Resource center

Filter by:

Clear Filters

Back to top

Subscription Management

View all ()

Billing & Accounting

View all ()

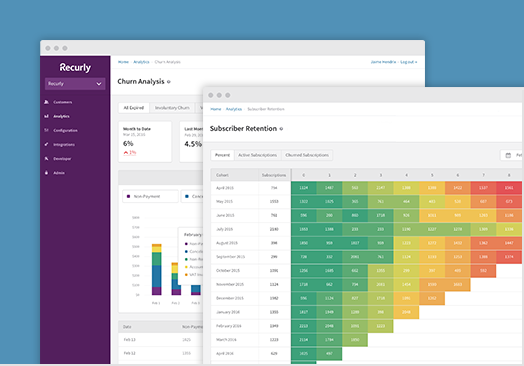

Subscriber Retention

View all ()

Analytics & Insights

View all ()

Resources

Showing of items

Show More

Recurly blog

Stay ahead of subscription trends.

You're subscribed!

Be sure to check your inbox for insights and proven strategies to grow your subscriptions!

![[REPORT] State of Subscriptions: What consumers want](http://images.ctfassets.net/wob906kz2qeo/22zRkdk7kLWTE4V3I5Iuph/3a0f02d1a8b759dee4df8ece285f91eb/img-2023-06-what-consumers-want-report-resource-720x502.png)