How Recurly’s Credit Invoices streamline billing and accounting

On the surface, subscription billing may appear straightforward: bill the same amount each billing cycle. The reality is that the subscriber lifecycle can involve a number of complex pricing models and billing scenarios such as upgrades, downgrades, additional products, changing quantities, usage-based billing, or any combination of these—each of which may require you to prorate the invoice to accurately reflect the change in terms or usage.

Managing complex enterprise billing scenarios can quickly become a workflow and reporting challenge. In addition to product or plan changes, an unsatisfied subscriber might need a refund or service credit, or you may decide to issue promotional credits or discounts to reward and retain your most loyal subscribers.

Subscription businesses must account for all of these changes accurately, both in terms of the invoice sent to the subscriber and in terms of the accounting team’s monthly process to close the books and produce financial reports. Working with the right subscription management platform and invoicing software is key to achieving this.

Recurly’s Credit Invoices provides automated workflows for billing scenarios that involve refunds and credits to help your finance team maintain accurate reports. These automated workflows also reduce the workload of customer support teams who are asked to resolve issues.

When finance teams have accurate data, they can work much more efficiently and effectively by reducing the time spent correcting errors and discrepancies. Because reporting is less time-consuming, reports are available earlier, which can be significant when critical business decisions must be made.

Automate complex billing scenarios

Subscriber plan changes can result in charges, credits, or both. Separating charges and credits is an accounting best practice and provides your business with more flexibility in handling subscriber refund requests.

Through the Credit Invoice key feature, Recurly will automatically calculate the charge or credit and any proration and then issue a credit invoice. It also automatically generates the sub-ledger data needed to create the journal entry.

With Credit Invoices, you can provide subscribers with a more detailed invoice that’s easier to understand. We’ve streamlined subscriber communication by condensing communications into one subscription change email.

Provide the refund options your subscriber wants

There will always be times when a subscriber needs an online payment refund. Depending on the circumstance, you may want to refund the subscriber’s credit card or issue the refund as a store credit towards their next renewal or purchase.

Make the invoicing process a lot easier with Credit Invoices. Issuing a refund in Recurly allows you to issue a store credit rather than refunding to the original payment method.

On the invoice: Credit invoices that result from a refund now show how much of the credit amount was returned to the subscriber as a payment refund and how much remains as a credit balance.

Reduce reporting errors when refunding subscribers

Having options for handling a subscriber’s money—whether it be the type of credit issued or when and how you can issue credits—helps you better meet their needs, which is a key element in maintaining loyal, happy customers.

For example, refunds can be a headache when the invoice being refunded was partially paid with a store credit, but your subscriber is demanding a refund to their credit card. The subscriber doesn’t care about your billing system’s limitations—they want their money back. But, because of how the original transaction was paid, refunding the subscriber will result in your billing system being out of sync with your gateway transactions. This will cause reconciliation errors that require additional manual effort to correct.

To resolve this, Recurly allows you to refund a credit payment back to the subscriber’s credit card, even if all or part of the original purchase was made with a store credit. The subscriber gets their money back, and you ensure that your revenue and cash accounting stay synchronized across systems.

The details: When refunding an invoice paid with a credit balance, if the credit payment originally came from a credit card purchase, Recurly will find the original purchase and issue a payment refund against it. Additionally, Recurly automatically creates a refund credit payment to ensure your reporting reflects that a portion of the credit payment was refunded to the subscriber's credit card.

Give your business more flexibility

The customer experience is paramount–starting with billing. Sometimes, you may want to give the subscriber a credit, perhaps to compensate them for a late shipment or to reward them for new subscriber referrals. To do this, you need to be able to issue one-off credits on their own invoice, separate from charges, and Recurly’s billing solution can help you.

Additionally, you must ensure that your accounting team can track when the credit was issued, how much was issued, and its outstanding balance. At scale, mixing charges and credits would provide net figures that are difficult for any accountant to unwind.

Correct mistakes and create an audit trail for accounting

Mistakes happen, and subscription businesses need to be able to correct them to prevent affecting customer lifetime value. For example, a customer service agent might issue a credit by mistake, and you want to revoke it.

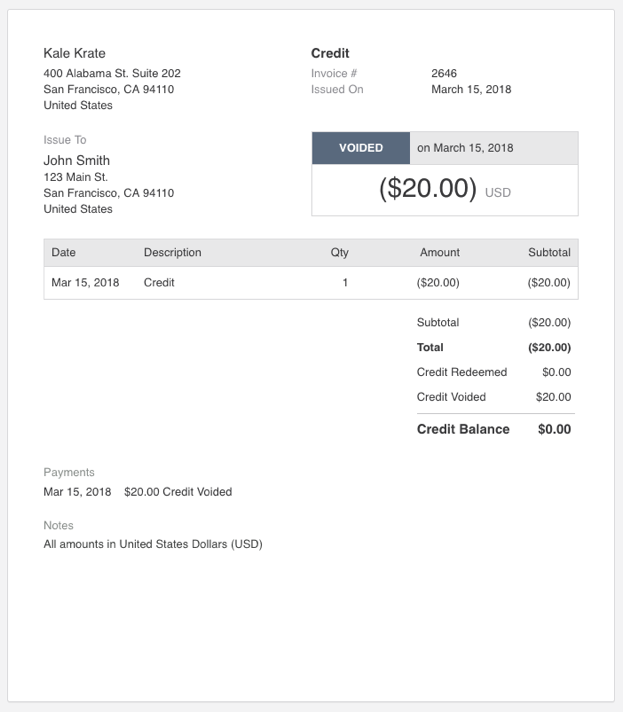

Manual billing capabilities might make this move complex, but Recurly provides two options: void the entire credit invoice or withdraw the remaining credit balance.

The details: If the credit balance was never used, you can void the entire credit invoice. If a portion of the credit invoice was used, such as for a subscription downgrade where the issued credit helped pay the issued charges, you can still remove the remaining credit balance by voiding the balance. Since a portion of the issued credits were used, the invoice moves to a closed state instead of a voided state.

On the invoice: To track that all or a portion of a credit balance was removed, Recurly creates a reduction credit payment, which can be reported in the Credit Payments export.

Improve reporting accuracy with automated workflows

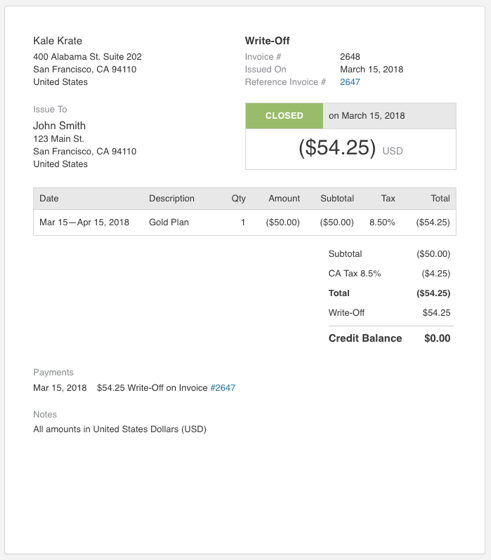

Not every subscriber invoice is going to be paid. At some point, the invoice will need to move out of collection to either a paid or failed state. Recurly now automates write-offs with the option to fail an invoice at the end of the dunning period. You may also manually stop collection and fail an invoice at any time.

The details: With the new Credit Invoices feature, failing the invoice will now issue a write-off credit invoice to bring the failed invoice balance to zero. Automating write-off credit invoice creation reduces the burden on accounting teams when they have to account for failed invoices. It also improves reporting accuracy.

Scale your business while streamlining billing

From streaming services to software, our subscription management capabilities and key features make complex billing easier as your business scales.

Customer support teams need to be armed with automated workflows that allow them to spend more time helping subscribers and less time trying to fix billing issues. Accounting and finance teams need clean data with clear audit trails for accurate and efficient reporting and effective decision-making.

With Recurly’s Credit Invoice, you’ll accomplish these goals and improve subscriber satisfaction at the same time.

Learn more about Credit Invoices in our documentation, or get an overview of Recurly’s subscription billing platform in our on-demand demo.