Recurly’s Account Updater Fights Churn in the Background

Failed transactions are an everyday part of e-commerce. As a merchant, the last thing you want to see is the error message ‘card declined.’ On average, B2C and B2B can expect a failed transaction rate of approximately 11.5%. One of the most common decline reasons is outdated card information. That’s an enormous amount of revenue left on the table for such an easy issue to fix.

Enter Recurly’s Account Updater

Account Updater allows Recurly customers to access the most up-to-date credit card information for their subscribers. This is accomplished via a value-add integration Recurly has with card companies such as Visa and Mastercard. By obtaining the most up-to-date card information, Recurly avoids failing the transaction when it comes time for renewal: the card information is updated and the payment is successful. From a customer standpoint, updating this information means your subscribers’ service won’t be interrupted due to a failed payment.

This simple feature is crucial for maximizing revenue.

To turn on Account Updater

Open your Recurly Dashboard > Configuration > Payment Gateways > Account Updater > Enable button.

But, what if you elect to leave the Account Updater off? A digital bank called Bó recently had to replace 30,000 cards due to an oversight in their authentication software. That’s 30,000 subscribers whose cards will likely fail on their various subscription renewals. If one of those subscriptions is under the Recurly umbrella, rather than failing the transaction and sending the subscriber into dunning, the Account Updater would apply card updates and ensure that the payment is collected.

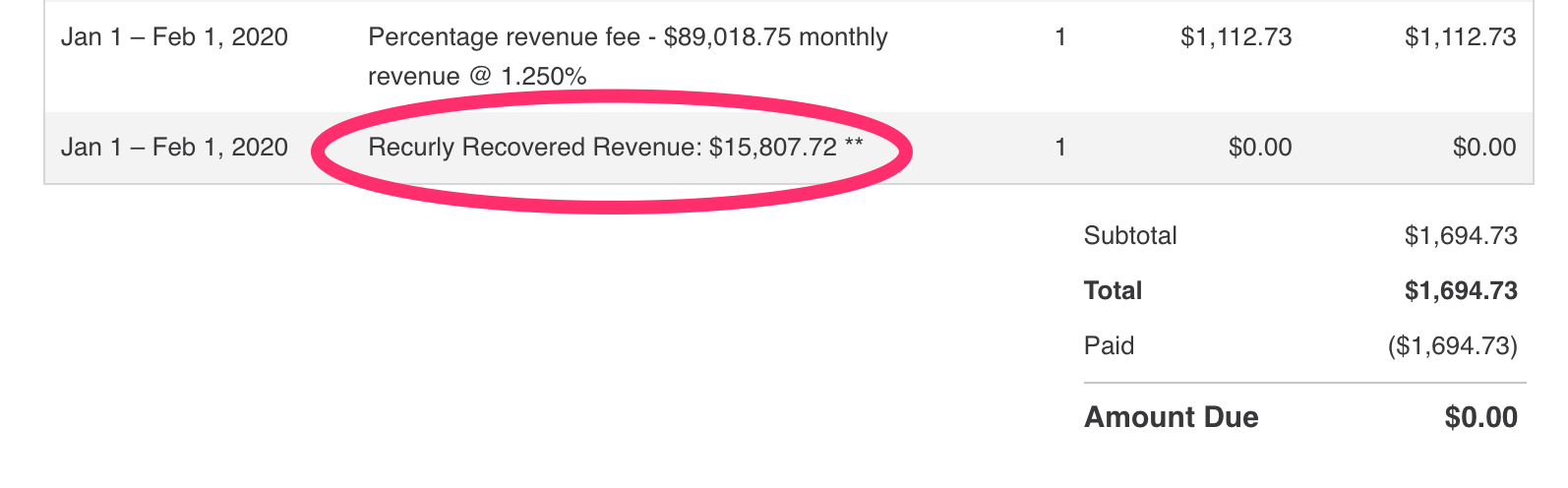

Recurly displays on every invoice how much revenue we recovered for you using our Account Updater technology. Often, this amount is greater than the amount of your Recurly invoice.

This is just another way that Recurly is putting smart technology and machine learning to work to help you maximize your revenue.