The critical payment experience in consumer subscriptions

As payments become a crucial part of the customer experience, optimizing your payment experience is key to maintaining backend efficiency and a strategic imperative to foster trust, reduce churn, and unlock unprecedented growth.

Forrester Principal Analyst Lily Varon, Recurly CPO Jonas Flodh, and Recurly CMO Lina Tonk came together to discuss the key findings of the commissioned study report conducted by Forrester on behalf of Recurly in May 2024.

Watch the webinar on-demand or keep reading to get the highlights of this insightful conversation.

Why billing and payments are more than "just a tactic"

Varon kicked off the discussion by emphasizing the strategic importance of billing and payments. In today's digital landscape, subscriptions have become ingrained in how consumers buy and interact with products. 48% of U.S. consumers have four or more subscriptions, while 93% in the U.K. have at least one, making it crucial for businesses to master their billing and payment processes.

The challenges of subscription business growth

Flodh expanded on the challenges that businesses face as they scale and implement subscription models, and how the lack of maturity in billing and payment technology and processes impacts growth.

79% of businesses say expanding products or markets is a priority—and 63% of this group say it is challenging

59% of tech and operations say they face significant challenges in making billing, payments, and revenue operations more efficient

67% of executives say a top priority is growth by acquisition—reporting that, with current technology, they struggle to achieve that goal

The key to overcoming these challenges? A mature billing and payment system that can support such growth. Launching new payment methods, managing taxes, and efficiently handling revenue operations are just a few areas where a robust payment system can make a substantial difference.

From acquisition to retention: Growth is the top priority

While subscriber acquisition remains a top priority for subscription businesses, Varon points out that businesses are primarily in a growth mindset. You can’t afford to overlook the opportunity for improving retention and lifetime value.

A subscription business has different stages, from experimentation to intermediate to expert. Interestingly, respondents fell into a classic bell curve, with most in the intermediate range, in which they’re actively improving operational efficiency, alignment, and tech flexibility.

These organizations consider acquisition rate (74%), trial-to-paid conversion (71%), and churn rate (61%) as their top three Key Performance Indicators (KPIs) when measuring subscription growth. This shows that most businesses are too focused on acquisition and use basic KPIs to measure their success.

What does Varon suggest? Implement mature measurement strategies. Rely on your technology partners to provide benchmarking data, and complement the acquisition metrics with retention ones.

The strategic leverage of payment functions

As businesses evolve and mature, payment functions become a strategic lever that many companies often underutilize. Managing payments effectively is crucial, as failed payments can result in a decrease in customer lifetime value, lost revenue, increased costs, and even damage to brand reputation.

Winning back lost subscribers becomes challenging once they've severed ties due to payment issues. Technology plays a crucial role in crushing involuntary churn, like having subscriber wallets or backup payment methods.

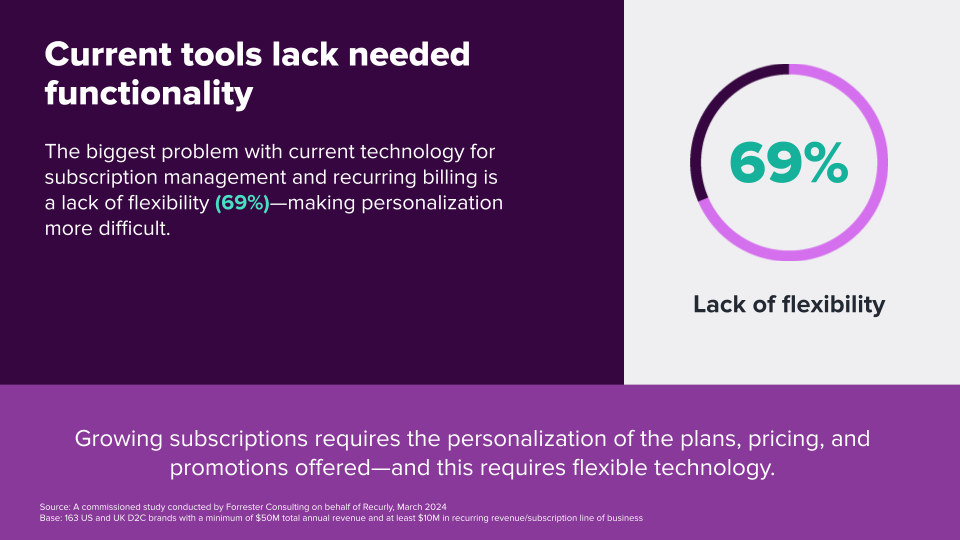

The flexibility factor in subscription management

Flexibility is a major driver of subscription growth. The ability to iterate and experiment with different pricing and billing solutions was highlighted, with the lack of flexibility identified as a significant barrier.

Flodh emphasized the importance of finding a partner that offers strategic guidance, scalability, and flexibility in plans and pricing capabilities. A subscription platform partner who can guide businesses and provide valuable insights on billing and payment processes is crucial in overcoming these challenges.

Varon also points out how flexibility and rigidity differ based on the industry, product, and maturity level. As you’re looking for potential partners, it’s crucial to determine what flexibility means for you and what you need from this third-party platform.

The flexibility factor in payment orchestration

Speaking of flexibility, 63% of respondents also pointed out the constant friction in payment orchestration, from payment execution to choosing the right payment methods. This is an area where partners can provide diverse tools and solutions to manage these inquiries.

Besides payment processing, businesses also highlighted the lack of churn management capabilities (56%), the ability to scale (55%), and limited analytics and reporting (52%) as everyday challenges.

When it comes to churn management and retention, Flodh shares, it’s much more efficient to prevent users from leaving you versus losing them and trying to win them back.

What businesses are looking for in a subscription platform partner

Based on the priorities and challenges that respondents have expressed in the study, businesses are looking for a partner that can both help them build a robust strategy and execute it efficiently.

Expertise (87%), flexibility (84%), and scalability (77%) are the top three characteristics they consider critical when choosing a partner, followed by intuitive dashboards (75%), payment orchestration (73%), and churn management capabilities (71%).

Unlocking the potential of subscription payments

Failed payments don't just hurt revenue, they damage the customer relationship. A mature subscription management strategy is essential to growth. From this session, we can conclude that:

Maturity matters: The lack of maturity makes it harder to monetize value and deliver positive customer experiences

Retention matters: Acquisition is key. But retention is just as important—if not more

Expertise matters: Subscription businesses want expertise in consumer subscription management and billing

Check this out: Recurly’s built-in benchmarks allow you to compare renewal invoice paid and decline rates, acquisition rates, signup decline rates, churn rates, and dunning recovery rates versus other players in your industry.

Get more insights: The payment experience is critical to subscriber growth and retention

Failed payments mean lost sales, a loss of confidence, and eroding customer lifetime value. In May 2024, Recurly commissioned Forrester Consulting to study the challenges and opportunities in the payment experience for consumer subscription brands.

The study found both challenges with the payment experience and immaturity in subscription management as many struggle to achieve sustainable subscription growth with their current technology.

Explore these critical insights and practical solutions to help you build a more resilient, subscriber-centric payment experience capable of scaling as dynamically as your industry.