Fraud management

Protect your business and deliver a secure and satisfying subscriber experience.

Advanced fraud protection when and where it counts

Equifax works within Recurly, validating transaction details for each new card prior to contacting the payment gateway.

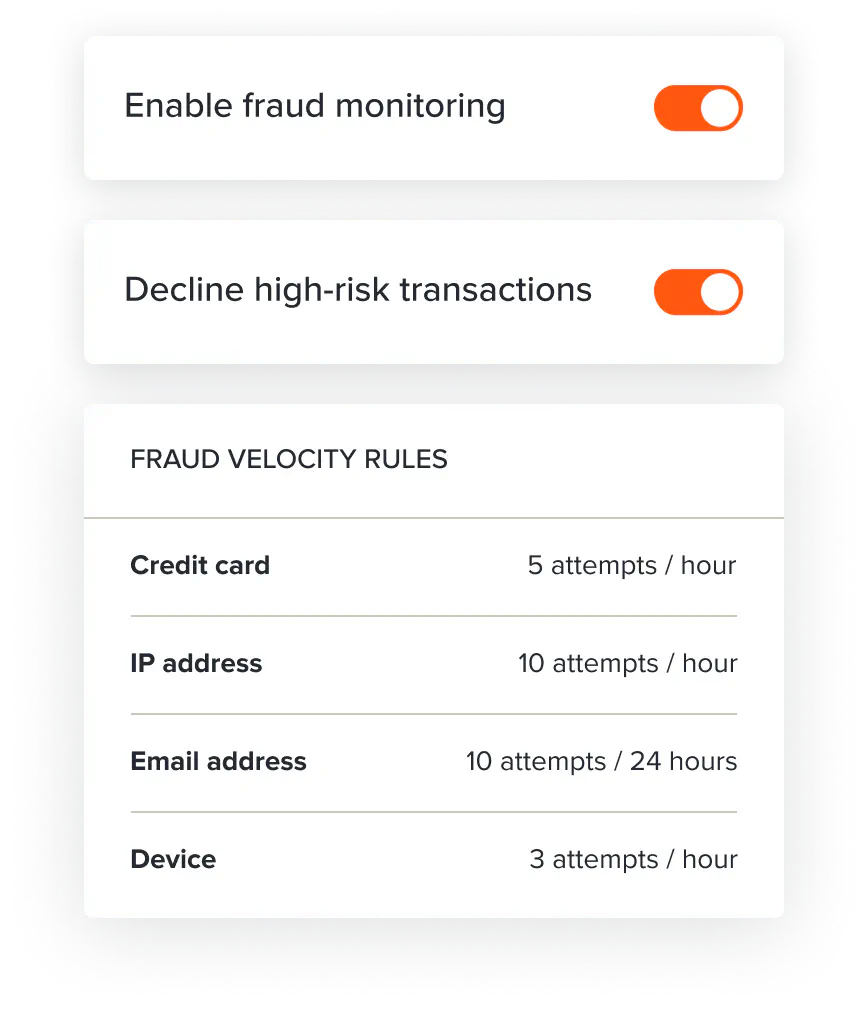

- Create custom rules based on fraud trends and business policies

- Access to the Equifax and their Kount360 technology tool for in-depth analyses

- Leverage next-generation artificial intelligence scoring

Anything related to our revenue is obviously very significant. So, our ability to ensure that our payment processing works smoothly and is effective was critical. This is the most important benefit Recurly gives us.

Read case studyFrequently asked questions

What is fraud management?

Fraud management is a term encompassing business policies and technology tools, including AI and machine learning, that work to detect and prevent online payment fraud.

How does Recurly help prevent fraud?

Recurly partners with Equifax, a leading eCommerce fraud prevention and digital identity trust solution. Recurly will perform risk inquiries on new card verifications (sign up and billing information updates) to help prevent chargebacks.

How much does online payment fraud cost businesses?

eCommerce losses to online payment fraud were estimated at $41 billion globally in 2022, up from the previous year (according to Juniper Research).

What can I do to reduce fraud?

Because eCommerce fraud is so widespread—and cybercriminals are increasingly sophisticated—any effective fraud management strategy will need to include technology tools built for the task. Learn more about subscription fraud trends.