How are recurring payments processed?

Think back to the last time you signed up for a subscription with a well-known company like Paramount+, Speedo, or PupBox. It was likely a fast and easy process. You provided your payment details, and off you went. From there, you were automatically charged an agreed-upon amount on an annual basis (for the best price), and you might have never given it a second thought.

Processing payments takes more than just running a credit card number–and that’s why many companies rely on a subscription billing platform that can handle all things related to recurring payment processing. There are integrations, revenue recovery, subscription billing models, gateway routing, pricing experiments, and much more to consider.

What is subscription payment processing?

Subscription payment processing is a structured approach to handling recurring payments for services or products consumers receive on a periodic basis. It encompasses more than just executing the transaction: comprehensive subscription payment processing solutions that handle billing cycles, tiered pricing structures, and a customer self-service component that ensures flexibility and satisfaction.

What once was a mere transaction has evolved into a sophisticated partnership of buyer and seller, facilitated by cutting-edge payment technologies. Payment technology advancements have taken credit and debit card transactions to a whole new level—making it possible for a business to accept secure payments remotely using a physical card or mobile device, online on a website, or a mobile app.

New state-of-the-art subscription payment models are replacing old point-of-sale merchant PCI systems with more versatility and features, as well as accommodations for new payment processes, recurring revenue, and alternative payment methods such as PayPal, ApplePay, and Venmo.

The three parties in payment processing

In global online credit card payment processing and similar systems, there are essentially three parties: there is a merchant who is selling something, the customer who is paying for it, and the third party is the technology itself.

Some people look at this type of three-party system as the “devil’s triangle,” especially if it leads to excessive latency and one party keeps the other parties waiting for any length of time, as every millisecond counts when it comes to processing online payments.

Source: Jan van Bon, LinkedIn

Modern point-of-sale technology is different, though, in that it happens very close to real-time. Those payment transactions only take a few seconds—if that—so we tend to forget that there is actually an elaborate process behind getting merchants paid by customers. In reality, payment processing has to navigate a complex financial network and get a myriad of things done quickly.

The online payment processing model, explained

Subscription payment processing plays a pivotal role in subscription-based services and products. These payment models handle payments in regular intervals and billing cycles, ensuring that subscribers are charged accurately for the services they receive.

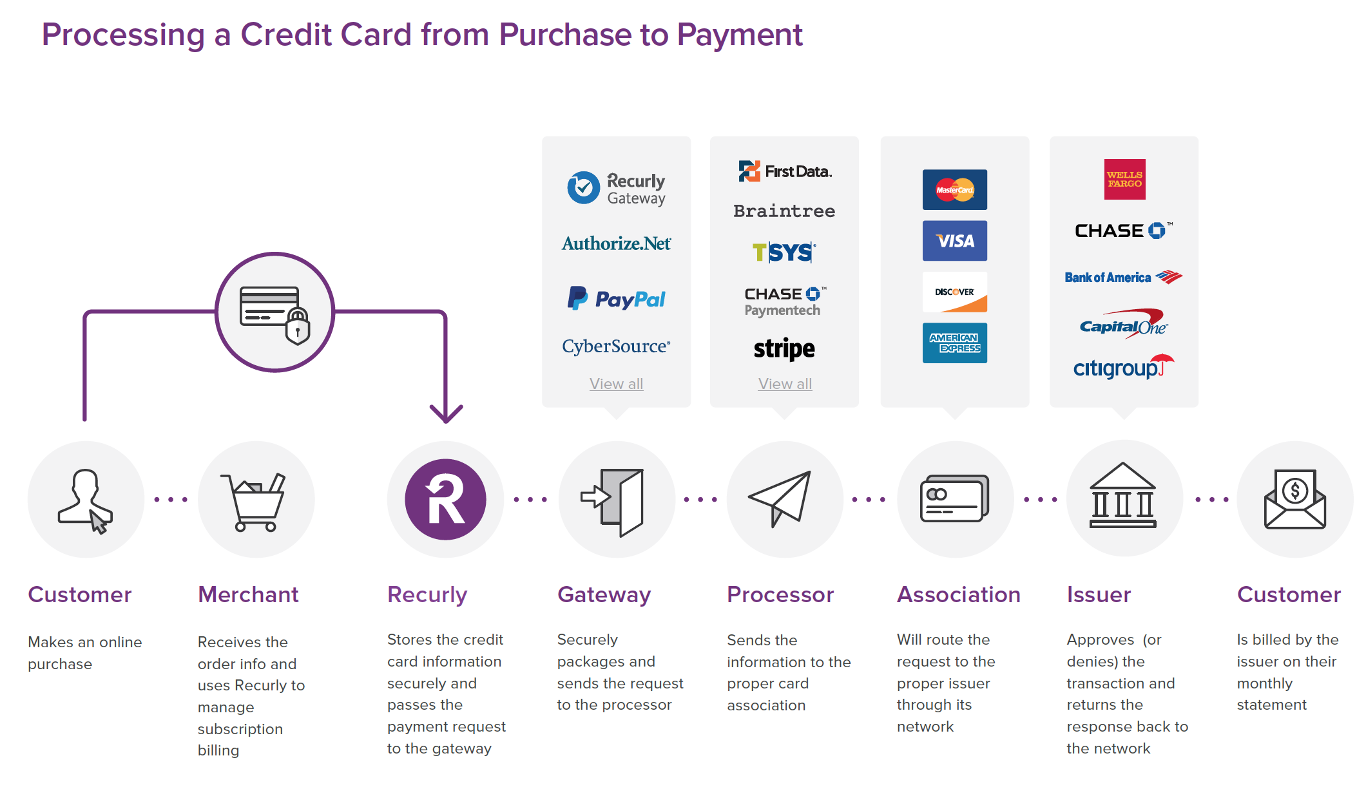

Check out this diagram about the payment processing process.

The customer hits the order button to initiate a purchase from the merchant.

The merchant receives the credit card information and hands it off to a third-party billing platform, like Recurly, avoiding any PCI liability that could arise from the storage of customer financial information.

The payment details are stored and the online payment request is sent to the gateway.

The gateway sends the request to the payment processor

Then its forwarded on to payment service providers or card associations (such as Visa, Mastercard, American Express, or Discover).

The association takes the request and sends it to the customer’s issuing bank.

The financial institution approves (or denies) the transaction and then informs the network of its decision. It's typically approved if the customer’s card details are accurate and have sufficient funds.

Assuming there were no hiccups, the customer is billed by the issuer on their monthly statement.

What’s remarkable is that this entire payment process takes place within a few seconds—so next time you’re online and waiting for a few seconds for your transaction to get approved, think about everything going on behind the scenes. And, of course, with recurring payment processing, this process repeats itself every payment cycle.

The efficiency and reliability of online payment systems are essential to deliver seamless customer experiences. Subscription businesses must prioritize a well-designed and secure payment processing infrastructure to foster trust, enhance customer satisfaction, and sustain a steady revenue stream.

Online payment processing providers

When it comes to selecting a subscription payment processing solution, there are numerous options available. Each platform offers unique features, integrations, and pricing models.

One well-known player in the space is PayPal. Merchants can embed PayPal in their site or send customers to PayPal to facilitate a transaction. Other platforms, such as Amazon Pay or Adyen enable you to ensure customers are charged regularly without manual intervention–simplifying the payment process for both customers and the business.

Check out our recurring payment gateways guide to learn more about the most popular gateways based on integrations, ease of use, cost, payment types, support, and more.

What are the different ways to process recurring payments?

“There’s more than one way to skin a cat” could apply to processing recurring payments. Not every payment solution is created equal:

Accounting software is an option if you have a limited number of plans and a small stable of customers. Accounting software isn’t sufficient for companies with complex needs unless managing tons of disparate spreadsheets is your idea of fun.

Payment gateways are a crucial piece of recurring payment processing. This can be a lower-cost option due to reduced payment processing fees, but relying on just one payment gateway for all your payment processing needs is risky. More on that in a bit.

Subscription management and billing platforms, like Recurly, can handle all billing needs. The best subscription billing software supports multiple gateways, provides subscription model metrics, and gives actionable insights to advance your business. Advanced subscription management platforms can help you recover revenue with automated retries you’d otherwise lose to involuntary churn.

Getting back to gateways, you may be wondering, "Why is it necessary to have multiple gateways?"

Multiple gateways are vital because no electronic gateway supports all types of transactions at a high volume. Geolocation and product type are just two of the variables that impact them.

Additionally, gateway failures happen—Recurly has documented an average of 40 performance issues per year across our supported gateways—and if your business does substantial volume, a gateway outage of a few hours could prove very costly.

Go with a subscription billing platform that integrates with a large number of gateways (Recurly, for example, integrates with more than 22) and supports gateway failover, a critical step to reducing your involuntary churn.

What kinds of businesses need recurring payment processing?

Recurring payment processing is essential for businesses that offer subscription-based products. Here are some examples:

Media and entertainment platforms: The explosion of streaming platforms like Paramount+, SoundCloud, or Twitch, and in-person activities, such as Cinemark have revolutionized entertainment. At the heart of this accessibility is a payment ecosystem that seamlessly delivers movies, music, and more to the devices of content-hungry consumers.

SaaS companies: Software as a Service (SaaS) businesses like Sprout Social, Pipedrive, Userlike, and LiveChat set the bar high for subscription payment experiences. Their agile models and robust payment systems are not only industry benchmarks but also catalysts for the continuing evolution of the subscription economy.

Consumer goods and retail subscriptions: The business-to-consumer sector has experienced a paradigm shift with the rise of subscription models. Businesses like AllTrails as well as FabFitFun, Barkbox, and Scentbird have not only embraced these models but have also become synonymous with them, sending curated products to customers on a recurring basis.

Subscription businesses have become increasingly popular because they are a win-win for both businesses and consumers. Companies are rushing to move from one-time payments to subscription-based morels to generate a steady revenue stream and make financial forecasting much easier.

How can recurring payments benefit your business?

Your company can enjoy several benefits when you use a recurring payment processing solution, such as:

Predictable revenue streams: One of the most significant draws of subscription payment processing is the predictability of recurring revenue. Instead of the peaks and troughs of traditional sales, recurring revenue paints a picture of consistent income, enabling businesses to plan with greater certainty.

Enhanced customer experience: Subscription models are inherently customer-centric. They offer a level of personalization and control that traditional models often struggle to match. Customers can tailor their subscriptions, add on services, select their preferred payment options, and manage their accounts with unprecedented ease, fostering a sense of ownership and engagement.

Flexible payment terms and packages: It’s easier to give your customers a variety of payment, plan, and billing frequency options, which they can change at any time. Some customers may want to make credit or debit card payments, while others want to pay using a virtual terminal like PayPal for automatic payments. Perhaps your value-packed but most expensive plan appeals to a small subset of your customers, but others see it as excessive and wish you had a pared-down offering. Without recurring payment options, this type of flexibility is difficult, if not impossible, to achieve.

Minimized effort: The setup is a one-shot deal, and no more work needs to be done every billing cycle. It sounds like a bonus for your business, but it also helps you build customer relationships. With online recurring payment processing, the invoice and payment information automatically flows into the right systems, preventing missed and late payments–making it easier for your finance team to track a client's payment history.

Error and fraud defense: There is less risk of card detail mistakes or fraud because your customers aren’t required to enter their payment details over and over again. Fraud and chargeback-related expenses make up 13% to 20% of businesses operating budgets. With automated subscription billing cycles, you can protect your business integrity by securing your client's payment methods and streamlining the process.

Data-driven decisions: The data goldmine that subscription models provide is invaluable for making informed business decisions. Insights into customer behavior, churn rates, and revenue forecasting can steer your strategy with precision, leading to smarter, more calculated moves.

The benefits of recurring payment processing are undeniable. But maybe you’re still wondering if it can help your business.

How do I choose a recurring payment processing solution?

To grow, businesses need real recurring payment processing solutions. A first-rate recurring payment processing solution does a lot of behind-the-scenes work to ensure that your customers’ payments go through without a hitch at every point in the billing schedule. Your customers likely have diverse preferences, so you should look for a billing solution that can handle every imaginable scenario.

If you need a complete subscription management platform, check out our subscription and billing solution evaluation worksheet to understand what capabilities to look for, what questions to ask your internal stakeholders and vendors, and what terms you need to know.

Recurly allows you to set up various recurring and one-time payments, regardless of business size. Our robust platform accepts major payment methods and is designed for enterprises to maximize profits through simplified recurring payments. In fact, Forbes ranks Recurly as the best payment platform for high revenue.

How to set up customer payment processing with Recurly

Gone are the days of manual invoicing and the laborious task of chasing down late payments. With an automated recurring billing and payment solution, you set the schedule for future transactions, and the system does the rest.

Recurly, does a lot of work behind the scenes with gateways, online payment processors, and other parties like associations, issuer banks, and customer banks. It's like having a diligent assistant who never sleeps, never forgets, and never misses a beat–except it fits neatly within your digital infrastructure.

Recurly is integrated into your company’s payments ecosystem, combining subscription management, advanced features, and billing elements in a solution that supercharges revenue growth.

Subscription payment service FAQs

What is the purpose of payment processing?

Payment processing serves to facilitate the transfer of funds from the customer to the business in a smooth, secure, and compliant manner.

How do I receive subscription payments?

You receive subscription payments through a subscription payment service or a recurring billing platform. Recurly, for example, can easily integrate your payments ecosystem, combining subscription and billing elements to supercharge your revenue growth.

Why is subscription payment processing beneficial?

Subscription payment processing automates the billing cycle, provides a predictable revenue stream, and enhances the customer experience, leading to improved business performance.

Who should use recurring payments?

Any business that offers products or services regularly, such as weekly, monthly, or annually, can benefit from recurring payments. This includes software, content, and service companies, among others.

Processing subscription payments is more than just a convenience. It's a strategic component of customer management and retention for modern business. By understanding and harnessing subscription billing capabilities, companies can solidify their positions and provide superior value to their subscribers.