How automated credit card account updaters fight subscriber churn

"Card declined." These two words can do more than spoil someone's binge-watching plans.

Credit card declines can hurt a subscription business' bottom line, and at the very least interrupt your cash flow. Card info changes all the time, and the more customers you have, the harder it is to track every single number change.

What you didn't know is that a high decline rate is actually forcing your sales teams to work harder than necessary.

Let's show you why. You'll also discover how to address avoidable credit card declines while lightening the load for your entire business.

Let's start with a hidden miracle in the modern economy: Automatic card updates.

What does an account card updater service do?

An account updater service securely checks the major card networks for changes to card information to make sure your business never finds itself with inaccurate card details.

We called it a hidden miracle because customer credit cards and debit cards run the modern economy, and an account updater service makes it run smoothly. In a form of corporate teamwork, the major financial institutions created a kind of card network solution that works together to make life easier for businesses like yours.

An account updater service navigates today's highly secure financial information network to communicate between issuing banks, payment gateways, merchants like your business, and card brands themselves such as Visa or American Express.

Thanks to this teamwork, if one of your subscribers gets a replacement card for any reason, a credit card account updater can prevent outdated or incorrect card information from stopping the flow of business, regardless of the card type.

What causes outdated cards in the first place? Fraud prevention, essentially.

Card decline rates, expiration dates, and you

Subscription commerce is more complex because you're taking down the original payment method during an initial sign-up transaction and reusing it at renewal. Each renewal becomes a chance for a decline code. You want a long subscription life cycle, but the longer that subscription life is, the better the odds their card data changes.

Some declines are inescapable. Virtually every credit card comes with an expiration date to prevent fraud. Meanwhile, cards get lost, people change banks, or they simply sign up for a card with better rates. An average of 13% of recurring revenue transactions are declined every month, based on our experience managing and resolving credit card decline codes.

One of the most common decline codes: A new card expiration date or credit card security code. This starts to hit your subscription business right in the churn rates.

Customer churn, or customer attrition, refers to a subscriber canceling their business with you. Sometimes it isn't even on purpose, meaning that involuntary churn has occurred. When a transaction fails, your subscriber doesn't update their customer profile to replace the card in question, and then they have a disruption in service until the subscription cancels. All without the customer knowing.

The customer didn't make a decision to cancel their subscription, which is what makes it involuntary. This most often occurs because of an expired credit card, a change in bank information, a server error, or insufficient funds.

Now, your customer service team could call every customer with a card that registers one of the dozens of decline codes, which is very time-consuming. Or the customers themselves could update their own customer profiles with new data. That's risky because you don't want them rethinking whether or not they should keep your subscription services.

That means using a card updater for automatic updates and higher authorization rates will save both your business and the cardholder time.

How account updater services work

Before credit card payments have a chance to fail, credit card updater programs track various types of financial changes to keep card information current. Card issuers such as Visa and Mastercard facilitate authorization approvals as well as manage the payment information, so they set up a protected pathway to share payment card details with select companies, including Recurly.

Meanwhile, our own systems update and check the information in your subscriber database on Recurly. Our systems monitor and update card details either several business days before a billing cycle is supposed to renew or if a failed payment occurs. Recurly uses machine learning to discover the best days and times of day to retry cards. The system runs card updater tasks regularly, in real-time or on a schedule, to provide a seamless experience for both you and your subscribers.

Julie Conant, Customer Success Team Lead at Recurly, shares a brief explanation in this video:

Video transcript:

Hi! I’m Julie Conant, the Customer Success Team Lead at Recurly. I’d like to highlight and share with you Recurly customers’ favorite features and tools that drive subscription growth.

Today, I’m going to talk about our Account Updater. This is the first step in a churn management strategy–before our custom retries and dunning come into play.

Recurly’s account updater prevents transactions from failing by confirming subscriber payment information is up to date. The service monitors your customers’ Mastercard, Visa, Discover, and American Express credit cards for changes, updating the records when necessary, safeguarding transactions.

Allow our updater technology to do the heavy lifting of keeping accounts up to date and spend more time working on what matters: delivering value to your subscribers.

Want to know more? Visit the product page we’ve linked for you or request a demo with our team. See you next time!

Account updaters and payment gateways with popular card brands

Card updater programs work differently, depending on the customer's card on file.

Account updaters with Visa, Mastercard, and Discover

Visa, Mastercard, and Discover all host card updater services to improve authorization rates for business owners everywhere. Those card updater services need the participation of major credit card-issuing banks such as Chase, Citibank, Bank of America, MBNA, Wells Fargo, etc. Each alliance and relationship creates a card network solution that reaches farther than North America.

American Express and its special card refresher

While many payment gateways offer a card updater function for Visa, Mastercard, and Discover, the same can't be said for American Express. That's because their card updater service, called Card Refresher, sends change alerts as they happen, instead of waiting for a ping from the card. You're busy running your subscription model, not a card updater service. That's where a savvy recurring payments platform steps in.

If an American Express Card receives a new CVV code, expiration date or credit card number, the Recurly system updates your payment information that day.

That means merchants like you can access American Express card updater, even if their gateway can’t.

How customer churn improves when you activate an account updater

There are more than 2,000 types of decline codes. Facing a lot of credit card declines while devoting yourself to providing an excellent product? Time to change course.

Preventing a failed payment when a customer loses their debit card keeps your business running smoothly. That's the goal for every credit card account updater. You can avoid failed payments with a proactive, automated updater service. Instead of letting your authorization rates slide, a card updater service prevents failures on credit card payments, meaning that you’ll be losing fewer customers with every billing cycle.

Recurly customers can enable the account updater service to address avoidable declines by checking their cards on file. Once enabled, the system can update and make whatever automatic chances it can while alerting your service and team to any changes that need to happen. This maps the checkout process smoothly and keeps your customer retention high.

The truth is, holding onto the customers you have is cheaper than the spending effort and resources needed to win new customers.

Keep in mind, the account updater saves you real money. It's easy to dismiss the impact because your business model depends on high customer satisfaction, and we're talking about a system that streamlines your customer payments without your customers even finding out. That said, the impact is significant.

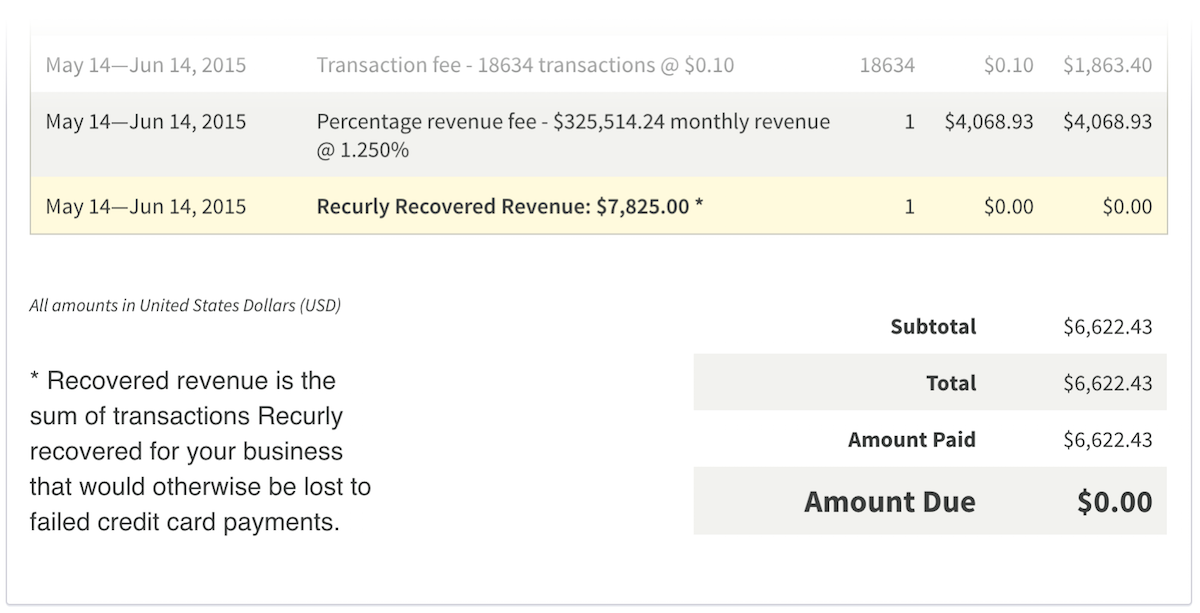

How much revenue can Recurly recover for you with our card updater program? Often, it's more than our invoices.

Involuntary churn is costly. More than half of all customer attrition (53%) is involuntary churn. Expired cards and preventable billing issues might be more than half the reason for customers you do lose. Customers may not know how to update their payment information or notice that they need to.

The account updater allows you to access the most up-to-date credit card information, identifying cards at risk of failure and processing a successful transaction.

It's like having a team in constant communication with credit card issuers.

Involuntary churn and B2C companies

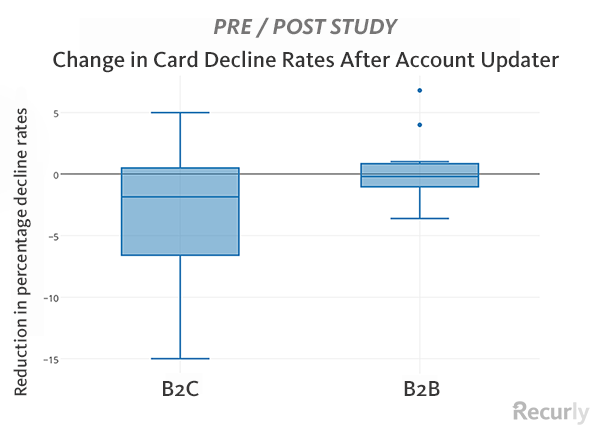

Our internal studies show that B2C companies benefit the most from an automatic card updater program. We measured the change in card decline rates a month before B2B and B2C companies enabled the account updater and a month after.

B2C merchants had their authorization rates improve by almost 2%.

We attribute the difference to their clientele: Average consumers are more vulnerable to security breaches, more likely to lose a card, and subsequently more likely to need a new card.

A 1.9% absolute reduction in decline rates can make a significant difference to any company's bottom lines. That's a major payoff for an automatic service that takes about 10 seconds to enable.

How to enable your account updater in Recurly

First, your site must be in production mode. Open your Payment Gateways page and scroll to the account updater section. Then click "Enable" on the right-hand side.