Ditch Those Spreadsheets and Improve Revenue Recognition

In the best of circumstances, financial reporting can be a complicated and sometimes difficult task. Accuracy is critical but not always easy to achieve. Subscription-based businesses face added challenges in accurately recognizing revenue. The business may have different billing models with different terms, have numerous customer upgrades and downgrades that need to be accurately calculated, along with many other customer events each month which affect billing. And many high-velocity B2C companies will process a huge volume of transactions throughout the month. All this makes for a complicated daily revenue-recognition process.

The Case for Automation

A very effective solution to this challenge is to automate revenue recognition. Businesses do this by integrating their subscription billing software with their accounting software.

Integrating billing and accounting systems enables more efficient revenue recognition and supports compliance with the FASB’s Accounting Standards Update. Merchants may start by doing cash-based revenue recognition, but many will transition to mid-month and finally daily revenue recognition as they see how automation improves their results. In fact, choosing daily revenue recognition provides additional benefits as subscription businesses that use cash-based and mid-month methods may see an increase in reporting inaccuracies as their company grows.

Reduce the Burden of Spreadsheets

By automating manual processes, subscription businesses can reduce their use of spreadsheets which are a cumbersome and ineffective way to complete finance and accounting deliverables.

Spreadsheets are particularly susceptible to keystroke or data entry errors when fallible humans work with them. The news is rife with unearthed tales of costly results from such errors, which have cost companies millions. The biggest such error was perhaps the infamous “London whale error” that contributed to the $6 billion loss JPMorgan Chase bank suffered in 2012.

Manual processes are also time-consuming, frequently preventing a subscription business from compressing the time required to close their books at the end of the month. With automation and integrated data, staff can reconcile bank balances quickly and easily, which also supports proper audit procedures.

Recurly Provides Automated Revenue Recognition

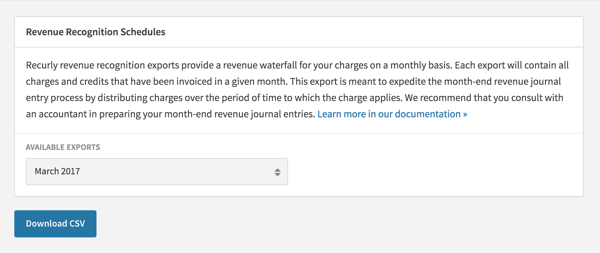

Subscription businesses that use Recurly benefit from our automated revenue recognition tool, which produces a deferred revenue waterfall report. This report can then be summarized into a journal entry and posted to your accounting software—significantly streamlining your month-end close process. As noted above, this automation eliminates the complexities involved in tracking revenue between different billing models that combine ongoing, usage-based, and one-time charges, along with other billing complexities. To learn more about Recurly’s revenue recognition capabilities, read our data sheet.

QuickBooks Online and NetSuite Integrations

Recurly also has integrations with QuickBooks Online and NetSuite to further streamline reporting activities, allowing our customers to more effectively manage recurring revenue, improve accuracy, and eliminate the burden of manual calculations.

A More Effective Solution

For subscription businesses, financial reporting and the month-end close process can be challenging undertakings. But if you choose a sophisticated, feature-rich subscription management platform for your business, you’ll realize significant benefits including increased accuracy and decreased time and resource needs. To learn more about how you can take the pain out of your month-end close process, view our on-demand webinar.