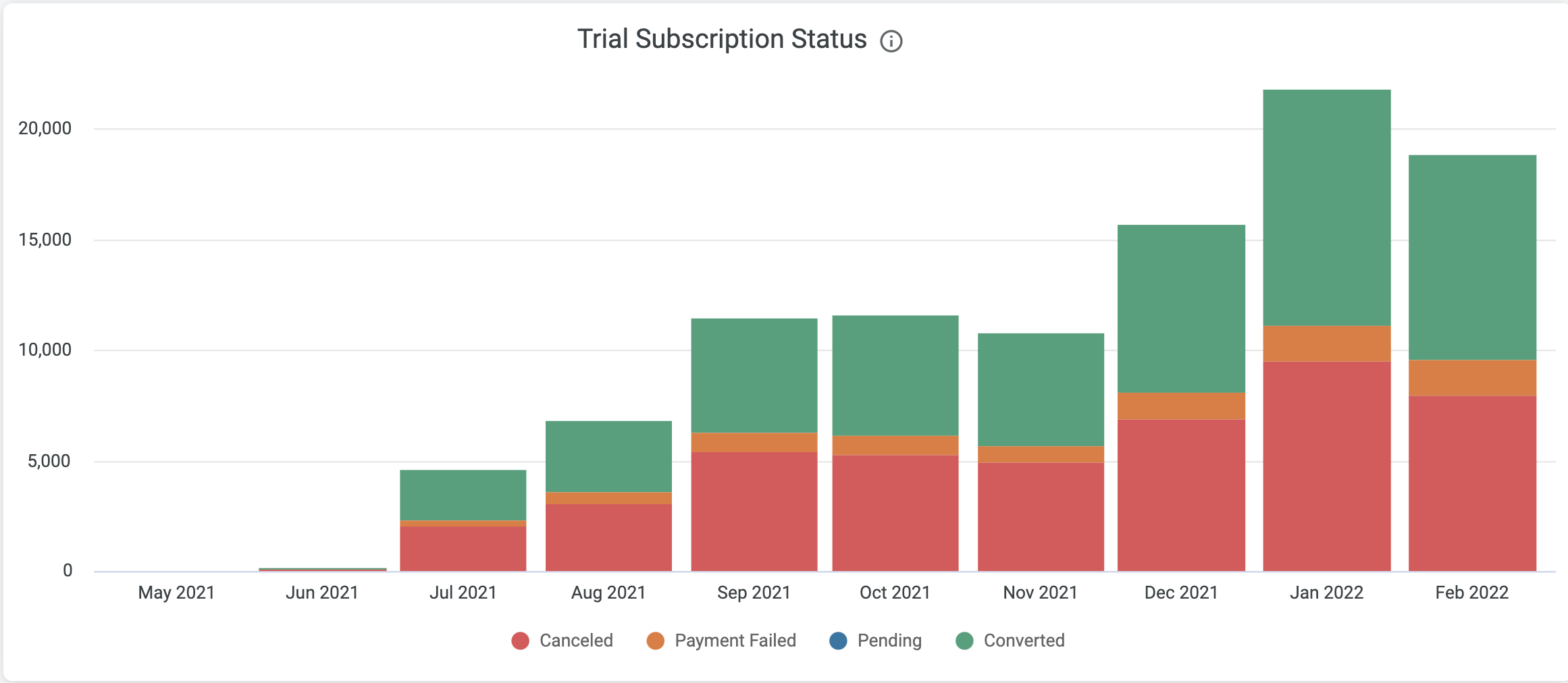

Track conversion rates over time to get an insight into when your prospects become subscribers. Recurly’s Trial Performance report, for example, shows you the conversion rate for trial to paid subscriptions.

Additionally, you can dig into the trials’ status and understand why customers aren’t converting. Maybe they canceled the subscription before the trial ended, or their payment failed.

Understand subscriber preferences & boost your sign-ups

Competing in an increasingly crowded marketplace requires continued innovation and the ability to meet subscribers’ ever-evolving needs and preferences.

How can businesses reinvent their offerings to beat the competition, subscriber demand shifts, and new buying behaviors? Check out this guide with seven proven strategies to help you overcome these challenges.