Special Report

The Impact of the Global Pandemic on Subscription Growth Rates

COVID-19 accelerates free trials and new subscription growth in digital media and entertainment, education, software, and consumer goods/e-commerce. Cancellations kept at bay with pause functionality.

For this special report, we used the time period of March 16, 2020–June 29, 2020 (COVID) compared to the week of March 9, 2020 (Pre-COVID).

Introduction

The COVID-19 pandemic has wreaked havoc on the global economy, consumers' emotions, and our very way of life. From social distancing and wearing face masks to over 20 million jobs lost in the U.S., both businesses and consumers have faced an unprecedented reality that changes and evolves with each passing week.

As a society, we're used to the convenience of having everything we need and readily available at our fingertips—from streaming media and other forms of digitally-delivered entertainment to a variety of consumer goods that get delivered to our doorstep on a regular basis.

Interestingly, the pandemic didn't cause consumers to want or need fewer things. If anything, it heightened their needs—to be entertained, for essential household goods, food, and beverages and their desire to discover new products. During the first few months of the pandemic, consumers looked for ways to cope with social distancing, shelter-in-place mandates, homeschooling children, furloughs, and a variety of other challenges. Most retail outlets, restaurants, and other sources were either shut down or people didn't feel comfortable going out and being at risk, many had no other option than to shop online to procure the items they wanted. Because of these changes, there's been a shift in how subscription products and services are consumed and delivered.

Some subscription businesses have seen a positive impact, others have experienced a revival, while some have faced more challenges than opportunities.

In many ways, COVID-19 has accelerated us to the future, because the convenience factor of subscriptions that have been appealing to subscribers has only been furthered now that they are reconsidering the true cost of going to the store or the mall, browsing aisles and racks, finding something they like and then bringing it home.

From mid-March, the very start of the pandemic in the US and Europe, we've kept a close eye on data surrounding Free Trial and New Paid Subscription Growth Rates across six core verticals: Business & Professional services, Consumer Goods & E-Commerce, Digital Media & Entertainment, Education, Software, Travel, Hospitality & Entertainment.

In this Impact of the Global Pandemic on Subscription Growth Rates Special Report, we'll examine relative growth rates for each industry. In addition, we'll share the key takeaways that matter most to subscription businesses during these ever-evolving and uncertain times.

New Trial Growth Rates

The total new, free trials that subscribers began during the study period.

- All Industries

- Business & Professional Services

- Consumer Goods & E-Commerce

- Digital Media & Entertainment

- Education

- Software

- Venue-Based Entertainment

All Industries | New Trial Growth Rates

Compare to All Industries

ON

OFF

- 350%

- 300%

- 250%

- 200%

- 150%

- 100%

- 50%

- 0%

- -50%

- -100%

Example

New trials started in the week of March 9: 200,000 (Pre-COVID).

New trials started in the week of April 6: 340,000 (COVID).

Relative growth for April 6 is calculated as:

340,000 COVID

200,000 Pre-COVID

— 1 = 1.7 — 1 = 0.7 = 70% Growth

April

May

June

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

Week during covid

- All Industries

All Industries | The Story Behind the Data

While there was an initial decrease in the number of new trials the first week of our COVID study period, the last two weeks of March saw the largest increase in New Trials at 120% and 101% respectively. In April, there was healthy growth, with trials hovering between 20%-30%. Once the massive increase in Education and Digital Media slowed down, the drop-off in Travel, Hospitality, and Entertainment throughout the whole COVID period led to a negative growth period throughout the month of May.

This number is getting closer back to our pre-COVID level in mid-June with the last week of our study being just -9% below the pre-COVID measurement.

New free trial rates showed consistent growth compared to the Pre-COVID period ranging from 30% all the way up to a 115% increase. Business & Professional Services have seen a consistently higher level of activity throughout all of quarantine.

Consumer Goods & E-Commerce saw a quick spike in trials starting in late March, with a relative growth rate of between 40-56% compare to the pre-COVID period. This continues through early May until this rate slightly decreased to between 25-35% relative growth until the end of June.

New trials for OTT/Streaming Media peaked near the beginning of quarantine, the week beginning 3/23 with a 114% increase compared to the week of 3/9. Most of April brought anywhere between 15% and 26% more trials on a weekly basis as compared to the pre-COVID week of 3/9.

The end of April and early May saw this rate dip below the initial period and stay between -21% to -36% through the first few weeks of June. The last week of June saw this number return closer to Pre-COVID levels with a -14% increase relative to 3/9.

New free trials for Education peaked right off the bat the week of 3/23 with an increase of 327%. For the next 6 weeks, until the beginning of May, education companies saw an increase in new trials hovering between 55% and 183% relative to the week of 3/9.

The first two weeks in May new trial volume was 54% and 48% higher than Pre-COVID levels, but as the school year came to a wrap near the end May, we saw new trials getting closer to Pre-COVID levels, which is to be expected with schools on summer break.

The week of 3/16 saw an uptick of 22% above the Pre-COVID period. This trend continued through the week of May 11 at 22%-69%. During the last two weeks of May subscription growth slowed to just 20% above Pre-COVID measurements.

A large decrease of over -90% relative to the Pre-COVID period has held steady the entire COVID-19 timeframe included in this study. Because many venue-based businesses had to close completely during the COVID period, they were unable to offer any free trials or sign up new customers.

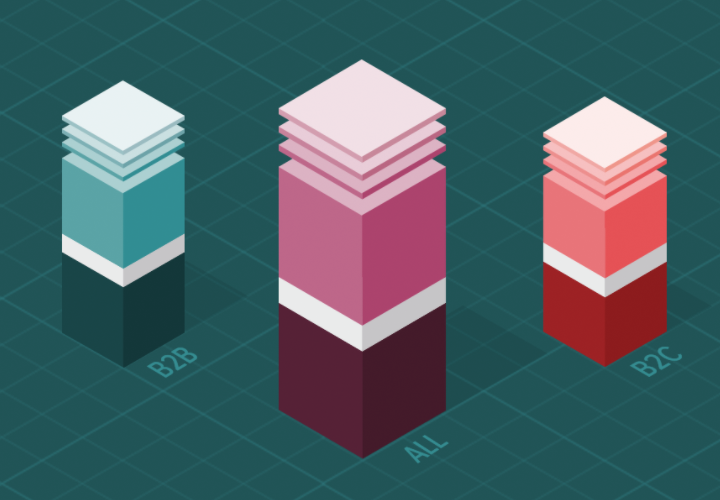

New Subscription Growth Rates

The total new, paid subscriptions during the study period.

- All Industries

- Business & Professional Services

- Consumer Goods & E-Commerce

- Digital Media & Entertainment

- Education

- Software

- Venue-Based Entertainment

All Industries | New Subscription Growth Rates

Compare to All Industries

ON

OFF

- 200%

- 150%

- 100%

- 50%

- 0%

- -50%

- -100%

Example

New trials started in the week of March 9: 200,000 (Pre-COVID).

New trials started in the week of April 6: 340,000 (COVID).

Relative growth for April 6 is calculated as:

340,000 COVID

200,000 Pre-COVID

— 1 = 1.7 — 1 = 0.7 = 70% Growth

April

May

June

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

Week during covid

- All Industries

All Industries | The Story Behind the Data

Growth in new subscriptions immediately increased during the first few weeks of the COVID period, ranging from 20%-40% higher than the pre-COVID timeframe. April saw the highest growth of any month with a peak growth of 85% and the weekly data staying above 60% the entire month.

This carried into May until growth slowed a bit towards the end of the month. For the last several weeks of May and first weeks of June, the growth rate was between 31%-42% above pre-COVID levels.

New paid subscriptions saw little change in March and early April with growth rates fluctuating between -7% to 12%. But as free trials converted in late April, new paid subscriptions shot up and their growth rate stayed between a 45% to 60% increase for all of May.

As June arrived, the growth rates dipped slightly to 27% above Pre-COVID all the way down to -44% below Pre-COVID.

The first week of quarantine (March 16-22) the Consumer Goods & E-Commerce category saw a decrease in new subscribers by -6% as compared to the Pre-COVID phase. After that, we saw a steady increase at the end of March and early April. In mid-April we saw the peak of new subscribers which lasted until the week of May 11, showing an increase of 108%-148% with the growth slightly slowing down the week of 4/20 to 82%.

The last weeks of May saw an overall decrease in new subscriber growth but still were 20% higher than the Pre-COVID period. This vertical saw the highest growth of any in terms of new subscriptions in April and May (146%).

The first four weeks after 3/9 saw a substantial increase of 30-52% in new paid subscriptions relative to Pre-COVID levels. Then new subscriber growth peaked during the weeks of 4/20 and 4/27 at 76% and 90%. May saw the weekly growth rate stay between 66% and 75%, and the last week of May had the new subscriber growth rate end at 50% above the Pre-COVID period.

The Education sector saw its first large wave of new paid subscriptions during the last week of March at 39% above the Pre-COVID period. The first few weeks of April saw this number decrease as a lot of potential subscriptions were still in the trial stage. By late April, a lot of trials began to end and there was a huge increase in new paid subscriptions, between 99%-173% above Pre-COVID: The rate then stayed between 52%-94% until late June.

During the last few weeks of June, due to the end of the school year, we saw a seasonal slowdown, with new subscriber levels hovering above 17% Pre-COVID levels.

During the first two weeks of COVID, the SaaS sector saw a small 11% increase in new paid subscriptions followed by 21%-40% growth through the week of May 11. The last few weeks of May showed growth of 15%-20% above the Pre-COVID period.

For March, April, and May, the Travel, Hospitality & Entertainment sector saw a drastic decrease of -70% to -80% relative to Pre-COVID levels. This number slightly increased in June and ended at -50%.

Trial Conversion Rates

The total number of subscriptions that started a trial and converted to paid divided by the total number of subscriptions that started a trial in the study period.

- All Industries

- Business & Professional Services

- Consumer Goods & E-Commerce

- Digital Media & Entertainment

- Education

- Software

- Venue-Based Entertainment

All Industries | Trial Conversion Rates

Compare to All Industries

ON

OFF

- 80%

- 70%

- 60%

- 50%

- 40%

- 30%

- 20%

- 10%

- 0%

April

May

June

0

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

Week during covid

- All Industries

All Industries | The Story Behind the Data

Trial onversion spiked quickly after the COVID period began, jumping from 42% to 53% the last few weeks of March. From there, outside a slight dip in April to 38%, the conversion rate remained above 49% for the remainder of the study period.

This is important to note given the massive number of free trials that began in late-March/early-April that ended in May. This shows that subscription businesses offering trials were successful in converting those trials into paid subscriptions.

Business & Professional Services saw a sharp increase after the first few weeks of March. Jumping from 23% all the way to 40% by the first week of April. From April to June, the trial conversion rate fluctuated between 31% to 40%, and tended to be higher towards the end of each month.

Consumer Goods & E-Commerce had the second highest conversion rate of any vertical in our study. In fact, the conversion rate never dropped below 55% during the entire COVID period. Through March and April the rate stayed between 55% to 58%. It increased slightly during May and stayed between 58%-60% through the end of June.

Conversions from free trials to paid subscribers started out around 40% for the first few weeks of March and then temporarily rose to the 50% range towards the end of the month. You might expect that when many trials were ending the week of 4/20 and 4/27, that the conversion rate would decrease, but it stayed above 53% and remained steady until the last week of May when it decreased to 48%.

Free trial conversions hovered around 56% for most of March. As more trials reached their expirations toward the end of May, there was a slight decline in conversions to 53%. It should be noted that with such a large spike in new trials the slight drop in conversion was made up for in new subscriptions.

The trial conversion rate increased initially during the COVID period from 24% to 28%-35% until late June when it dropped back down to 26%.

Venue Based Entertainment presented one of the more puzzling trends in Trial Conversion Rate. Given the extreme drop off in new subscriptions and new trials, we expected Trial Conversion Rate to decline which initially happened the first few weeks of March with rates of 21% and 28% respectively. However, after that, the Trial Conversion Rate shot up to 80% at the end of March and stayed between 68%-80% all the way through mid-May.

Since the number of new trials dropped by about 90% in this vertical, merchants that were still able to offer new trials saw extremely high conversion. These businesses were likely in areas that opened early or were not under lengthy quarantine orders.

Industry Summaries

- Business & Professional Services

- Consumer Goods & E-Commerce

- Digital Media & Entertainment

- Education

- Software

- Venue-Based Entertainment

Business & Professional Services

As the economy rode the roller coaster of COVID-related implications many workers were furloughed, laid off, and many companies put their hiring needs on hold given hiring remotely comes with its own set of challenges. As a result, many companies turned to using consultants, agencies, and third-parties to keep business afloat during these uncertain times. Business and professional service companies saw the positive impact with a steady stream of new trials and paid subscriptions.

Consumer Goods & E-Commerce

With the onset of the COVID-19 pandemic and shelter in place orders sweeping the nation, the obvious consumer reaction was justifiable panic. Store shelves were barren as consumers stockpiled essentials and necessities including toilet paper, frozen and canned foods, and alcoholic beverages. This knee jerk reaction was understandable as consumers across the nation grappled with many new challenges from homeschooling their children to working from home to not going to their favorite restaurants and sporting events.

Scores of consumers reeled in discretionary spending in the first month of the pandemic in an effort to protect themselves. For many, purchasing anything nonessential was a no-go. For some who faced layoffs, furloughs, or other economic challenges, it meant canceling or pausing subscriptions until some of the economic pandemic dust settled.

As the reality of month after month of quarantine set in, consumers started to look for ways to access necessities through subscriptions, as well as “treat themselves” to little luxuries delivered straight to their doors. FabFitFun, a Recurly customer, recognized early on in the pandemic’s outbreak that its members may need self-care and wellness goods that might otherwise be challenging to procure, so the company focused energy on making sure those types of items were available via its website. Some examples include skin care products, shampoo and conditioner sets, and workout equipment that could be used at home including exercise bands.

Digital Media & Entertainment

Being stuck inside with little to do besides work, homeschool children, and bake banana bread, consumers were desperately in need of entertainment in the form of streaming media. Without sports, the public latched onto surprise breakout shows on Netflix including the Tiger King, classics on Disney+ including the Star Wars franchise, and original series, The Mandalorian with its tiny star, the Child (aka baby Yoda).

It’s no surprise then that new trials in streaming media peaked early in the quarantine timeline and held steady throughout. In order to attract consumers, many streaming media companies extended their free trial periods from 7 to 30 days in order to incentivize customers to try them out. While new subscriptions grew in March as well, the completion of many of these trials towards the end of April led to some of the largest increases in conversions to new subscriptions we’ve seen of any industry.

We expect Digital Media & Entertainment companies to continue seeing substantial growth in new paid subscriptions through August 2020. This sector typically sees a decline in subscriptions during the summer season due to summer vacations and outdoor activities. However, we expect to see another growth period for OTT merchants who offer access to watch live sports as the MLB, NBA, NFL, and other sports return.

Education

When overnight quarantine orders went into place in mid-March and schools closed for the unforeseeable future, parents faced the unprecedented challenge of educating their children and helping them navigate classroom sessions via video conferencing and home study. Often, parents found themselves trying to teach something they hadn’t studied in decades. At the same time, parents often had to juggle their own work from home which meant a collision of priorities and multitasking on a whole new level. To say the struggle was real is an understatement.

Parents, caregivers, educators, and children of all ages needed help in the form of educational resources so it’s not surprising that in mid-March we saw an immediate spike in new free trials in education-related products and services for K-12. A number of K-12 education companies extended their free trial lengths to as long as 60 days in order to attract new prospects and provide value, as well as have the ability to market and upsell products to these consumers after the trial period ended.

We saw a similar trend in continuing education, graduate exam prep, and career improvement products and services as students of all ages had time to invest in their futures.

This demand for educational resources led to a boom across the broader Education category throughout April and early May resulting in weekly/monthly new subscription growth as high as 90%.

Software

Quarantine meant a new remote workforce. Millions of employees quickly set up home offices from their dining room tables to their bedrooms, sheds and garages as they attempted to adapt to the new norm of staying connected to their coworkers, bosses, and customers. As expected, teleconferencing and collaboration technology led the subscription pack. Overall, the SaaS industry saw a halo effect as a result of the pandemic as many organizations beefed up their tech stack to help their remote workforce to be more efficient, connected, and empowered to achieve revenue goals.

Venue-Based Entertainment

From mid-March through June, nearly all physical entertainment venues were mandated to stay closed. Some briefly re-opened only to be ordered to close again when COVID cases spiked again. As a result, consumers could no longer go to the movies, trampoline parks, concert halls, and sports arenas. These venue-based entertainment companies experienced an understandable decline in free trials and paid new subscriptions. However, of note, many of them used the ability to automatically pause subscriptions for their members as a tactic to retain subscribers and provide a proactive service saving members the time and energy of having to figure out how to pause subscriptions themselves. This kind of service amidst the uncertainty of the pandemic was an excellent customer loyalty tactic and one that members are likely to remember and value.

As shelter in place mandates began to lift and entertainment venues begin reopening their doors it’s their job to enable consumers to visit with confidence and peace of mind. Many are extending rewards, offering free perks, and providing the ability to get refunds or exchanges.

Conclusion

The effects of COVID-19 will be felt for a long time as businesses adjust and recover and consumers navigate through the new normal. How will consumer purchase habits change? How will businesses respond and evolve? There are many questions to be answered and Recurly is here to track the trends and share our findings.

Request a DemoMethodology

Time Period

For this special report, we used the time period of March 16, 2020–June 29, 2020 (COVID) compared to the week of March 9, 2020 (Pre-COVID).

For due diligence, we expanded our Pre-COVID timeframe to look back into February but did not see significant changes in our observed trends. For this reason, we kept the Pre-COVID time period as one week to keep a 1:1 comparison during the COVID period.

March 9

Pre-Covid

March 16

June 29

Covid Research Time Period

Growth Rate Percentage

For each Industry and metric, the growth rate percentage is the relative change for each week from March 16, 2020–June 29, 2020 (COVID) when compared to the week of March 9, 2020 (Pre-COVID).

Example

New trials started in the week of March 9: 200,000 (Pre-COVID).

New trials started in the week of April 6: 340,000 (COVID).

Relative growth for April 6 is calculated as:

340,000 COVID

200,000 Pre-COVID

— 1 = 1.7 — 1 = 0.7 = 70% Growth

Merchants

In order to be included in the data set, merchants must have met the following criteria.

- At least 1000 successful transactions during the entire Pre and COVID period

- For Trials, must have at least 1 trial started in both the Pre and COVID periods

- For New Subscribers, must have at least 1 new subscriber in both the Pre and COVID period

Transaction data was aggregated and anonymized; no personally-identifiable data was used in the study.