Understanding subscriber churn

Churn–it’s the most coveted topic for all businesses, especially businesses that rely on the recurring revenue of subscribers.

To understand churn–what it is, why it matters, how to calculate it, and how to minimize it–is to fully understand what your subscription business needs to grow faster, smarter, and stronger.

While it’s impossible to eliminate, there is an acceptable amount of churn for all industries, and we’ll show you how to get there–and how to get it to as low as 1%.

Our goal with this guide is to make you a master of all things churn. We want you to walk away feeling confident that you know everything there is to know about churn and how to intelligently manage it in your business.

In this guide, you’ll learn how to define churn, get key benchmark data you should swear by, and find best practices to automate your churn management strategies.

What is churn?

Simply put, the definition of churn is when a customer stops using your product or service. Some businesses think of it as the customer attrition rate. For recurring revenue businesses, the churn definition means a customer discontinues their subscription, either voluntarily or involuntarily.

You can view churn by way of subscriber churn and revenue churn. Subscriber churn, also known as customer churn, is the percentage of customers lost in a given period of time as the percentage proportion of active subscribers at the beginning of the same time period. Most discussions of churn refer to subscriber churn.

Revenue churn rate is the amount of revenue lost in a time period, usually a month. High revenue churn may suggest that you’re losing high-value subscribers, which impacts revenue loss more than average or low-value subscribers, even if they’re loyal customers. Therefore, it’s important to evaluate both subscriber and revenue churn.

Let’s dive deeper into the basics of churn.

Why does churn matter?

Churn is fundamental to understanding the overall profitability and health of a business as it indicates what percentage of customers are leaving your business for a variety of reasons in and out of their control.

In some ways, it can help you identify holes in the customer journey; in others, it can help you identify which loyalty programs your customers would care about. We also know that between marketing efforts and advertising campaigns, it’s more expensive to acquire a new customer than to retain an existing customer, and minimizing churn helps drastically with keeping your customer count high.

Additionally, a high level of churn impacts your current recurring revenue and future recurring revenue, and more specifically, it affects monthly recurring revenue (MRR), customer lifetime value (LTV), and customer acquisition cost (CAC). We’ll talk more about key churn metrics and how they relate to overall churn later.

The bottom line: Your monthly or annual churn rate indicates whether your subscriber lifecycle is optimized at every stage of the customer journey. When subscribers start churning at an alarming pace and rate, something has to change.

Different types of churn

Churn can be broken up into two main buckets: voluntary and involuntary churn.

Voluntary churn occurs when a subscriber actively chooses to cancel their subscription with your business. This is a conscious decision that can happen at any time–during a renewal stage, at the end of a free trial, after a gift subscription term, and more. Voluntary churn has a direct correlation to the value and customer satisfaction associated with your product or service.

When most of your customer segments choose to continue purchasing from your business, your business model is working. When you see a rising level of churn that’s voluntary, then it’s time to empower your customer success teams to do anything they can to retain at-risk customers.

Watch on-demand: How to never lose a subscriber

On the other hand, involuntary churn results in an unintentional termination of a subscription because of a failed recurring payment. It has nothing to do with customer loyalty. For example, a subscription renewal failed because the customer’s credit card expired. 53% of total churn is due to involuntary churn due to failed payments. While you can’t completely erase involuntary churn, with the proper churn management tools in place, you can reduce it significantly and minimize repeat offenses. More on that later.

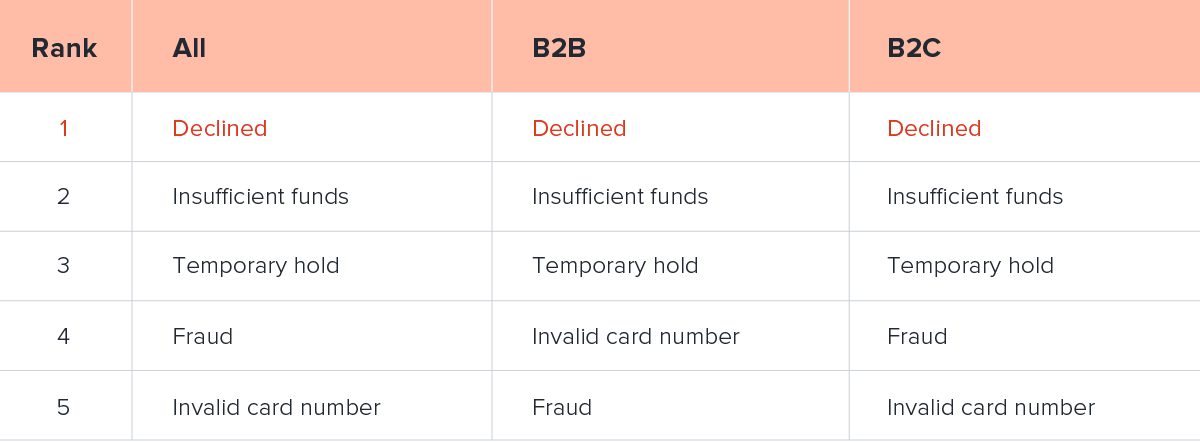

There are over 2,000 reasons a credit card can be declined–see the top reasons.

Key churn metrics

Measuring churn requires a multi-faceted approach. Many metrics fall under churn, and each plays a role in a full churn analysis to understand its impact. These are the most common churn metrics to know.

Monthly recurring revenue (MRR): The total of all of your recurring revenue normalized into a monthly amount. In regards to churn, MRR changes as a result of cancellations, downgrades, and the like. Monitoring churn is essential for maintaining and growing MRR over time.

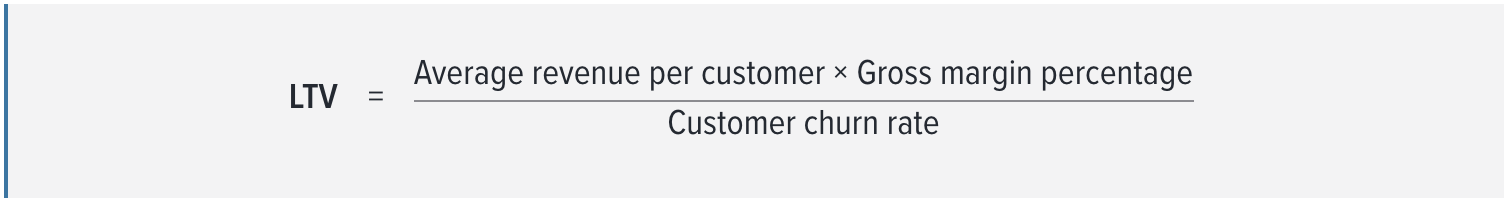

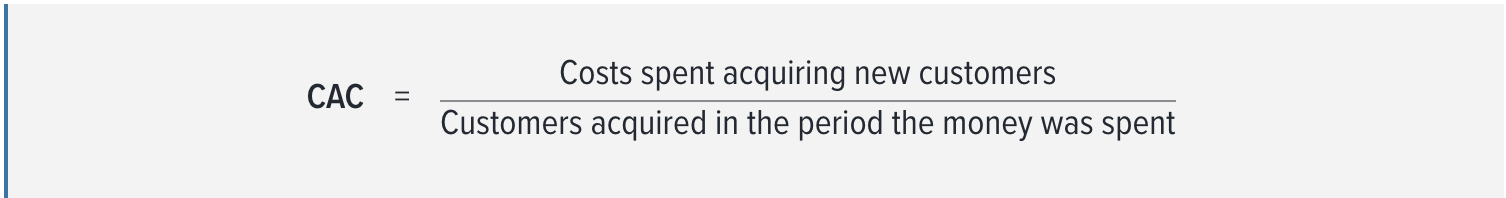

Customer lifetime value (LTV): The average dollar amount a customer spends with a business throughout their customer lifetime. To calculate LTV, a business must know the average revenue per customer and the average churn rate. High churn negatively impacts LTV–if customers leave the service early, the total revenue generated from each customer is lower.

Customer acquisition cost (CAC): The total costs of acquiring a new customer, on average. As churn drops, the lifetime value of your customers extends, and revenue increases. With more cash on hand, you can dedicate more resources to optimize for growth, reducing your CAC.

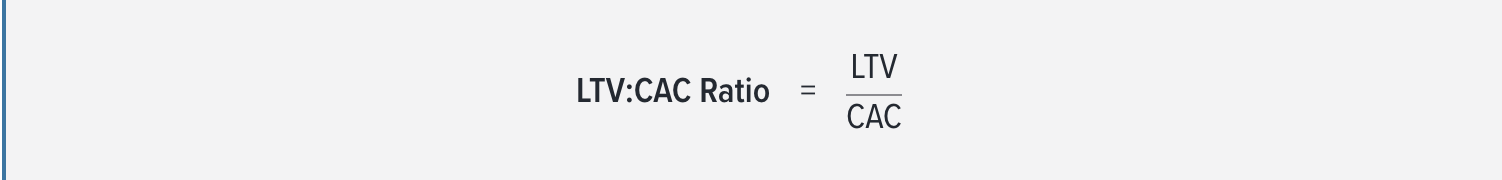

LTV:CAC ratio: This ratio measures the relationship between the lifetime value of a customer and the cost of acquiring that customer. Subscription businesses rely on lasting customer relationships to fuel their recurring revenue stream–an easy way to see if your business is positioned for sustainable growth. Ideally, subscriber LTV should exceed the total cost to acquire a customer to identify where the acquisition efforts are most profitable. A ratio of 3:1 is standard, while a ratio of 5:1 means you could be growing faster–invest more into marketing.

Retention rate: The percentage of subscribers you retain relative to the number of subscribers at the start of a given time, excluding new subscribers. An easy way to know your retention rate is, for example, if your churn rate is 3%, your retention rate is 97%.

Decline management efficiency: A measure of the percentage of subscribers who were at risk of involuntary churn but were saved by automated decline management methods. These methods are typically provided by your subscription billing software and may include an account updater service, retry logic, and a dunning management plan.

Invoice recovery rate: A measure of past-due invoices and what percentage are ultimately recovered before subscriber churn.

Revenue lift: Also known as recovered revenue, revenue lift measures the percentage of revenue recovered in a month from decline management strategies.

Learn more about key subscriber churn metrics and how to calculate them.

How to calculate monthly churn rate

We’ve come up with a better way to calculate your churn rate that encompasses what you want and need to know to calculate churn correctly. Churn is typically calculated on a monthly basis, but you can also calculate a rate of churn on a daily, quarterly, or annual basis.

Annual churn rates allow you to see a panoramic view of your customer base while daily churn rates tend to dial your attention to customer experience and customer feedback. The most basic calculation of churn rate is dividing your churned subscribers by the total number of subscribers.

Churn rate formula:

Churn rate = Churned customers / Total customers

It seems simple, but don't miss the small details that make a big difference. Calculating churn is easy math and relates to how you count subscribers and activations.

Subscriber formula:

End of period subscribers = Beginning of period Subscriber - Churned customers + Customer acquisition

Pretend there is a fictional company called Box of the Month, or BOTM for short. For July, BOTM starts with 10,000 customers and loses 500 by the end of the month. However, 600 new customers join the subscription community and are active at the end of the month.

From the table above, you can see that BOTM has a 5% churn rate and 10,100 subscribers by the end of July.

Let’s imagine you experience the same subscriber behavior in August. You start the month with 10,100 subscribers from the end of July, 500 consumers churn, and you gain 600 new subscribers.

This example shows that churn decreased in August, but in reality, the monthly churn rate would slightly increase because the company grew, and new subscribers tend to churn at a higher rate. Make sure you’re using a smart churn rate formula before delving into your customer churn analysis.

Try it out: A better way to calculate churn rate

Is it possible to have a negative churn rate? Yes, and it’s not a bad thing. Negative churn shows when a business’ MRR from existing customers is greater than the revenue lost from cancellations and downgrades. Put another way, the upgrades from your existing customers helped increase your revenue even though you lost subscribers. Increasing the MRR from your current customers via upgrades, add-ons, and cross-sells may put you at a negative churn rate. Learn more about how to calculate negative churn.

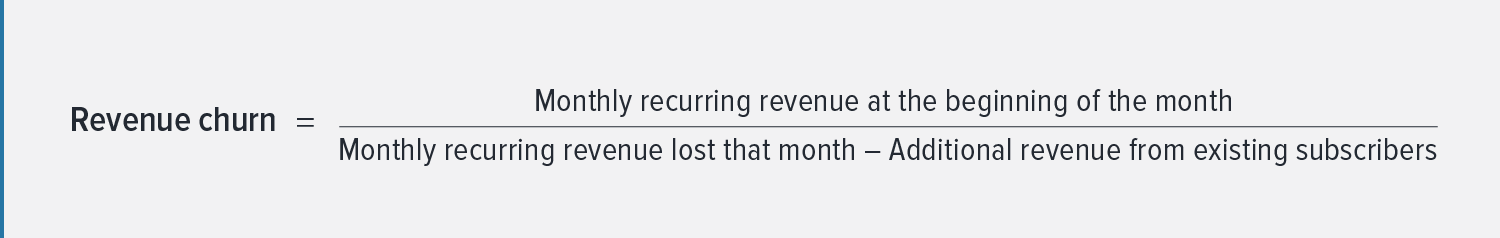

It’s also important to know how to calculate revenue churn rates, which is the MRR at the beginning of the month divided by the MRR lost that month less additional revenue from existing subscribers. This is key because new revenue in the sales cycle shouldn’t count towards revenue churn as you’re calculating how much recurring revenue was lost.

How to reduce subscriber churn

First, identify churn rate benchmarks to compare to. While this varies if you’re a business-to-business (B2B) or business-to-consumer (B2C) business and by industry, a good customer churn rate is a low churn rate. Next, understand the drivers behind voluntary and involuntary churn to map a robust strategy to minimize each one effectively.

What is a good churn rate?

Churn boils down to your product or service–how sticky is it? How robust is your offering compared to your competitors?

In a nutshell, a low customer churn rate is a good churn rate. It means customers are satisfied and don’t care to leave, which means more recurring business revenue in the long term. It also means payments are happening as they should, and you have a solid system in place to manage renewals, expired cards, and more. On the contrary, a high churn rate means you should probably look into what’s causing your customers to leave in such high volumes so rapidly. Customer engagement starts with understanding the customer behavior and what’s increasing the risk of churn. Analyzing your churn rate will yield valuable insights for both your customer service teams and your sales teams.

So, what is a good churn rate? Well, it depends if you’re a B2B business or B2C business as well as the industry you’re in. Looking at the churn rate benchmarks of Recurly customers in 2022, however, the average churn rate across all subscription-based businesses is 5.6%.

Overall average churn rates

B2B benchmarks indicate a lower average churn rate of 5.6% compared to B2C churn rates of 6.8% because B2B purchase processes can be complex, resulting in a more thought-out purchase. Moreover, the average voluntary churn rate is 4.0% and the average involuntary churn rate is 1.4%.

Do you have a good churn rate? Compare with our churn rate benchmarks.

Average churn rates by industry

However, as mentioned above, the benchmark for a good churn rate varies from industry to industry. Unsurprisingly, businesses in the Healthcare, Software, and Business and Professional Services industries have the lowest average churn rates of 6.0%, 4.8%, and 6.6%, respectively. On the contrary, Digital Media and Entertainment (6.4%), Education (7.2%), and Consumer Goods and Retail (7.6%) businesses experience much higher average churn rates on average.

Churn rates by average revenue per customer

In our research, we also found that when looking at churn rates by average revenue per customer (ARPC), an ARPC of less than $10 USD and $50-100 USD resulted in the lowest churn rates of 3.4% and 3.8%, respectively. The average churn rate is highest when the average revenue per customer is more than $250 USD (5.9%) and $10-25 USD (5.6%). Generally, higher-priced purchases require more consideration, whereas lower price points mean subscribers are more ready to purchase–and cancel–without much thought.

Reasons subscribers churn

The leading factors behind voluntary churn are price increases, a product or service becoming obsolete to the subscriber, and the discovery of a better competitor offering. Every aspect ties to the customer experience. While the conversion goal is to acquire subscribers, the brand promise has to live up to the subscriber’s perceived value over time as well.

Today’s consumers crave omnichannel experiences that deliver different value manifestations throughout the subscriber lifestyle in the form of personalization options, a variety of pricing plans, and more. A bad experience leading to customer cancellations will show up in your customer churn analysis.

Top payment decline reasons

On the other hand, the cause of involuntary churn can be attributed to one category of reasons: declined payments. With subscription models, payments are more complex than the traditional one-time transaction–payment information is captured at the initial transaction during signup, which means this credit or debit card information is held over the life of the subscription and used automatically every billing period. With more than 2,000 reasons a payment can fail, you must have the right subscription billing software to retain more subscribers.

How to reduce voluntary churn

The best way to tackle voluntary churn is by creating a subscriber experience that makes customers rarely question leaving your product or service. There are opportunities across the subscriber lifecycle to remind customers of their subscription value.

In a nutshell, reducing voluntary churn means understanding the different ways consumers consume, how their preferences impact their purchase decisions, and how you can cater to these needs. Some of the most important subscriber experience elements include:

Offering customization features and options. Customers want choice. From add-ons and upgrades to billing frequency choices and bundles, providing the ability to create their desired subscription plan lends to fewer churn reasons.

Building community and loyalty. The direct-to-consumer shift left consumers with more to be desired on the community and social fronts. Creating a sense of community via omnichannel experiences rewards loyal and engaged subscribers emotionally.

Providing alternatives to canceling. While cancellation means churn, it’s still advantageous to create a positive cancellation experience. Instead of a hard cancellation, suggest alternatives in a quick but intentional process, and end with the option to pause the subscription instead. Use this opportunity to collect feedback for win-back campaigns as well.

Read more: Why pausing a subscription can be a powerful churn management tactic

Voluntary churn can be tackled internally as well. By unlocking subscriber insights, you’re able to take advantage of your unique subscription analytics to leverage churn management techniques and grow your ARPU and LTV. With the right data, you can learn how to identify subscribers who are at risk of churning.

To identify any seasonal or cyclical trends in churn behavior, conduct a cohort analysis. In addition to learning when in the lifecycle subscribers are churning, a cohort analysis allows you to regularly test different churn prevention strategies and understand the behavior of each cohort. You can use this information to strategically and more efficiently allocate resources throughout the subscriber lifecycle.

How to reduce involuntary churn

Did you know 53% of total churn comes from involuntary churn? Involuntary churn, if not managed correctly, will result in lost revenue. When failed payments are the cause, the solution is to prevent and automatically recover declined transactions. To be proactive, you must employ decline management techniques to drastically reduce failed payments and increase transaction success. Decline management tactics include:

Automatic updates through an account updater service, usually provided by your payment gateway. This service monitors credit and debit cards for changes and updates records automatically to increase the chances of a successful payment.

Automatic transaction retries to recover soft declines, which means the card number is likely valid but was denied by the issuing bank. Retrying the card later may work.

Learn how to minimize churn and maximize revenue to keep a good thing growing.

Another automated involuntary churn fighter is dunning, the process of systematically communicating with subscribers via email to collect overdue payments. When done correctly, an effective dunning strategy can improve transaction success rates and offer control over subscriber communications that cover a topic as touchy as unsuccessful payments.

Incorporate these dunning best practices into your strategy:

Set up ideal dunning settings. With a monthly billing cycle, the ideal dunning cycle should be no longer than 28 days.

Send multiple emails during the dunning process to offer several chances to update their payment information.

Set up a return email address that accepts replies. This has two benefits: Acquiring subscribers’ most updated email addresses and making the email feel more human.

Craft your emails to match your brand. This is great for open and click-through rates.

Customize each message to maximize its impact. Pro tip:Make the tone of each email increasingly urgent as the payment deadline approaches.

Include a clear call to action.

Watch on-demand: 5 Dunning dos and don’ts to minimize subscriber churn

How to proactively & automatically cut churn to 1% with Recurly

In 2021 alone, Recurly helped our customers recover nearly $800 million in revenue. Additionally, we have successfully helped our customers:

Recover 73% of at-risk invoices

Save 8.4 million at-risk subscribers

Add an average of 12 months to the subscriber's lifetime

Manage an average 13% revenue lift monthly

The best part? We’ve helped some customers cut their involuntary churn rate down to just 1%.

The secret’s out: 8 Industry leaders reveal how they actually reduce churn

See why it’s imperative to partner with a proven subscription management and billing platform to help you fight subscriber churn.

Grow faster

Consumers change, and businesses must always be ready to pivot at a moment's notice. An integrated, easy-to-use subscription management platform like Recurly offers the flexibility to iterate, experiment, and adapt quickly.

To manage voluntary churn, you must test endlessly. The subscription model is not a one-size-fits-all approach–it requires experimentation and segmentation to see what resonates with a specific set of subscribers. Test pricing, plans, promotions, and even personalization options to identify your ideal customer profile as well as factors that contribute to voluntary churn.

The ability to adapt is crucial for subscription businesses, especially those in the direct-to-consumer industries. Offering options across the subscriber lifecycle such as trial lengths, flexible payment options, custom bundles, ad-based tiers, and more make it easier for businesses and subscribers to adapt to shifts in demand.

Grow smarter

What’s one thing your subscription business has that no other business can get? Your unique subscriber data. Motivated to accelerate growth, maximize revenue, and minimize churn, Recurly’s Subscription Analytics offers real-time access to faster data and smarter insights so you can target your subscribers with the right plans, better manage your MRR, and more accurately track customer LTV.

With more detailed subscriber data, you can more easily identify and better understand which segments of subscribers are churning and for what reasons. Recurly’s advanced Subscription Analytics allows you to filter and segment data by time frame, date range, plans, currency, and more so you can focus on fostering long-term subscriber relationships with real insights.

How-to: Cohorts & line graphs to understand and predict LTV

Analyzing your subscriber churn rate can surface actionable insights to further improve revenue recovery. Our Revenue Optimization Engine has helped put $800 million of revenue back in the pockets of our customers in 2021 alone. Our innovative technology automatically and proactively recovers failed payments while offering deep insights, analytic dashboards, and integrated systems for accurate data. Learn more about Recurly’s Revenue Optimization Engine.

See how much revenue Recurly can recover for you. Calculate now.

A 1% involuntary churn rate is possible–with the right support, that is. The ideal payment gateway proactively and methodically minimizes churn and improves transaction rates with an Account Updater. This type of service works by monitoring credit and debit cards for changes. When a change happens, the Account Updater updates the record automatically to increase the chances of a successful payment. If the update can’t be made automatically, the Account Updater alerts the business to resolve the situation directly with the customer.

To increase the likelihood of a successful transaction, Recurly’s Account Updater checks a card’s status a few days before the renewal date. Changes are made quickly, easily, and days before the renewal transaction to ensure a frictionless experience.

Recurly’s Revenue Optimization Engine recovered an average of 61% of failed subscription renewals & increased monthly revenue by an average of 11%.

Another form of intelligent retention relies on dynamic retry logic. Using advanced statistical models and machine learning, our retry logic compares each potential transaction to the hundreds of millions of transactions Recurly has processed to apply the ideal retry schedule, using machine learning to give each invoice the best chance of success.

Additionally, smart dunning strategies coupled with Recurly’s Dunning Effectiveness Report make fighting involuntary churn easier. This report allows you to gauge the effectiveness of your dunning tactics and settings while also monitoring your dunning recovery over time.

Grow stronger

Grow big or go home, right? Global expansion is top-of-mind for any growth-minded company, but getting there is easier said than done–until now.

To go global, you need a partner that is prepared to handle all the complexities abroad, such as compliance issues, localization efforts, and an entirely new consumer base–on top of regular churn management. Recurly offers all of that and more.

Recurly assists with future-proof global growth and the ability to scale without limits, handling high volume, high-velocity transactions effortlessly and anticipating challenges before they arise. With the industry expertise to gather and share best practices and benchmark data, you’ll be able to stay on top of global trends and be more proactive in your cross-border business efforts.

As your security and compliance backbone, by understanding and adhering to localized requirements for currencies, payment gateways, tax regulations, and languages, your business has the support of a present partner in that geographic region.

From the subscriber perspective, customized payment, currency, and language support are defining components of a successful subscription business abroad. See how Recurly makes it effortless for businesses to scale globally:

A variety of payment methods and more than 20 gateway integrations so your customers can pay how they want from anywhere in the world

More than 140 currencies to choose from to give your subscribers the freedom to choose how they want to pay, increasing your purchase completions and renewals

Customized checkout pages and targeted subscriber communications in the language you need to communicate meaningfully

Final thoughts

You did it! You’re now equipped with the subscriber churn know-how to reduce your churn rate like an expert.

Even though churn plays a crucial role in understanding the success and health of your subscription business, getting to a healthy churn rate–both voluntary and involuntary–is not as intimidating as it may seem. Understanding the ins and outs of your churn health can help you formulate a robust retention strategy that helps you achieve your biggest goals.

Ready to beat churn? Learn how to minimize churn and maximize revenue in our guide.