Reduce involuntary and voluntary customer churn

Churn is the enemy of every subscription business. Reducing it requires smart churn management strategies and tools.

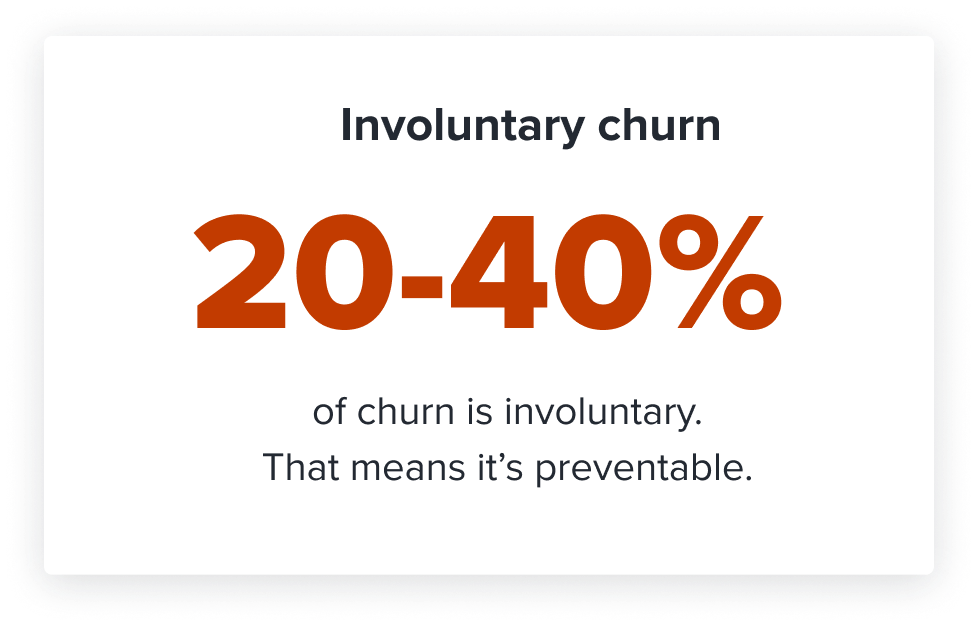

Churn can be unintentional and preventable

Involuntary churn is unintentional—an expired card or card reported lost, for example. Some industry reports have found that 20-40% of churn is involuntary.

Businesses with automated tools and insights can stem involuntary churn and recapture lost revenue, making a significant impact in both the bottom line and customer retention.

Maximize recurring revenue, minimize attrition, and boost customer lifetime value with industry-leading churn and revenue recovery tools

Minimize churn and maximize revenue

Stem churn before it takes root. Recover failed payments before customers are gone for good. Recurly combines proprietary, proactive, and reactive revenue recovery tools and tactics to keep accounts up to date, and optimized for transaction and processing success.

Retain and win back subscribers

Make it easy—and pleasant—for customers to subscribe and stay. Offer relevant upsell opportunities, subscription add-ons, and incentives to keep your offering fresh. And when an account gets off track? Recurly has the tools that bring them back.

Scale faster with smarter insights

Confident, strategic decision making is possible through subscriber activity, plan performance, and recurring revenue insights. Leverage smart reports, dashboards, imports, and exports to spot trends, capitalize on opportunities, share info, and scale quickly.

Key features

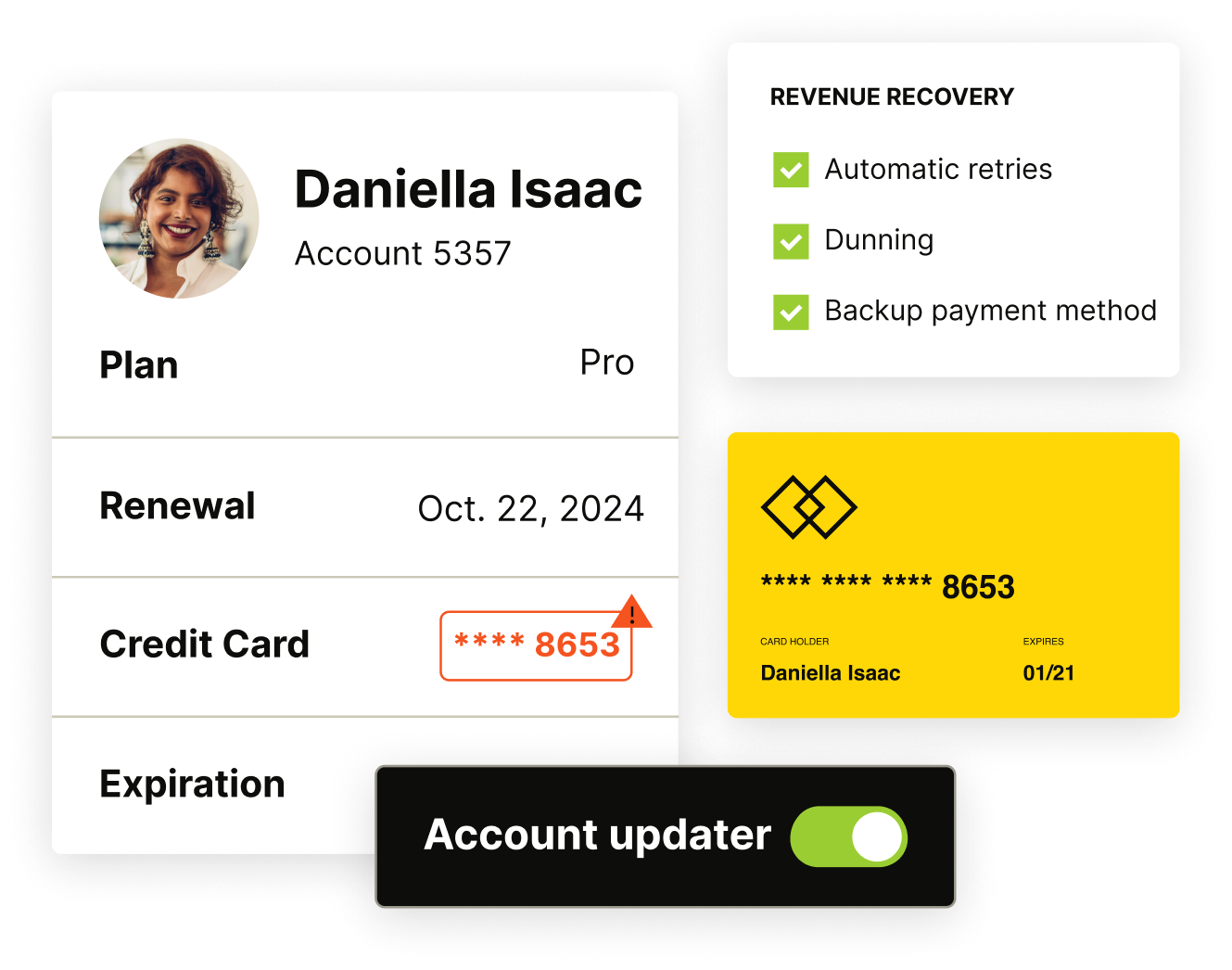

Dramatically reduce both voluntary and involuntary churn using a focused churn management approach, including intelligent retries, automatic account updater, and dunning campaigns.

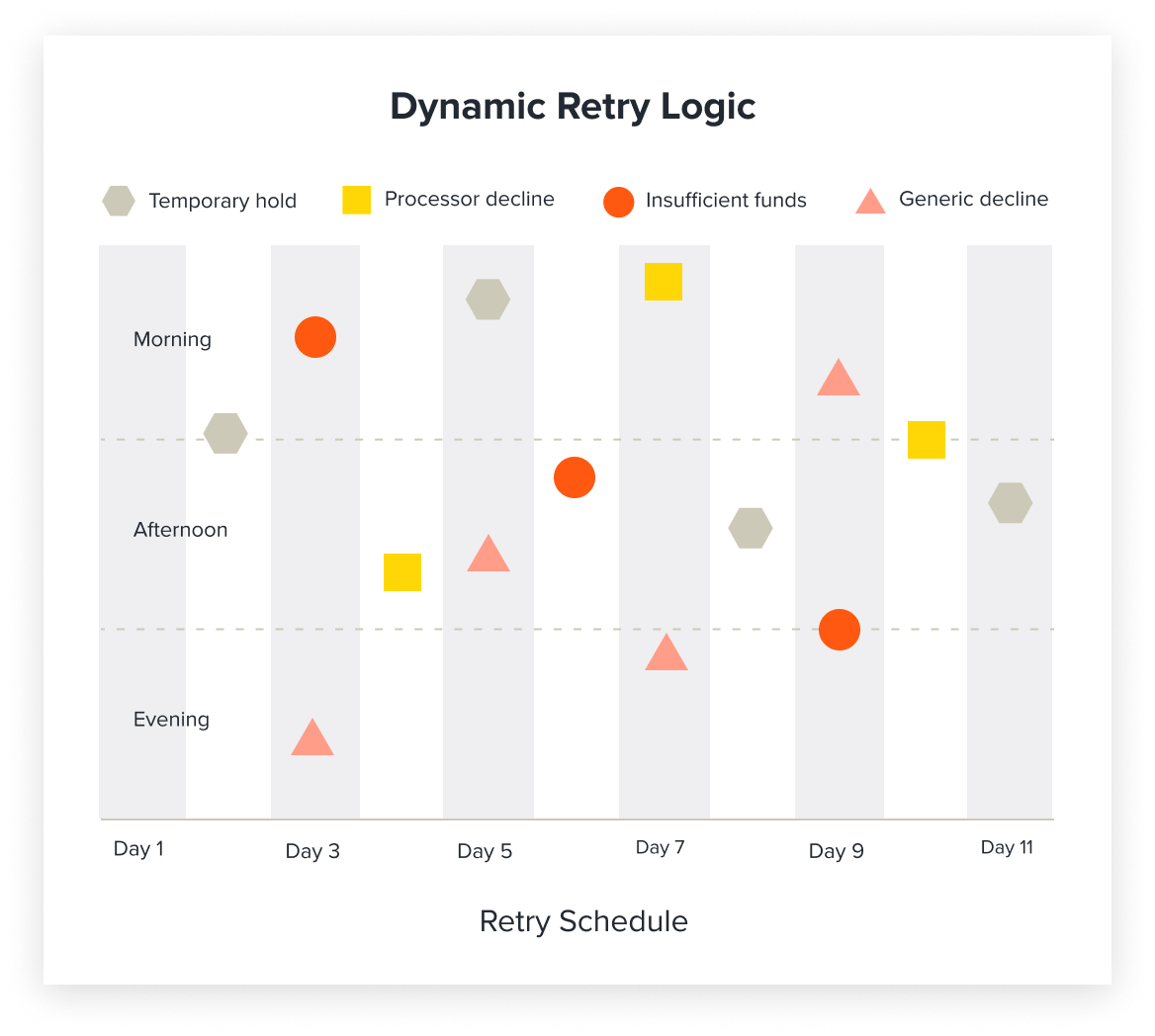

Intelligent retries stop churn before it starts

Dramatically cut involuntary churn and recover failed payments. The Recurly retry engine intelligently retries declined transactions using machine-learning, whenever and however the transaction is most likely to be accepted.

- Powered by millions of data points

- Operates automatically to increase revenue recovery

- Or apply your own retry configuration

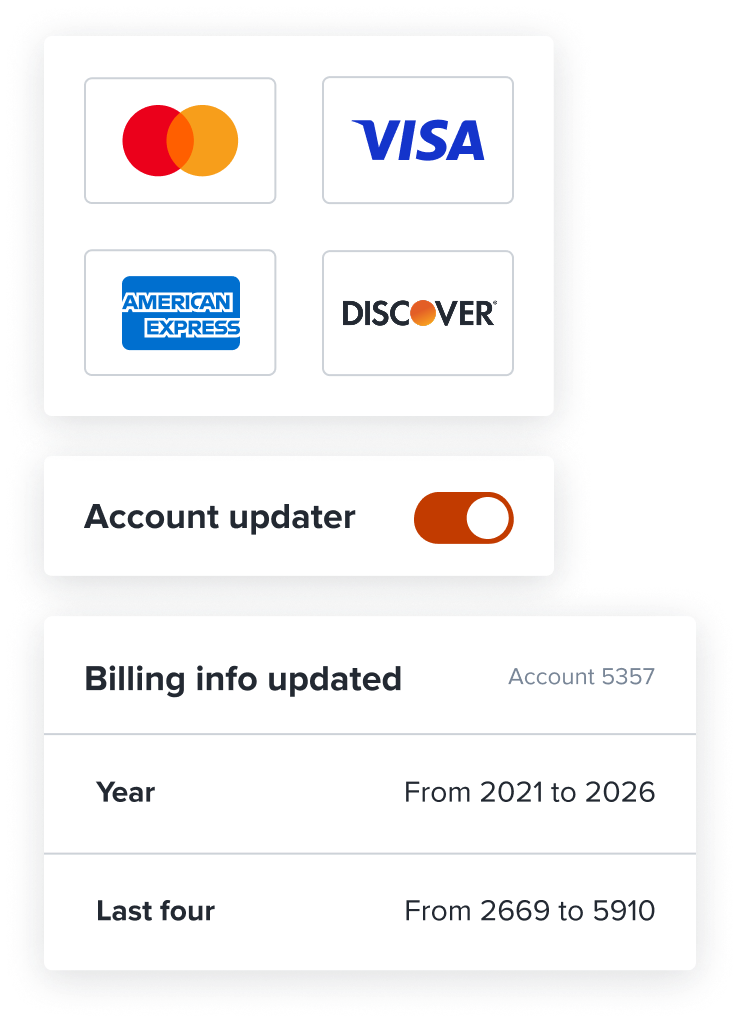

Account updater keeps you one step ahead

Avoid failed payments by monitoring customers’ credit cards for changes, making updates in Recurly's records as needed.

- Checks for updates before renewals

- Writes updated information into subscription records

- Works with account updater programs managed by leading credit card providers

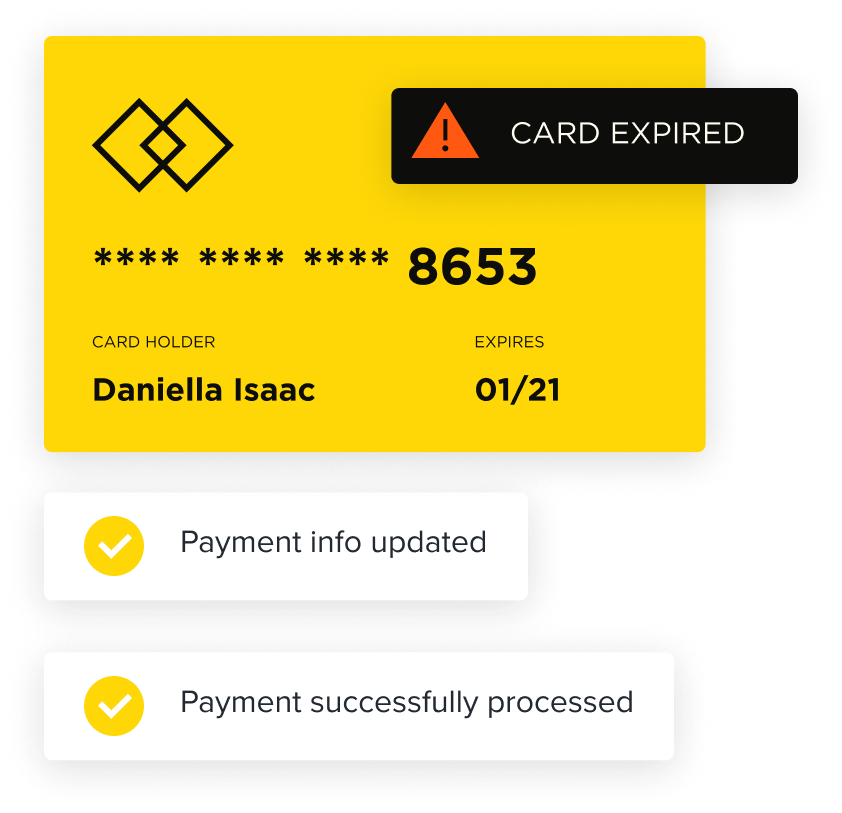

Expired card management reduces declines

An expired credit card is one of the most common reasons for transaction decline. Avoid it by keeping card data fresh, automatically updating customer records with the accurate data.

- Automatically updates account billing data and preserves the event record

- Customize and enable email communications to notify subscribers

- See what revenue is saved with recovered revenue dashboards

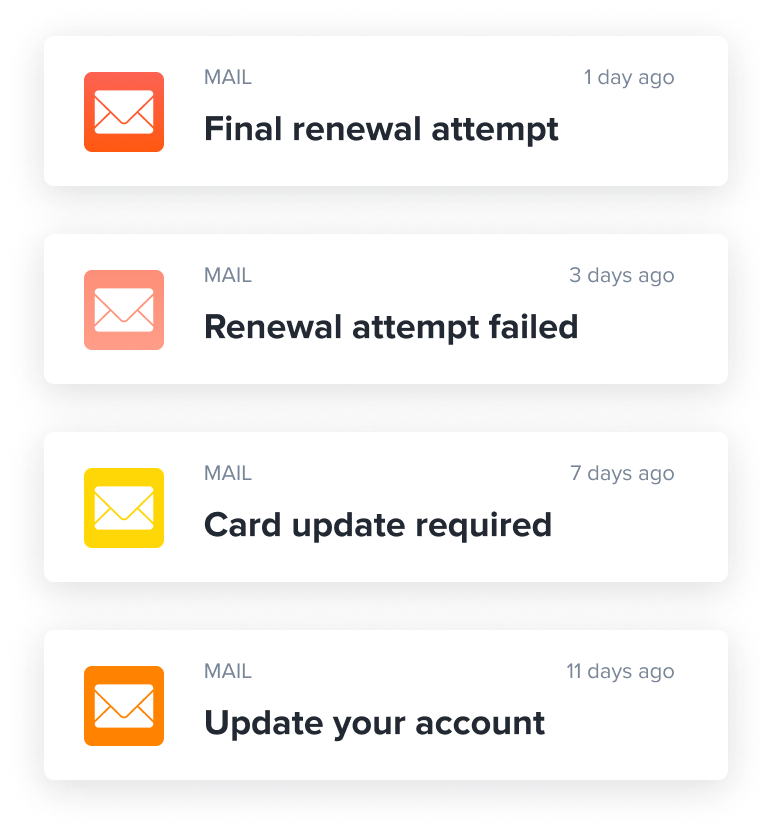

Dunning campaigns work overtime

Increase the effectiveness of your collection efforts with automated dunning communications. Configurable across period and timing, if the payment is past due or declined, your selected and personalized dunning campaign launches.

- Configure multiple dunning campaigns for various cohorts

- Assign different campaigns to specific plans or accounts

- Customize templates for manual, automatic invoice, and post-trial declines

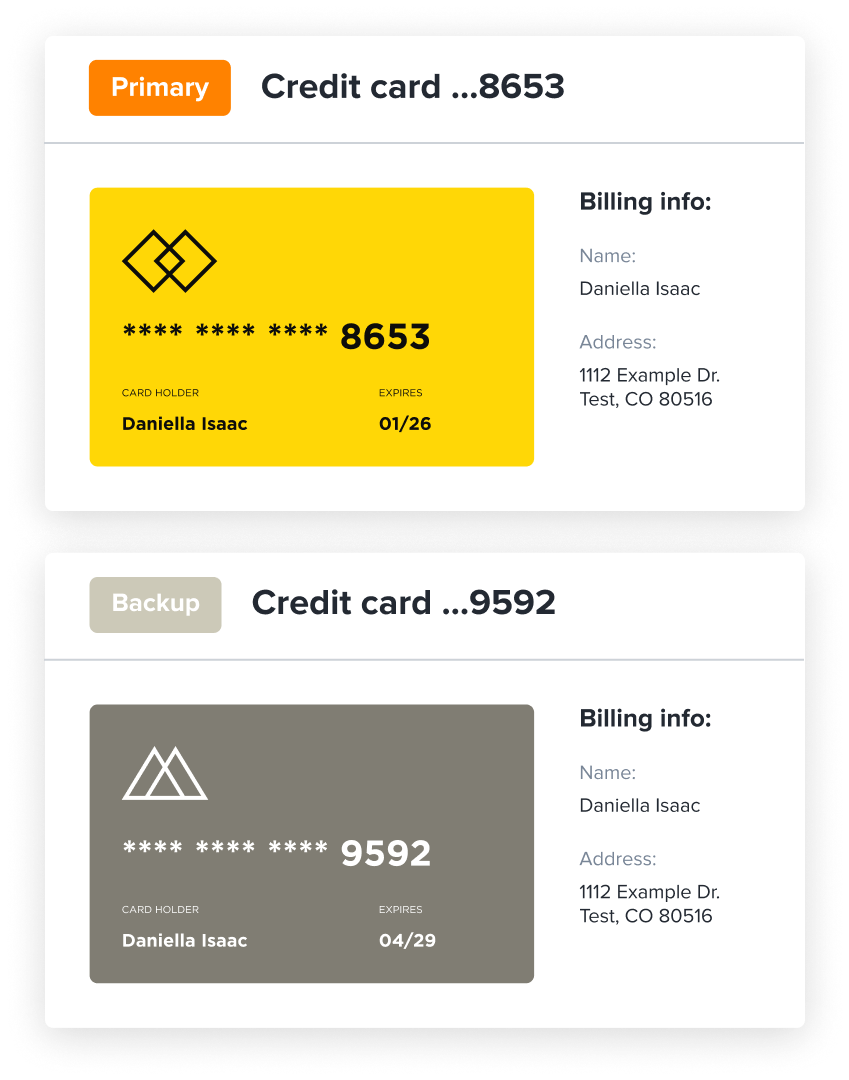

Backup payment method keeps revenue flowing

Did you know that there are over 2,000 reasons why a credit card transaction may fail? Whatever the reason, when it happens, Recurly automatically reaches for the backup payment method for every account.

- Designate one payment method as the backup

- Use it on any invoice that goes into dunning

- Prevent service and subscription interruptions

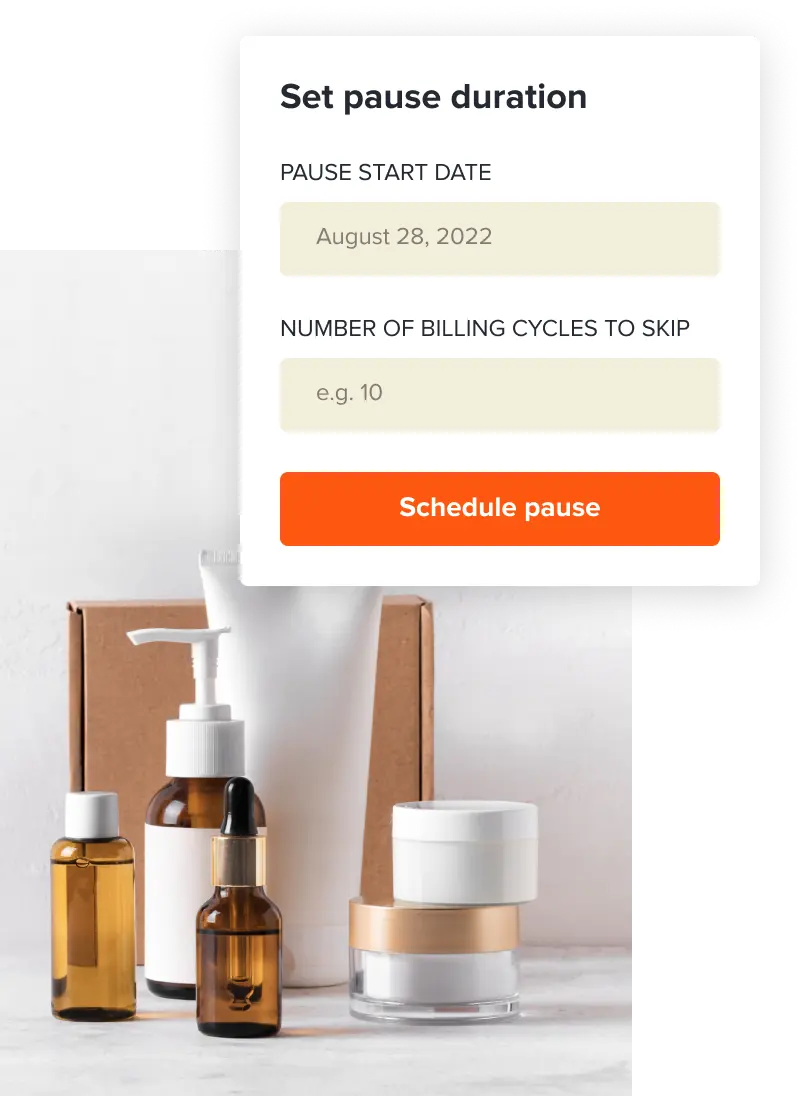

Subscription pause is a valuable customer retention tactic

Put the brakes on voluntary churn by offering pause instead. Avoid losing valuable customers by allowing them to pause their subscriptions on demand.

- One click pause functionality

- Specify the pause start date and/or number of cycles

- Automatically reactivate the subscription

Identify growth opportunities with advanced subscription analytics

Gain deep insights into business performance with advanced subscription analytics via charts, tables, and graphs that allow you to optimize what’s working and tweak what’s not.

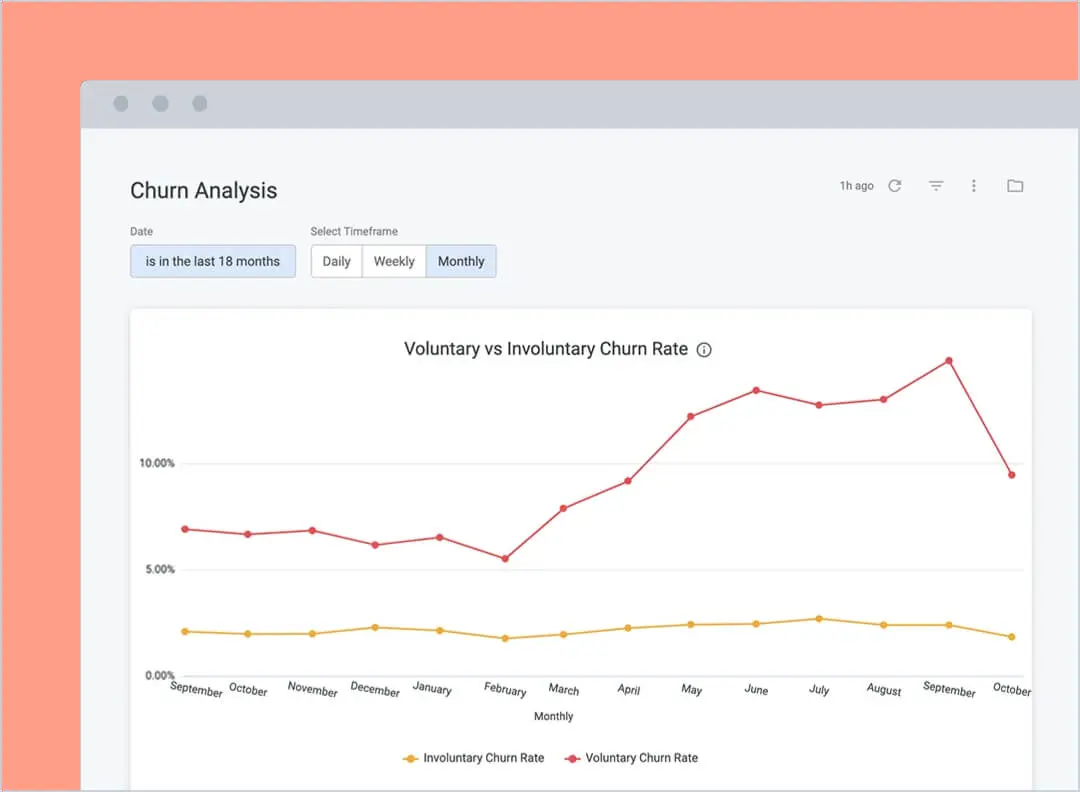

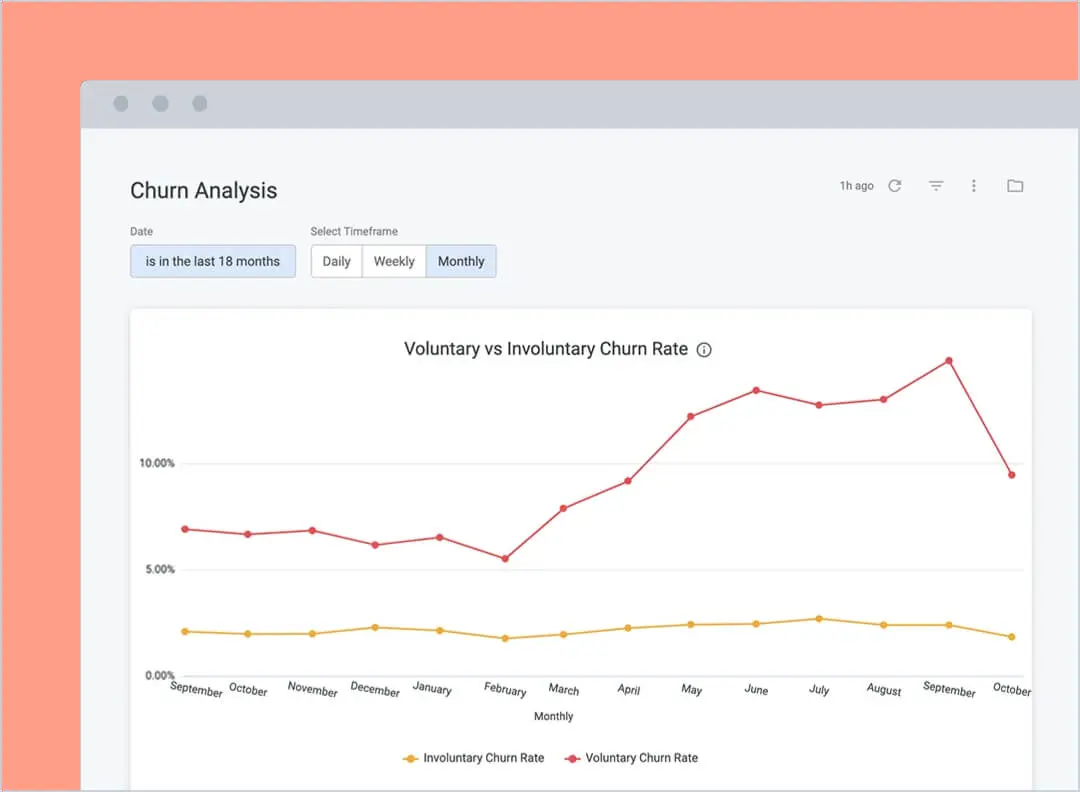

Learn more about reporting & analyticsChurn analysis

Calculates and monitors the total number of subscriptions that have expired during a selected time period, and categorizes into two churn types: voluntary or involuntary.

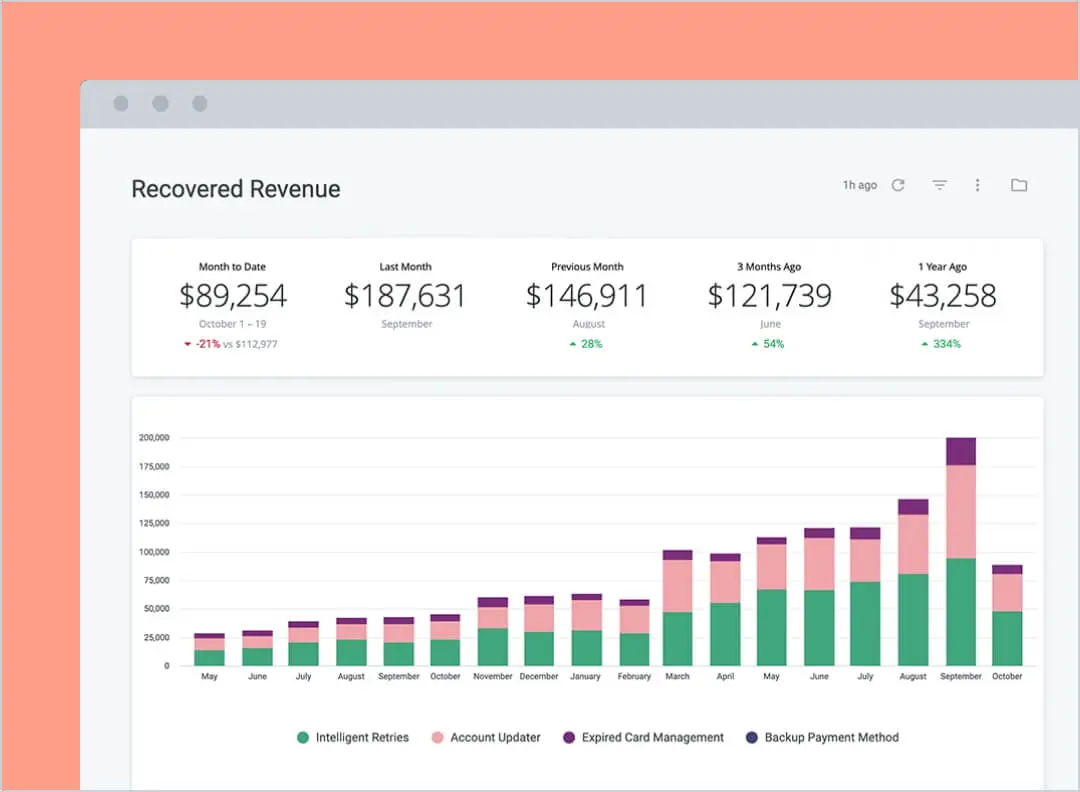

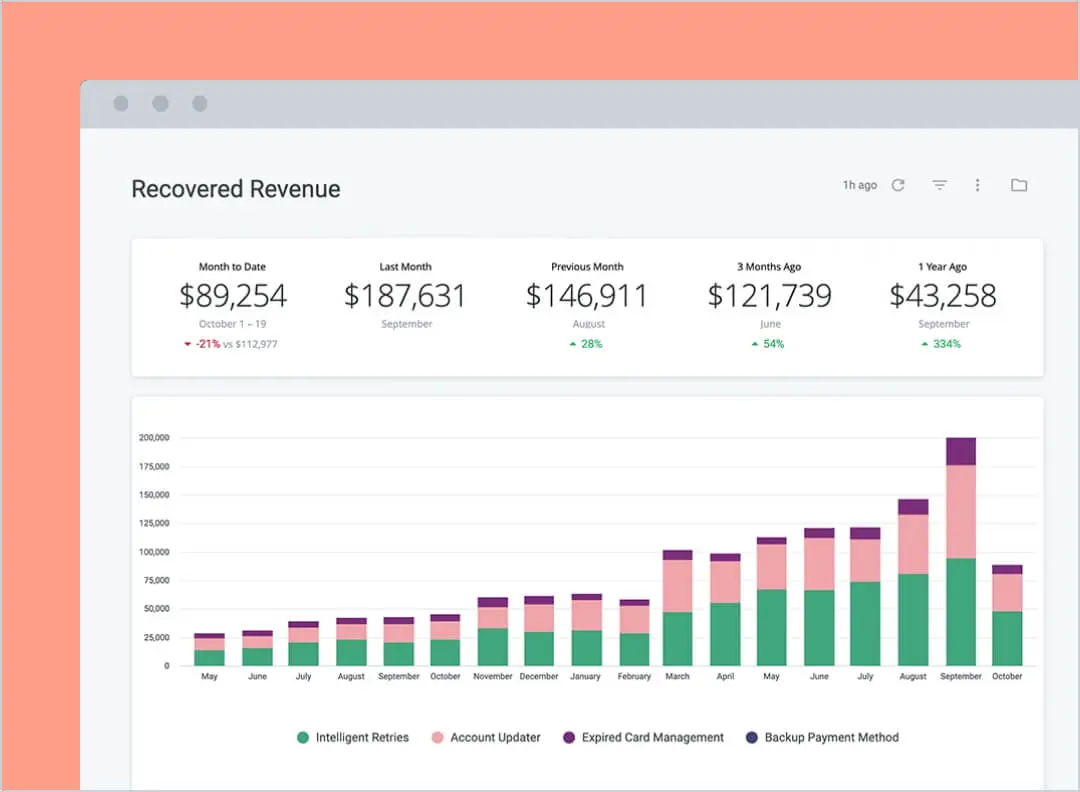

Recovered revenue

Calculates and reports the total revenue recovered by minimizing involuntary churn from declined transactions, segmented by recovery method:

- Intelligent retries

- Account updater

- Expired card management

- Backup payment method

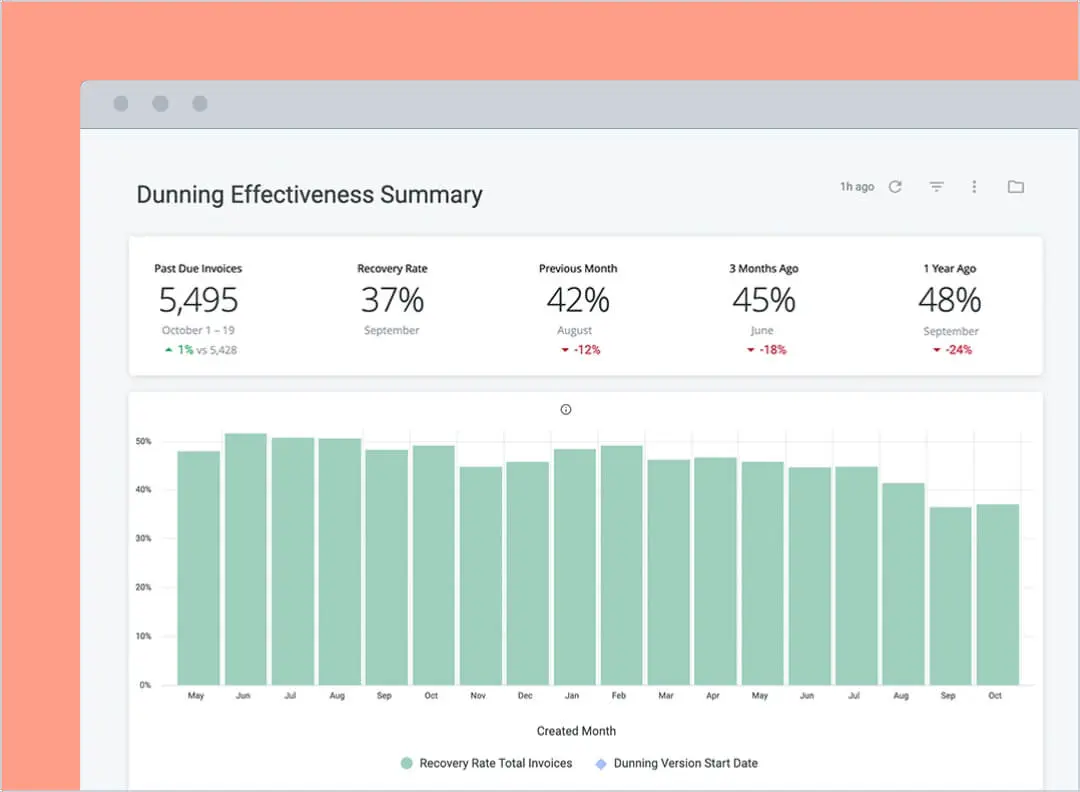

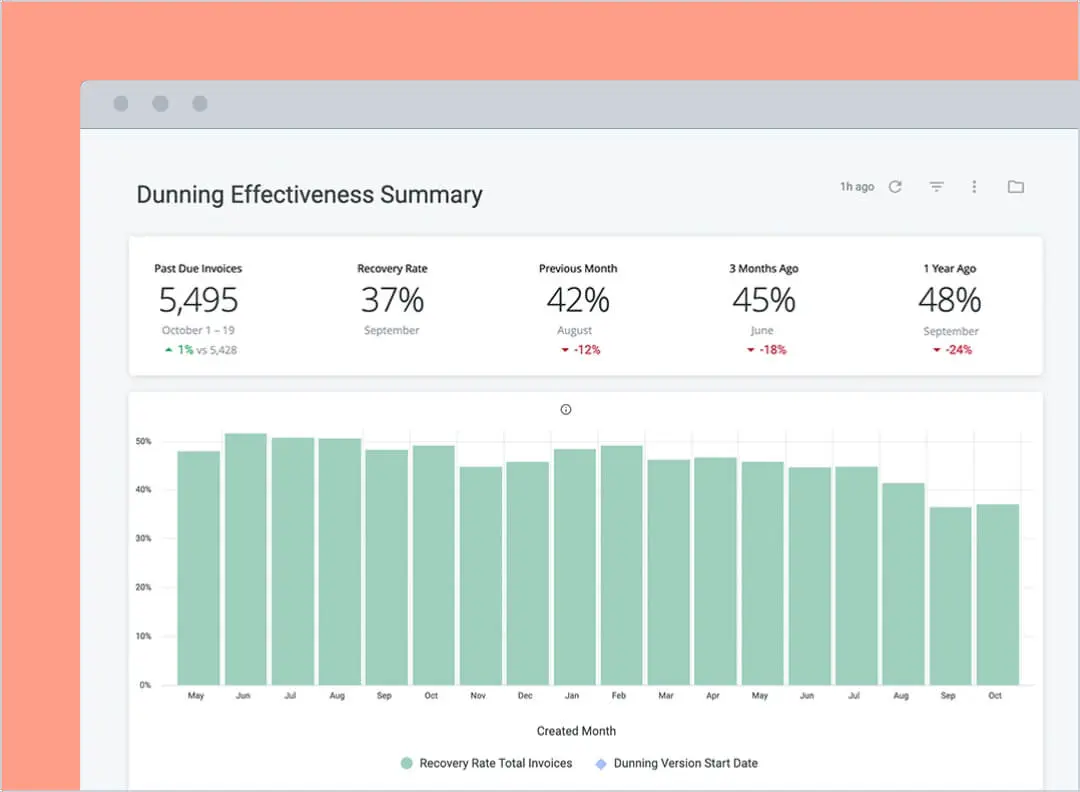

Dunning effectiveness

Tracks the dunning recovery rate, amount of revenue recovered, and number of subscriptions saved for invoices that go past due.

Get connected through the Recurly partner ecosystem

Seamlessly extend your existing workflows and tech stack with pre-built integrations for dozens of CRM, ERP, and data systems, as well as gateways, accounting, tax, and fraud solutions.

View all partner integrationsKount

Protect your business from suspicious activity with superior and customizable fraud-fighting capabilities directly within Recurly, leveraging Kount’s next-generation artificial intelligence scoring and business intelligence tool to perform in-depth analysis.

Learn moreZendesk

Provide better customer service by answering customer questions and handling more customer requests quickly with three available syncs: Zendesk Chat, Zendesk Support, and Zendesk Sell.

Learn moreSnowflake

Glean greater insights into the performance of your subscription business by automatically exporting account-level data from Recurly and combining it with other data sources stored in Snowflake.

Learn moreZapier

Increase process efficiency and extend subscription capabilities by easily enabling your own connections with best-of-breed SaaS applications or transfer data through the use of simple integrations called "Zaps".

Learn moreExperience matters. Enjoy unmatched, proven scalability with Recurly.

$1.3B

annual recovered revenue

49%

annual dunning recovery rate

72%

at-risk subscribers saved annually

96%

annual renewal invoice paid rate

Each of Recurly's decline management features alone would have taken us significant time and resources to develop and optimize. By using Recurly for subscription management, these capabilities are included with near-zero work on our side.

Read case studyFrequently asked questions

What is churn management? And what is churn prediction software?

Churn management is the business process dedicated to understanding and reducing subscription churn. Churn prediction software gathers data and anticipates which customers are likely to churn by identifying patterns and recommending the necessary actions to retain them.

How do you track customer churn?

Subscription management platforms, like Recurly, continually monitor, predict, and prevent churn.

What are churn risks?

Churn rate or churn risk describes the likelihood that a customer will stop using or paying for a product or service. There are numerous best practices for reducing voluntary and involuntary churn, and businesses should monitor this vital metric.

How do you reduce churn in SaaS?

While some churn is inevitable, businesses can reduce churn by ensuring accurate payment processing to prevent failed transactions and optimizing their subscription offerings to attract and retain subscribers. Learn the 16 effective strategies to reduce subscriber churn.

How do you forecast churn? What is the best method for churn rate forecasting?

Churn prediction or forecasting is the practice of analyzing data to detect customers who are likely to cancel their subscriptions and to identify payment transactions likely to fail. To forecast churn rates, subscription management platforms, like Recurly, combine historical customer data with machine learning algorithms to rank a customer’s likelihood to churn.

What is a reasonable churn rate for a subscription business?

The average churn rate across the subscription industry is 5.57%, but it varies widely across industries and company types. Learn how your churn rate compares to others in the industry with our State of Subscriptions research.

What is the difference between churn and retention?

Churn is the rate at which your company loses customers. Churn can be both voluntary (a customer cancels) or involuntary (a payment transaction fails). Retention is the rate at which your company retains customers.