How to streamline payment processes for revenue efficiency

Now, more than ever, payments play a pivotal role in subscriptions. Clunky and complicated payment procedures can lead to customer churn and missed opportunities. Instead, recurring billing should give you a competitive advantage and simplify your business.

If the phrase “simple payment process” sounds like an oxymoron, keep reading. We've compiled a comprehensive guide on streamlining payments to help you optimize your revenue potential.

What is a streamlined payment process?

A streamlined payment process is an efficient, optimized system that handles transactions between your business and customers. It aims to simplify the payment journey, minimize friction, and enhance the overall user experience–encouraging longer customer retention.

What are the benefits of streamlining payment processes?

An optimized payment system brings benefits to both customers and companies.

Enhanced subscriber experiences: Simplifying the payment journey can help you reduce customer churn–voluntary and involuntary.

Operational and security efficiency: Automating payment processes minimizes errors and frees your teams to focus on value-added tasks. Additionally, integrating robust security measures into payable processes helps protect sensitive information and build trust.

Data-driven insights: Streamlined payment systems often generate valuable data that can be used to analyze subscriber behavior and preferences to inform growth strategies.

Learn how leading subscription brands streamline payment systems to fix and prevent revenue leakage.

Below are five practical ways to create streamlined workflows to eliminate human error and establish continuous improvement practices to keep the lifeblood of your business moving.

1. Analyze your current payment system

Payment processing goes beyond charging for a product. It’s an array of interconnected components. Analyzing your company's payment system is a complex but essential undertaking. It requires dissecting its various components, analyzing their interactions, and identifying opportunities for improvement.

Before implementing any workflow process strategy, you must review your current system first. Start looking for inefficient processes in the following elements:

Payment alternatives and channels: This includes credit and debit cards, digital wallets, ACH payments, or other alternatives. Remember, different customer segments may prefer specific payment methods, making it essential to have several convenient options.

Payment gateways: Analyze their efficiency during high-volume transactions, security features, and integration capabilities with other systems.

Transaction processing: Delve into the mechanics of payment processing and assess the speed and accuracy of this process to avoid delays and inaccuracies.

Security protocols: Examine the security protocols to safeguard customer data, including encryption, two-factor authentication, and compliance with industry regulations.

Data collection and insights: Payment processes generate valuable data that can provide insights into customer behavior, preferences, and trends. Explore how this data is collected, stored, and used for business strategies.

Business process management requires a panoramic view of the forces impacting your internal processes as well as any processes your customers may work through. A hiccup in security or gateway issues that aren’t always at maximum efficiency during peak sales can set your business behind. Some inefficient processes may simply need to be replaced. That’s when it’s time for a platform update.

When you use Recurly for your business’s payment processing, your finance team and accounts team each have access to these key business processes for simple process mapping and improving. A seamless subscription payment infrastructure is a cornerstone of success, and obsolete payment systems, manual processes, and a lack of flexibility can hinder business operations.

2. Create a current process map of how your customers make payments

Process mapping offers a visual approach to operational processes. Generally, mapping process steps is reserved for the early days when you’re first building the workflow processes that make your business run.

It’s time to dust off this discipline to explore one of the most critical business processes: How your business gets paid.

Generally speaking, small operational changes over time will build up repetitive, unnecessary tasks. Each time a customer undertakes a repetitive task, you can count on two factors to chip away at your operational excellence: human error and dropping customer satisfaction. It’s annoying to have to enter the same data twice. It doesn’t matter to your customer that they’re on a microsite for one vendor and then on your payment gateway and the two systems don’t perfectly communicate. To customers, it’s just a repetitive task. They’ve said the same data before, so they’ll look for shortcuts, which adds human error to the mix. Before long, you’re churning customers without knowing why.

That’s where creating a current process map comes in.

Start with the moment when a customer wants to make a purchase and document the full, formal process your customers have to follow. What are all the manual tasks a customer may need to work through? How do their inputs communicate to your finance team? What steps are vital for the process workflow, and which repeatable tasks can be skipped?

Because a process map is a visual tool, process improvements and redundant business processes become visibly obvious. Mapping the manual tasks on your process map will show you exactly which key business processes you can move out of the customer’s hands.

With Recurly, you’ll see customer cohort data — from behavior patterns based on subscription level to churn analysis — that helps you catch this problem before customer satisfaction fades a single percentage point.

3. Find opportunities for process automation where you offer system flexibility

Few issues impact both employee satisfaction and customer satisfaction — and you’ll find those points where a business tries to be flexible for its customers.

When a customer tries to upgrade their subscription, does it necessarily have to turn into a customer service call? When a customer wants to use a preferred payment method, does someone in accounts receivable have to figure out a workaround? If subscription billing information is out of date, does an employee need to manually make sure the workflow functions the way it should?

What other process workflows can only a customer trigger yet can only be resolved by a live customer service representative?

Process improvements here might actually boost employee morale, too. After all, they’re not spending time manually updating account information when the right workflow processes could do the same thing. Some of your greatest champions for process efficiency might be the very employees who carry out the simplest tasks for one-time purchases, upgrades, downgrades, etc.

Along with improving employee morale, automating the right workflow processes could save you from rising subscriber churn.

Recurly secures payments for business owners, even if credit card information goes out of date, if a customer changes address, or a credit card expires. There are more than 2,000 payment failure reasons. And it’s not affordable to manually handle them.

Businesses with a streamlined payable process worry less about involuntary churn and focus more on improving their offerings. Recurly provides improved communication up and down the payment process to streamline any issues that might interrupt payments.

With Recurly you can:

Allow for plan flexibility: Providing plan options helps to funnel customers from free trial offerings to paid subscriptions. Recurly helps you easily organize and price plans tailored to business and customer needs.

Offer payment flexibility: Recurly caters to your customers’ preferences. Subscribers can pay any way they choose, regardless of location, whether by credit card, debit or direct debit, or electronic payment methods like PayPal and Apple Pay.

Set up multiple payment gateways: Businesses can choose their preferred gateways, change them anytime, and create custom routing based on unique needs. Multiple gateways mean broader access to the payments ecosystem and uninterrupted services during downturns.

Deploy strong fraud management solutions: Recurly and its partnership with Kount offers real-time fraud detection and machine learning algorithms to identify and block suspicious activities. Additionally, reducing data breaches risk by replacing sensitive payment information with unique network tokens.

4. Use automated dunning processes to solve the laborious task of asking for payment

Dunning may not seem like a part of your accounting processes. Consider this: Your accounts receivable team relies on effective communication with customers and clients every hour of the day. In a sense, the simple act of alerting customers when a payment is due represents a crucial trigger for your business.

If you run your payment processing through workflow management software, one of the first recommendations it might give you is to build a smart dunning process.

Dunning campaigns send email notifications and alerts to your customers whenever payment is due. A smart dunning campaign will initiate communication with a customer when their account falls behind, as well as offer a dozen customizable collection strategies.

Where do you start with dunning? It depends on your customers’ behaviors. Consider the following key metrics for your payment process:

Transaction success rate: The percentage of successful payments processed compared to the number of attempted transactions.

Average processing time: The average time it takes to process a payment, from initiation to confirmation.

Recovery rate: The percentage of failed payments that are successfully recovered through dunning processes.

Involuntary churn rate: The rate at which subscribers cancel their subscriptions due to payment-related issues.

Abandonment rate: The percentage of users who start the payment process but don’t complete it.

While all of them can affect your subscription business’s churn rates, dunning offers a remedy to three of them: abandonment rate, involuntary churn rate, and the recovery rate.

Improving your subscription payment infrastructure

A seamless subscription payment infrastructure is a cornerstone of success, and obsolete payment systems, manual processes, and a lack of flexibility can hinder business operations.

Updating the current systems

Outdated systems can introduce complexities and vulnerabilities. Upgrading to modern payment infrastructures and legacy systems can unlock advanced features such as multi-channel payment options, secure tokenization, and seamless integrations with third-party tools. These updates not only enhance customer security but also provide more convenience and choice, driving higher conversion rates.

Leveraging automated solutions

Automation empowers companies to deliver personalized and consistent experiences while minimizing manual efforts. It improves operational effectiveness, customer retention, and overall business growth.

Recurly is a subscription management and recurring billing platform that helps leading brands deliver powerful customer experiences through seamless, automated solutions–and much more. With Recurly you can:

Allow for plan flexibility: Providing plan options helps to funnel customers from free trial offerings to paid subscriptions. Recurly helps you easily organize and price plans tailored to business and customer needs.

Offer payment flexibility: Recurly caters to your customers’ preferences. Subscribers can pay any way they choose, regardless of location, whether by credit card, debit or direct debit, or electronic payment methods like PayPal and Apple Pay.

Set up multiple payment gateways: Businesses can choose their preferred gateways, change them anytime, and create custom routing based on unique needs. Multiple gateways mean broader access to the payments ecosystem and uninterrupted services during downturns.

Deploy strong fraud management solutions: Recurly and its partnership with Kount offers real-time fraud detection and machine learning algorithms to identify and block suspicious activities. Additionally, reducing data breaches risk by replacing sensitive payment information with unique network tokens.

Run smart dunning campaigns and retries: Recurly provides a reliable, immediate, and personalized process that helps prevent churn. Our decline management strategies can recover up to 76% of failed subscription renewals.

Improved communication can turn around involuntary churn rates. After all, those customers didn’t even consider leaving your subscription offering; their departure is the simple result of a broken workflow process.

When subscribers abandon the payment window, dunning can bring them back. They may have left because they believed they fulfilled the payment but only completed a redundant task. Solving that minor operational procedure adds up to huge dividends, especially when applied to your daily operations.

Recurly provides a reliable, immediate, and personalized dunning process that helps prevent churn. Our decline management strategies can recover up to 76% of failed subscription renewals.

5. Optimize the subscriber experience with digital payments

As technology evolves, so do subscriber expectations. While these needs and preferences may vary across generations, one thing remains consistent: Consumers want convenience and loyalty rewards.

The rising demand for digital payments

In today's digital era, convenience reigns supreme, and the demand for alternative payment methods (APMs) is on the rise. In fact, PayPal was the most popular APM in 2022–accounting for 18% of all transactions and 92% of APM transactions within Recurly.

Adopting these digital channels provides convenience and flexibility and improves overall payment experiences. Customers can choose the method that best suits their preferences and lifestyle, resulting in increased satisfaction and loyalty.

Introducing loyalty programs and incentives

One of the most effective ways to promote customer engagement and retention is through loyalty programs and incentives like exclusive offers, reward points, or discounts. Additionally, membership programs can be linked with electronic payments, automating the redemption of rewards or discounts. This simplifies the overall payment process, enhancing the subscriber experience.

Choose Recurly for valuable insights and data to streamline payments

As mentioned above, lack of visibility in valuable insights is a challenge most subscription businesses face. With the right metrics, you can make more informed decisions quicker based on relevant data.

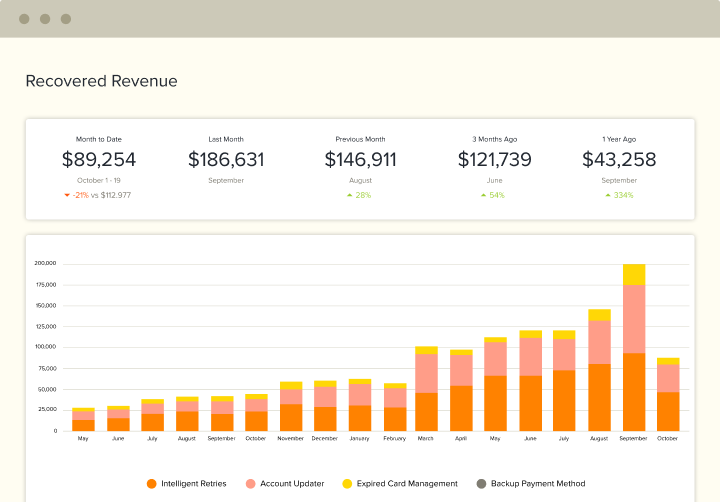

Recurly provides the insights and reporting your business needs to monitor subscription performance and drive improvements. Our customizable, out-of-the-box reports track the performance of your subscription plans, monthly recurring revenue, subscriber retention, recovered revenue, and more.

Want to see what else Recurly can do for your business? Watch our end-to-end product demo to find out.