Revenue recognition in subscription bundles & discounts

Revenue recognition specifies how and when businesses should recognize revenue and the associated costs over the life of the subscriber’s contract. The ASC 606 revenue recognition standard guides companies on how to account for revenue.

While the revenue recognition model may seem simple, it’s a more complex task in practice. This gets even more complicated when you work with several products and billing options.

In this article, we’ll focus on two powerful subscription strategies: bundles and discounts. How do you account for these promotions?

Many subscription businesses look to increase conversions and reduce churn with these promotions. Both play a significant role in acquisition strategies, but they also bring new challenges for your accounting and finance teams.

Watch on-demand: Hear from Recurly finance experts Steve Springsteel and Aswin Kurella as they break down the critical revenue management and forecasting strategies you can apply to ensure your team is a growth enabler.

Revenue recognition for product bundles

Product bundles are the combination of two or more products or services sold together for a single, reduced price. To recognize this revenue, allocate the total cost for each component based on their relative stand-alone selling price–the price you’d charge if sold separately.

For example, a company offers an online newspaper subscription and a special edition magazine bundle for $15/month. If the stand-alone selling price of the newspaper is estimated to be $8 and the stand-alone selling price of the magazine is estimated to be $12, then the company will allocate the transaction price based on the stand-alone selling price and can recognize $6 and $9, accordingly.

Additionally, you must determine when you’ll recognize revenue for each element. If the products or services are sold at the same point in time, then it doesn’t need to be recognized separately. However, you must recognize revenue separately if they have different recognition patterns.

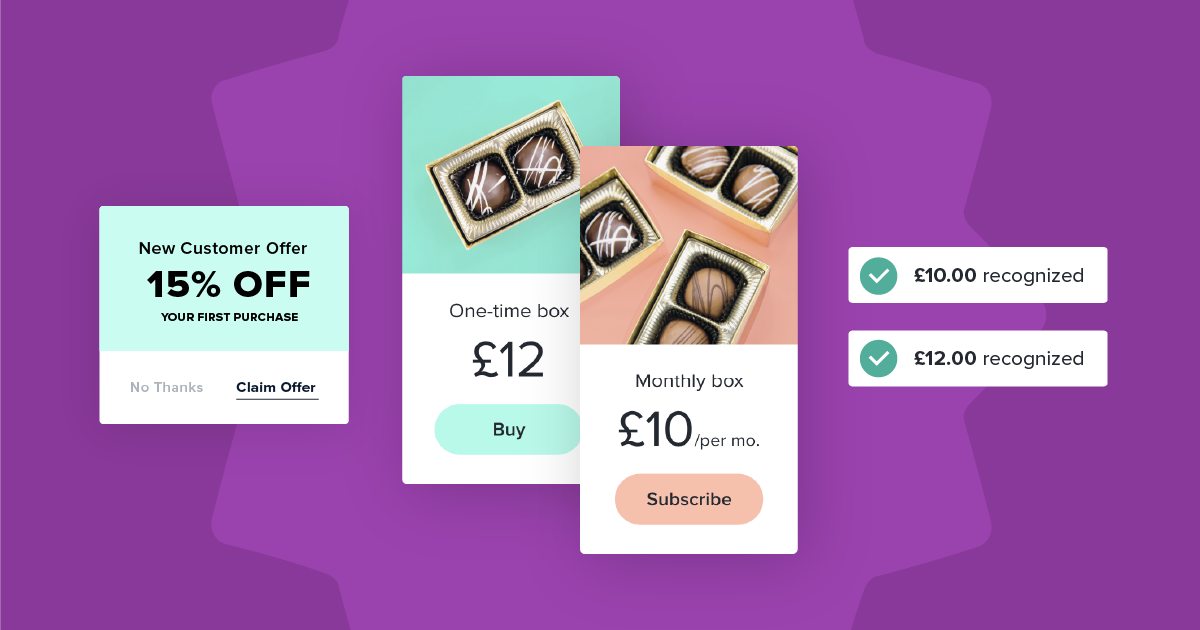

Revenue recognition for discounts

Discounts are often used to incentivize subscribers to sign up for a product or service. To recognize revenue from these discounts, you must determine the expected value of the discounts–considering the number of customers who are expected to take advantage of the discount and the duration of the discount period.

For example, a streaming company offers a $100 discount to subscribers who sign up for a one-year plan. If the company expects to sign up 100 customers and the discount period is one year, the expected value of the discount would be $10,000.

Revenue recognition for product bundles and subscription discounts can be complex, but it is critical to accurately report financial information. Companies must carefully consider all relevant factors when allocating the total price of a product bundle and determining the expected value of discounts.

Revenue recognition automation

Spreadsheet accounting solves revenue recognition problems for companies that offer one product. However, when you try to scale and handle multiple offerings, that’s where the challenge comes in.

Traditionally, revenue recognition for subscription businesses involved manual processes and a lot of manual effort. This could result in errors, delays, and inconsistencies, leading to significant challenges in managing cash flow and predicting future earnings.

Revenue recognition automation is a growing trend in the accounting industry, particularly for subscription businesses. With the rise of recurring revenue models, subscriptions face unique challenges in accurately recognizing revenue over time.

Automated revenue recognition software can help companies stay on top of their finances, manage their cash flow, and predict future earnings with greater confidence.

Making revenue recognition easy

Revenue recognition automation definitely makes the difference for subscription businesses. One of the key benefits of revenue recognition automation is the ability to handle the complexities of recurring revenue models.

Its ability to simplify the process while providing greater accuracy and efficiency is becoming an essential tool in recurring billing management.

Recurly revenue recognition streamlines compliance with multiple reporting standards to free your subscription business from accounting complexities, helping you:

Improve revenue visibility, reporting accuracy, and predictability

Accelerate your financial close and reduce compliance risks

Remove barriers to scale with a solution that supports your specific requirements

Direct-to-consumer subscription businesses must approach revenue recognition differently. Revenue recognition software is the answer for any growth-minded business looking to automate subscription revenue accounting.

With high-velocity, high-volume customer contracts and seemingly endless contract modifications, revenue recognition standards such as ASC-606–and IFRS-15 for businesses operating abroad–can easily become more complicated.

Check out this checklist with five revenue recognition must-haves for DTC subscription businesses.