Five revenue recognition examples for subscription billing

From software companies to streaming companies to box of the month subscriptions, recognizing revenue is a key aspect of business compliance that demands careful consideration. The revenue recognition landscape can be challenging to navigate; however, it is essential for both financial transparency and strategic decision-making.

In this blog article, we’ll share a brief introduction to the revenue recognition standard and explore three examples of the scenarios that companies often come across when recognizing revenue in the subscription business model.

A brief intro to the revenue recognition standard

Revenue recognition is the process of accounting for the revenue generated by a company. It’s a key concept in financial accounting as it affects your company's financial statements–providing a clear picture of its financial health to investors and stakeholders.

Proper revenue recognition helps subscription businesses comply with ASC-606 and IFRS-15 accounting standards. These standards ensure that companies are consistent and transparent in their reporting, make informed decisions, and improve financial health.

Revenue recognition is vital for subscriptions as it affects financial reporting, compliance with accounting standards, stakeholder trust, tax implications, and overall business success.

Want to learn more? Check out this blog post about the revenue recognition process in subscriptions.

Five examples of subscription revenue recognition

One of the many questions business owners face is when they should recognize revenue: revenue recognition varies on the timing of payment collection. Contrary to traditional business models, where products are sold and delivered immediately, subscription-based businesses deliver them repeatedly and must recognize revenue over time.

Since revenue isn’t accrued until the subscription service is provided to the client, it remains deferred revenue during invoicing. Revenue becomes accrued or recognized once customers receive their products or services during the subscription period.

To better understand this, let’s review three possible scenarios you may encounter when recognizing revenue for your business.

1. Monthly plans: Recognizing revenue at the time of payment

Customers who sign up for monthly subscription plans, pay a fixed amount each billing period. In this case, revenue is recognized gradually as you provide the product or service over the delivery period of the subscription.

For example, you run a subscription box service for skincare and wellness products. A new member starts a monthly plan at $55. You would record these $55 in revenue each month for as long as the member is subscribed.

2. Annual plans: Recognizing revenue after the payment is received

When a customer buys a yearly subscription plan, they pay upfront for a fixed period. However, the product is delivered over the twelve months of the contract. Even though you receive the annual payment immediately, it should be gradually recognized as revenue until the service delivery period ends.

Here’s an example: Let’s say you run an audio streaming platform, and your customers pay for yearly subscriptions in advance. A subscriber decides to pay $120 for an annual subscription starting on the 1st of January.

You receive the payment immediately, but it’s considered unearned recurring revenue. The deferred revenue can be considered a liability until you provide the streaming service. Each month within the subscription time, that portion is marked as earned revenue, or a credit, debiting the liability balance throughout the contract.

So, each month, you recognize $10 in revenue, gradually over the year as you provide the subscription service. This way, revenue is recognized over the delivery service period, which, in this case, is twelve months.

3. Service-based subscriptions: Recognizing revenue before the payment is received

This method usually applies to service-based businesses, like consultancy companies. Revenue is recorded after the product delivery but before the payment is received. For example, a service delivered in June is recorded on June financial statements, even if the customer pays for it in August.

Let’s picture it with an example: You own a marketing consultancy firm, and a client signs a contract for a 3-month digital marketing campaign starting in June. Even though you’ll deliver the service throughout June, July, and August, you bill your client at the end of each month. You would recognize the revenue in your June financial statements when you provide the services, even if the client doesn't pay until August.

4. Subscription add-ons: Recognizing revenue as the payment is received

This scenario is most common for single purchases like one-time features in a SaaS product or a pay-per-event offer in a video on-demand streaming service. In this case, you deliver the product upon purchase and record the revenue immediately. Since the customer takes possession of the product instantly, revenue is recognized in the same accounting period as the payment was received.

How would this look like? Imagine you run a digital publishing company that offers a subscription plan for avid readers. Each month, you publish a $25 limited edition issue that users can buy for an extra fee through your site.

When your customers purchase this magazine as an add-on for their plan, you grant them instant access. You would immediately recognize the $25 in revenue because the customer takes possession of the product right after paying.

5. Subscription bundles: Recognizing revenue for separate units

Bundles in subscriptions have become an effective tactic for companies who seek to boost acquisition. However, its challenging to understand revenue recognition for services sold in bundles.

Sometimes, a new customer will pay for several products or features at once, such as set-up fees, consulting or support services, that may or not be mandatory. Revenue recognition is determined by whether or not these services are separate units of accounting.

Let’s say you run SaaS company that sells a marketing management platform for startups. Your offer an annual subscription plan at $10,000. Additionally, there’s an obligatory $700 set-up fee for customizations and instalment and an optional $2,000 fee for consulting services over the first three months.

In this scenario, you should recognize the revenue of the set-up fee and annual fee over the first year of the service. Since the set-up fee is obligatory, it is part of the same unit of accounting as the subscription fee.

On the other hand, the consultancy service is not obligatory and can be bought separately–hence, It is a separate unit of accounting. Record the revenue for this unit over the first three months as the delivery of the consultancy services occur.

Want to learn more? Check out this blog post that better explains how revenue recognition for product bundles and discounts work in subscriptions.

These are five simple examples that help you capture the essence of revenue recognition. However in reality, recognizing revenue is an accounting process that can be challenging, especially when supporting multiple billing and pricing models.

It's important to note that the timing of revenue recognition in subscriptions will depend on the specifics of your contract, performance obligations, and the revenue recognition principles your company must comply with.

Therefore, you should carefully evaluate your circumstances and consult your accounting and finance teams to determine the appropriate revenue recognition method to follow for each of your products.

Why revenue recognition automation is key to stay compliant

Subscription-based businesses face unique challenges when it comes to revenue recognition due to the recurring nature of their revenue streams. Working with a revenue recognition automation tool that’s designed specifically for the subscription model is crucial for ensuring compliance with accounting standards, maintaining financial transparency, and enhancing overall operational efficiency.

Forget about complex revenue recognition with Recurly

Compliance with accounting standards is essential to ensure accurate and transparent financial reporting in subscription-based businesses. Revenue recognition software can help you ease the calculations by automating these processes.

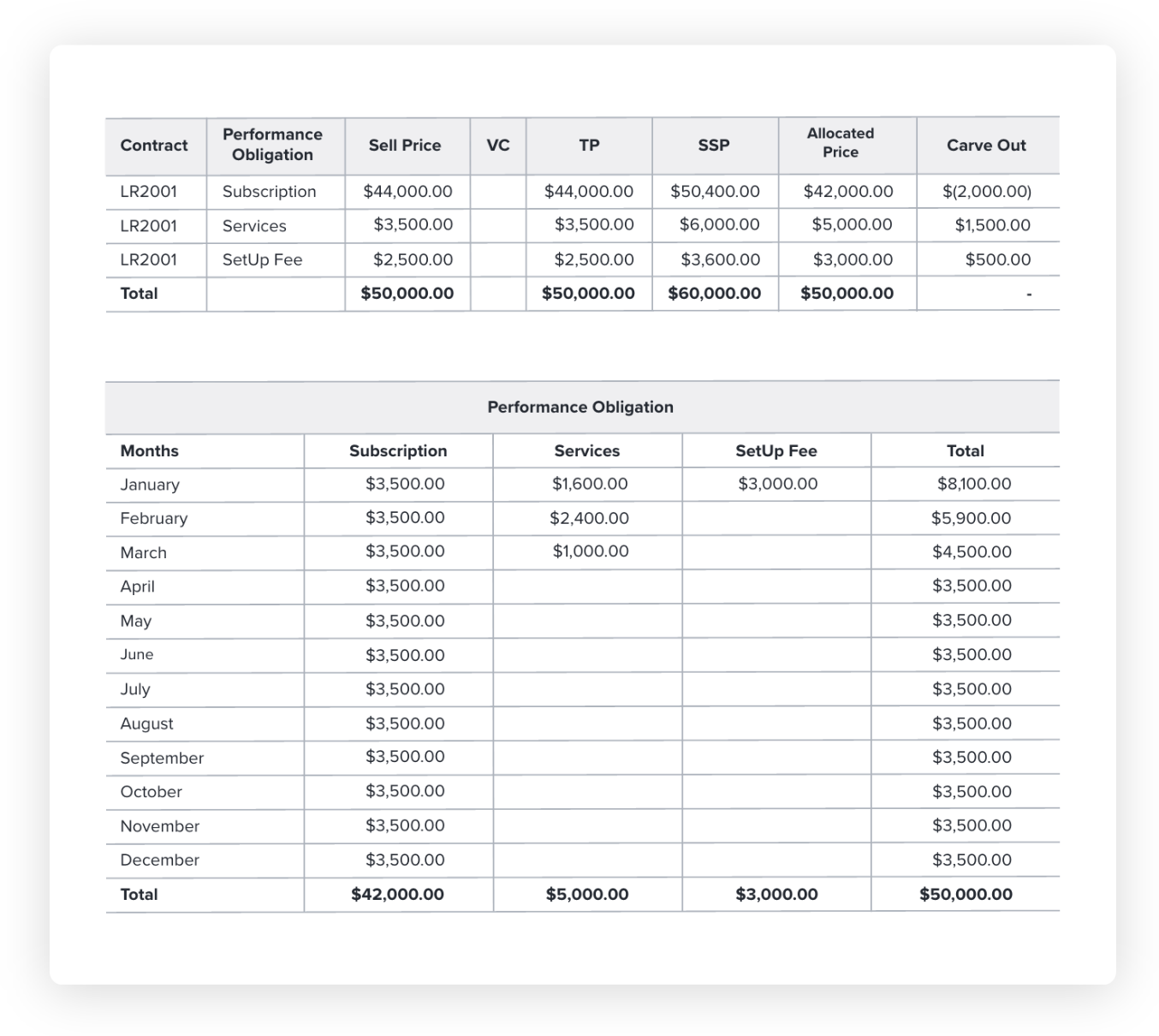

Recurly, for example, offers a revenue recognition solution for complex and straightforward revenue recognition requirements. Here’s what revenue recognition for a $50,000 one-year contract for a subscription, professional services, and an initial setup fee looks like.

Our revenue recognition solution automates revenue reporting and month-end close for companies with complex revenue models, as you:

Comply with ASC-606 and IFRS-15 with speed and confidence: Reduce compliance risks and audit costs associated with ASC-606, IFRS-15, ASC 842, and ASC 340-40 accounting guidelines as you automate revenue recognition processes complicated by diverse sets of performance obligations and pricing models.

Accelerate financial close and improve forecast accuracy: Eliminate manual processes and automate revenue recognition rules to reduce audit risk and costs. Close the books faster and forecast monthly recurring revenue with greater accuracy and predictability.

Support multiple revenue models with agility: Streamline revenue management for complex, diverse pricing and product bundles, support multiple revenue models (consumption, usage, milestone, percentage of completion or delivery), and accelerate global expansion with multi-currency and multi-book capabilities.

Gain an integrated view of data: Improve revenue visibility and forecasting across a diverse set of monetization models, multiple currencies, and international payment methods. Your finance teams can easily account for contract modifications, including volume discounts, up-sells, cross-sells, refunds, returns, cancellations, terminations, and price adjustments.

Direct-to-consumer subscription businesses must approach revenue recognition differently. Revenue recognition software is the answer for any growth-minded business looking to automate subscription revenue accounting.

With high-velocity, high-volume customer contracts and seemingly endless contract modifications, revenue recognition standards such as ASC-606–and IFRS-15 for businesses operating abroad–can easily become more complicated.

Check out this checklist with five revenue recognition must-haves for DTC subscription businesses.