How to calculate Monthly Recurring Revenue (MRR)

Consumers love their subscriptions–and so do businesses. The subscription model offers significant advantages for a company's financial health. Knowing your monthly recurring revenue (MRR) makes hiring more staff, investing in new product developments, or signing a lease for a bigger office space easier.

Let’s review what is monthly recurring revenue, how to calculate it, the factors that influence it, and the importance of MRR reporting.

What is MRR?

Monthly recurring revenue (MRR) consolidates all subscription-based revenue into a single, analyzable number. This financial metric is just one of several key subscription model metrics available to inform strategic decisions for future growth, providing you with a wealth of subscription analytics to explore.

How to calculate MRR

Here’s the formula: Multiply your monthly subscribers by your average revenue per user (ARPU).

For example, you have 200 monthly subscribers, giving you a $35 monthly revenue per customer. Your MRR would be 200 * $35 = $7,000.

To get your annual recurring revenue (ARR), you multiply your MRR by 12. So, in this example, $7,000 * 12 months = $84,000.

It seems simple and straightforward to calculate your MRR, right? In reality, a few factors sometimes make calculating MMR more time-consuming. In the real world, MRR is strongly influenced by three factors: new MRR, expansion MRR, and churn MRR.

New MRR

All those customer acquisition strategies do pay off. Your New MRR is the amount of additional revenue that new customers contributed to the top line. Let’s say your company acquired 65 customers this month. Also, 15 signed up for a $50 monthly plan, and 50 chose a $30 monthly plan. Your New MRR would be (15 * $50) + (50 * $30) = $2,250.

Expansion MRR

Your subscription customers want more than a basic plan. Your Expansion MRR is the additional MRR that results from cross-sells or upsells to your current customers. If seven customers upgraded their active subscriptions from the $30 tier to the $50 tier this month, your Expansion MRR would be (50-30) * 7 = $140.

Churn MRR

Customer churn rates affect your MMR. Your company will have subscriber churn, regardless of how well you serve your customer base. The impact of your cancellations and downgrades shows up when you calculate your churn MRR. For example, four customers downgrade from the $50 plan to the $30 plan, and five cancel their $30 plan. Your Churn MRR would be ((30-50)*4) + (-30*5) = minus $230.

Net New MRR

Now, you bring these factors all together to get your Net New MRR, which is a measure of MRR that your company is gaining or losing. Calculating it is easy. Take the sum of new MRR, expansion MRR, and churn MRR. In the example, your Net New MRR would be $2,250 (New MRR) + $140 (Expansion MRR) - $230 (Churn MRR) = $2,160. Tracking your Net New MRR gives your business an insight into growth trends. Did a new product development that hit all active subscriptions in the previous month improve your MRR? The Net New MRR shows how your decisions are affecting your entire customer base.

Common scenarios that impact MRR calculation

Your New MRR, Expansion MRR, and Churn MRR are neat buckets to capture changes in your monthly recurring revenue, but your company will face scenarios that aren’t as clear-cut. Here are two examples of common scenarios that impact MRR calculation:

Example #1: Cancelling subscriptions

You have a customer who wants to cancel their subscription, but you offer a deal to keep them on board–a smart move since customer acquisition costs tend to be higher than customer retention.

As part of the agreement, you give them three free months and then charge them $50 a month, paid upfront for one year. Your monthly recurring revenue would not be $50 a month and instead would be $40 a month, calculated as follows: ($50 x 12 months) / (12 months + 3 months).

Note that the one-time payment of $600 ($50 x 12 months) would be averaged over the 15 months—you wouldn’t record it as MRR in the month that the payment is made by the customer.

Example #2: One-time payments

A long-time subscriber makes a one-time purchase. Should you add the additional revenue to your MRR, even for just that month? No, because it's not recurring.

If you were to include the amount, you would artificially raise your revenue per customer for the month–and defeat the purpose of your MRR calculation (getting a baseline of future cash flows).

One-time payments do have a place in your subscription business; however, they're not part of your predictable revenue streams.

How Recurly makes MRR reporting easy

Having visions of your accounting and finance teams being overwhelmed by MRR calculations? Buried in spreadsheets and trying to sort out all of the scenarios that impact MRR?

A deeper understanding of monthly recurring revenue might be just what you need to unlock stronger financial performance for your company.

Recurly’s monthly recurring revenue (MRR) reporting gives you the insights you need to answer questions like:

What revenue should I expect every month?

Is revenue increasing or decreasing each month?

Are monthly recurring revenue targets being met?

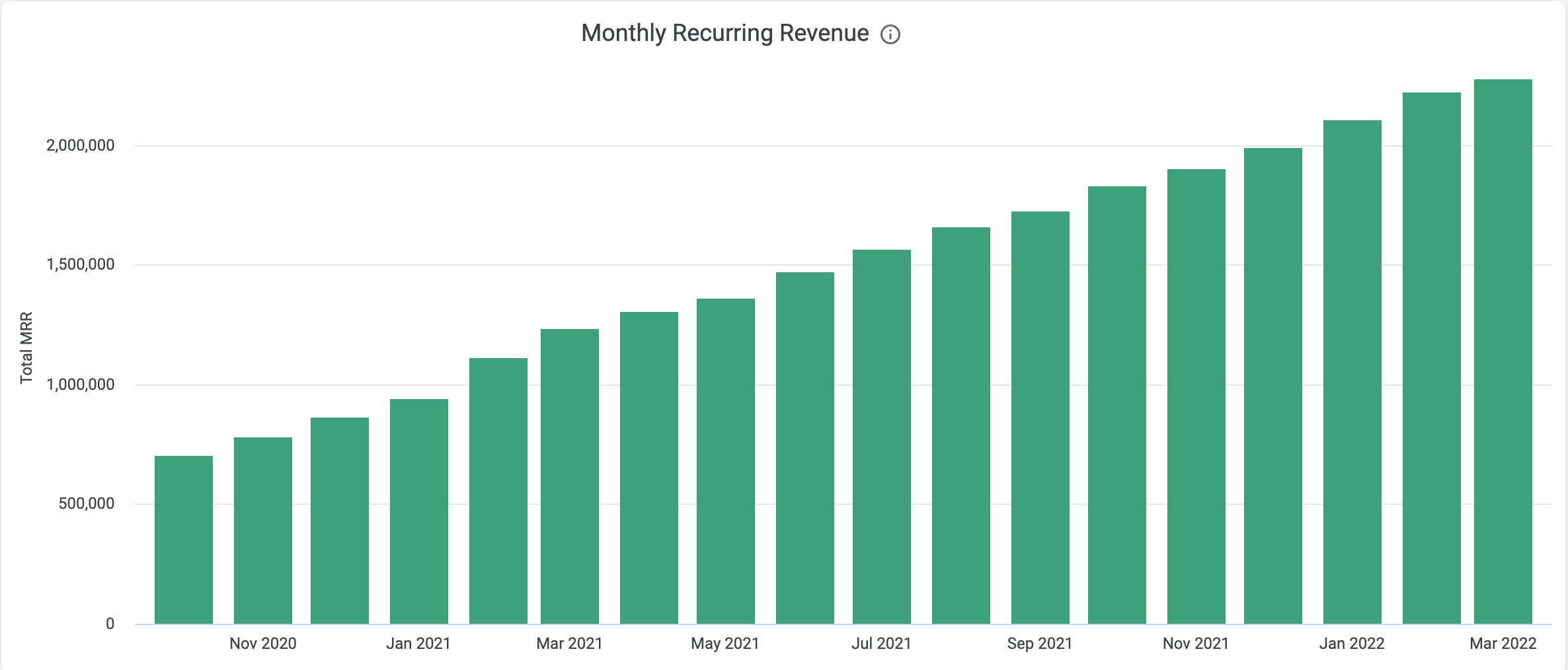

Our dynamic reporting capabilities track total MRR and MRR changes to evaluate your businesses’ growth and revenue momentum–including new, expansion, reactivation, contracting, churned, and net MRR.

Want to learn more? Check out Recurly’s reporting and analytics solutions.

How do KPIs impact your business?

Competing in an increasingly crowded marketplace requires continued innovation and the ability to meet subscribers’ ever-evolving needs and preferences. And tacking MRR can help you find trends in behavior.

Check out this guide with ten proven tactics to help you translate KPIs into actionable insights for subscription success.