Subscription revenue recognition: definition & steps

Cash flows differently for every business. Revenue recognition for subscription billing can be challenging to understand, calculate, and report.

Traditional businesses sell and deliver products immediately, and thus they can recognize revenue immediately. Subscription-based businesses, however, deliver their services repeatedly and must recognize revenue over the time the service is delivered.

On May 28, 2014, the Financial Accounting Standards Board (FASB) and International Accounting Standards Board (IASB) jointly issued the Accounting Standards Codification (ASC) 606, a new framework for companies to recognize revenue from contracts with customers.

This new standard helps with revenue recognition comparability across different in

dustries and business models. The main question for subscription companies is: When should you recognize revenue?

Keep reading to learn the ins and outs of ASC 606 compliance for subscription services.

Why is ASC 606 important for subscription-based companies?

Accurate revenue recognition allows you to confidently gauge your company’s performance and growth trajectory. Recognize revenue too early, and you’ll believe you have more to invest than you do; fail to recognize revenue correctly, and you may miss expansion opportunities.

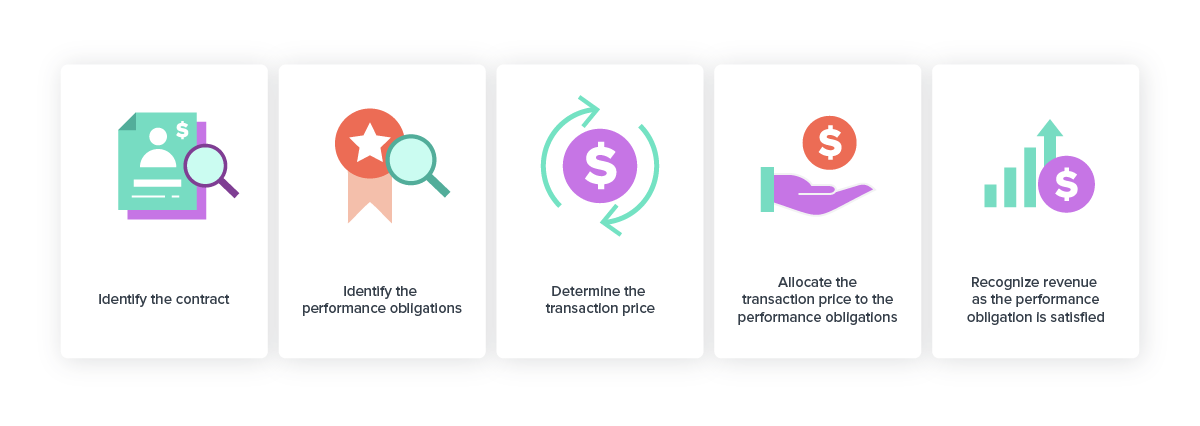

ASC 606 standardizes how businesses define contracts with customers, how pricing and quoting are established, and how revenue for these is recognized. It follows a five-step process that identifies revenue streams, covering all money earned from contracts and the costs incurred throughout the customer lifecycle.

This framework establishes flexible and compelling guidance for all the revenue recognition changes that could affect your financial statements–allowing your accounting and finance teams to report on complex revenue scenarios.

You can’t manage subscriptions at scale without getting revenue recognition right. Hear from Recurly finance experts as they break down the critical revenue management and forecasting strategies you can apply to ensure your team is a growth enabler–not a growth blocker.

Five steps to recognize revenue with ASC 606

The ASC 606 five-step model replaces transaction-specific guidelines, establishing guidance and clarity through the revenue recognition process.

1. Identify the contract with a subscriber

This means any valuable contract that details the enforceable rights and obligations your business and consumer have agreed on. Under ASC 606, you don’t necessarily need a signed contract, as long as it:

Identifies each party’s rights

Defines payment terms

Has commercial substance

Specifies that collectibility is probable

States that all parties have approved the agreement and are committed to fulfilling their obligations

2. Identify the performance obligations

This refers to the promise of transferring goods or services to subscribers. Here you determine the different services to the consumer–considering they can be transferred independently of other performance obligations, and the subscriber can benefit from them.

Identifying these distinctions is crucial because a series of dependent service deliveries are considered just one performance obligation.

3. Determine the transaction price

Once you’ve established the obligations, calculate the transaction price of the contract. Include cash and non-cash considerations and other variable considerations, like discounts, add-ons, mid-cycle upgrades or downgrades, and any price concession your business offers.

4. Allocate the transaction price

Here's where subscription businesses show a different focus, where the product or service delivery is recurrent, making it a continuous performance obligation. You can split the total amount to be recognized as revenue for each performance obligation.

5. Recognize revenue

After you’ve outlined each contract with its obligations and financial values, all that's left is to start recognizing revenue as you serve your customers.

While the ASC 606 framework seems simple, implementing it can be challenging. Under ASC 606, revenue is recognized when contractual obligations are met, not when the payment is made–changing the game for subscription businesses

Make ASC 606 compliance easy

Take the stress out of compliance challenges with compelling revenue recognition software. Your subscription management and recurring billing platform should be your source of truth. Recurly’s revenue recognition solution simplifies ASC 606 and IFRS 15 reporting processes, helping you

Lower costs and streamline your tech stack with numerous accounting standards that better connect your billing and revenue management processes.

Improve revenue visibility, reporting accuracy, and predictability with real-time, multi-dimensional revenue insights, reporting, and forecasting.

Accelerate your financial close with end-to-end revenue automation that delivers the metrics you need to speed up financial close.

Reduce compliance risk with automated workflows that meet the defined ASC 606 five-step model.

Remove barriers to scale with a fully configurable solution that supports your specific business requirements.

Partnering with the right subscription management and recurring billing platform can be a game-changer in revenue recognition. With Recurly, revenue recognition is automated, fast, and accurate.

Learn how Recurly Revenue Recognition can help you meet your subscription business compliance needs.

Revenue recognition FAQs

What is revenue recognition?

Revenue recognition (also known as rev rec) is a Generally Accepted Accounting Principle (GAAP) that specifies how and when you recognize revenue. It helps subscription businesses separate actual income from deferred revenue.

Contrary to traditional models where service delivery happens at the transaction moment, subscription businesses recognize revenue when the cash has been earned and not just collected.

What are the types of revenue recognition?

There are five revenue recognition methods–based on how performance obligations are set for your business model.

Sales-basis method: Recognizes revenue at the purchase moment.

Completed-contract method: Recognizes revenue when all performance obligations have been satisfied, and the contract is fulfilled.

Installment method: Generally used for high-ticket purchases, this method recognizes revenue when payments are received.

Cost-recoverability method: Recognizes revenue after you have recouped all the costs associated with the contract.

Percentage of completion method: Recognizes revenue according to milestones or other indicators of progress.

Revenue recognition example for subscriptions

Let’s say you run a box-of-the-month subscription business. You have a monthly $30 plan for skin-care product samples. You also offer a one-time $15 fee for a skin quiz to customize the samples according to the user’s needs and preferences before receiving their first box.

Since the skin quiz process is completed–the member has answered the questionnaire, and you’ve selected the products–that revenue can be recognized as earned. However, since the monthly box has not been delivered, this revenue is deferred.

Account receivable: $45

Earned revenue: $15

Deferred revenue: $30

At the end of the month, when the business has delivered both the skin quiz process and the monthly service, the ledger should reflect the newly recognized revenue.

Manage revenue recognition at scale

Direct-to-consumer subscription businesses must approach revenue recognition differently. Revenue recognition software is the answer for any growth-minded business looking to automate subscription revenue accounting.

With high-velocity, high-volume customer contracts and seemingly endless contract modifications, revenue recognition standards such as ASC-606–and IFRS-15 for businesses operating abroad–can easily become more complicated.

Check out this checklist with five revenue recognition must-haves for DTC subscription businesses.