How PandaDoc and Recurly built a path to efficiency with MuleSoft integration

Imagine saving two full days of work every month. What would you do with all that extra time? For PandaDoc, the answer was simple: focus on growth, innovation, and perfecting the customer experience. But getting there meant tackling a serious behind-the-scenes challenge.

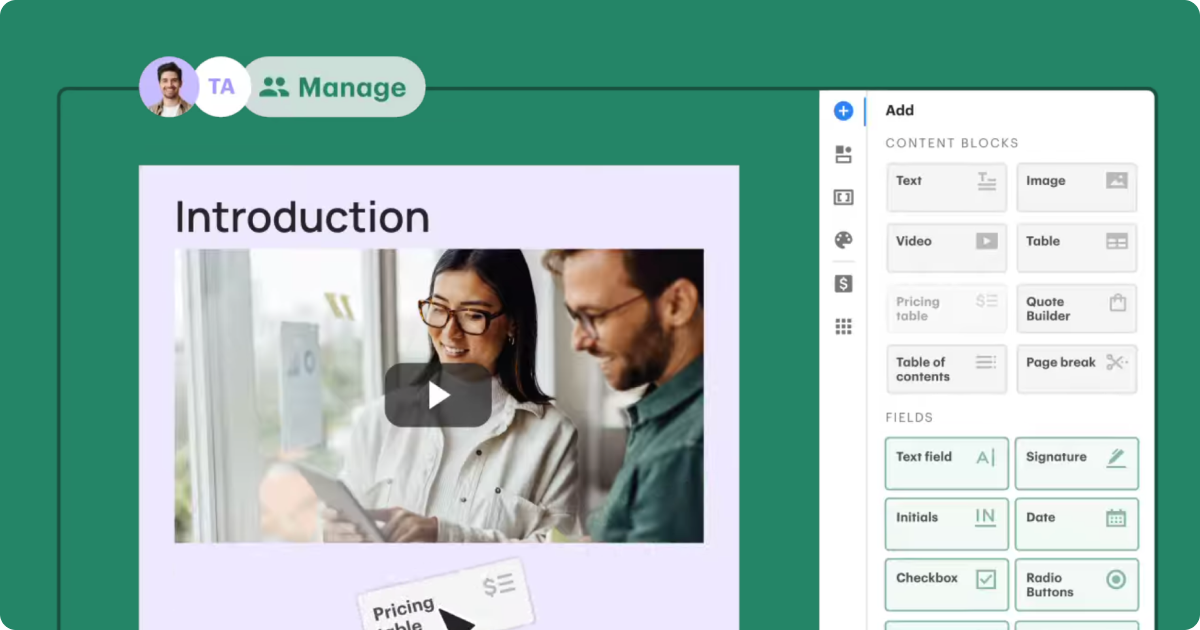

Known for revolutionizing document workflows with sleek proposals, smart automations, and eSignatures, PandaDoc is the go-to platform for businesses that want to cut the busywork and get down to business. Yet as they scaled, their internal financial workflows hit a bottleneck. Manual reconciliations turned into days-long grinds and logging payments became a burden. Their existing integration, while functional enough in the beginning, couldn’t keep pace with the company’s rapid growth.

The solution? A strong collaboration with Recurly and their dynamic MuleSoft integration, a fresh take on automating financial processes with speed, flexibility, and an eye toward the future.

The growing pains of success

Every fast-growing company knows that more business often brings more headaches behind the scenes. For PandaDoc, the scaling pains started with their old Jitterbit integration. Payments routed into a single account created tedious, resource-draining reconciliation runs. What should’ve been seamless required extra hands and valuable time, with up to three days spent every month just sorting out accounts.

But “efficiency” isn’t just a buzzword for PandaDoc’s financial team — it’s a non-negotiable. The team needed a better way to automate, scale, and simplify. That’s when Recurly stepped up with game-changing tech and a hands-on partnership.

From frustration to freedom

If there’s one thing Recurly understands, it’s that no two businesses are the same — which is why the MuleSoft integration was built with flexibility baked in. For PandaDoc, it meant ditching rigid processes for a smarter, more tailored approach. With MuleSoft, they gained the ability to map payment methods, gateways, and currencies directly to the right accounts, making manual reconciliations a thing of the past.

And the results were significant. Transactions that used to lag for hours with their old system now process like clockwork every 20 minutes. Reconciliation time dropped from three days to less than a single day. The financial team reclaimed hours of energy-wasting tasks and redirected them toward strategy and insights.

And the best part? This wasn’t just a tech upgrade; it was an all-hands-on-deck partnership. Recurly dove in to ensure PandaDoc’s migration was smooth, testing every step, troubleshooting in real-time, and turning feedback into future-proofed solutions.

A model for efficiency

What sets this transformation apart isn’t just saved time (though two full days each month is no small feat). It’s how PandaDoc and Recurly worked together to reimagine the financial workflow. By shedding the friction of support tickets and misalignment, PandaDoc’s team now has space to focus on what matters most.

"We’ve seen firsthand how Recurly takes our feedback seriously and delivers on the roadmap," explained Bibek Bhattarai, PandaDoc’s Vice President, Controller. “What stands out to me — and why we've still been around — is because of the receptiveness of feedback and willingness to listen to the customer.”

From cutting tedious tasks to slashing errors and clearing the road for future possibilities, MuleSoft became not just a tool, but a runway for PandaDoc’s next phase of growth.

Want the full story?

Switching integrations isn’t always glamorous, but for PandaDoc, it was a game-changer. Recurly brought more than technology to the table. They brought partnership, adaptability, and a future-proof solution that allowed PandaDoc to scale smarter — not harder.

Want to know more about how PandaDoc drove innovation, overcame roadblocks, and set themselves up for what’s next? Read the full case study here