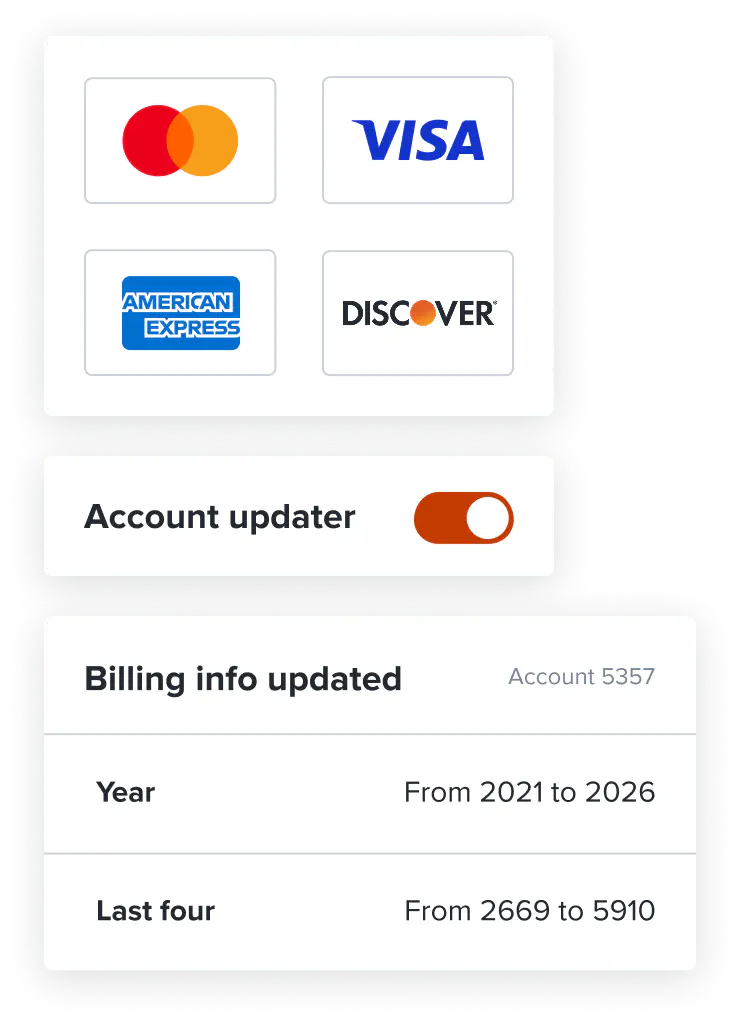

Account updater

Automatically updates your customers’ credit cards to help recurring transactions process successfully.

Shrink churn and maximize recurring revenue

Before custom retries and dunning come into play, Recurly’s account updater prevents transactions from failing by confirming subscriber payment information is up to date.

- Checks for updates before renewals

- Writes updated information into subscription records

- Works with account updater programs managed by leading credit card providers

Each of Recurly's decline management features alone would have taken us significant time and resources to develop and optimize. By using Recurly for subscription management, these capabilities are included with near-zero work on our side.

Read case studyFrequently asked questions

What is involuntary churn?

Involuntary churn refers to customer churn due to payment failures as the result of things like outdated information. Naturally, merchants want to reduce their churn rates to improve revenues.

What is an account updater?

Recurly’s Account Updater service monitors your customers’ Mastercard®, Visa®, Discover®, and American Express credit cards for changes, making updates in Recurly’s records whenever necessary. Account Updater is critical to minimizing loss in revenue due to avoidable failed payments.

When does the Account Updater check for updates?

Recurly’s Account Updater checks for credit card account updates before a subscription renewal and when a re-subscribe signup results in a hard decline.

How does the Account Updater work?

Recurly’s Account Updater works with the Account Updater programs for Mastercard®, Visa® and Discover® credit cards. Participation is first determined by the customer’s card issuing bank who provides account change events to Mastercard®, Visa® and Discover®.