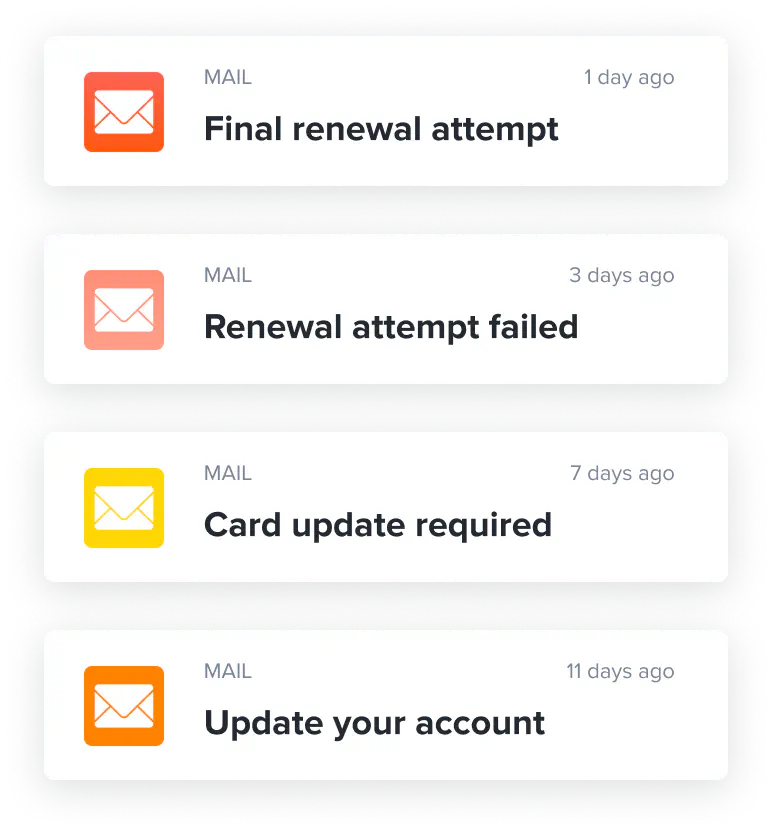

Dunning campaigns

Best-in-class dunning tools help you recover failed payments and increase revenue.

A customizable dunning process that gets results

Automate an effective dunning strategy that works behind the scenes to recover more revenue—an industry-leading 25% to be precise.

- Configure multiple dunning campaigns for various cohorts

- Assign different campaigns to specific plans or accounts

- Customize templates for manual, automatic invoice, and post-trial declines

Each of Recurly's decline management features alone would have taken us significant time and resources to develop and optimize. By using Recurly for subscription management, these capabilities are included with near-zero work on our side.

Read case studyFrequently asked questions

What is a dunning campaign?

Dunning campaigns enable the process of communicating with customers to ensure the collection of accounts receivable, typically once the receivables are overdue.

When do dunning campaigns begin on Recurly?

Dunning begins when an invoice has failed its initial payment attempt for automatic invoices (e.g., credit card, ACH, direct debit) or when net terms pass for manual invoices (e.g., check, wire).

Can we customize dunning campaigns for our business?

Yes, you can change the failed payment email intervals, number of email attempts, which email to send, and desired end-result for a subscription and invoice when payment is not successfully collected.

Do dunning campaigns work?

Recurly’s automated dunning campaigns are highly effective. Recurly recovered $214 million in revenue from dunning emails alone in 2022.

What factors influence the effectiveness of dunning campaigns?

Timeliness, persistence, consistency, and personalization all influence the effectiveness of a dunning campaign. Recurly automates the process to make it simple.